- New Zealand

- /

- Beverage

- /

- NZSE:FWL

Foley Wines (NZSE:FWL) Will Pay A Larger Dividend Than Last Year At NZ$0.047

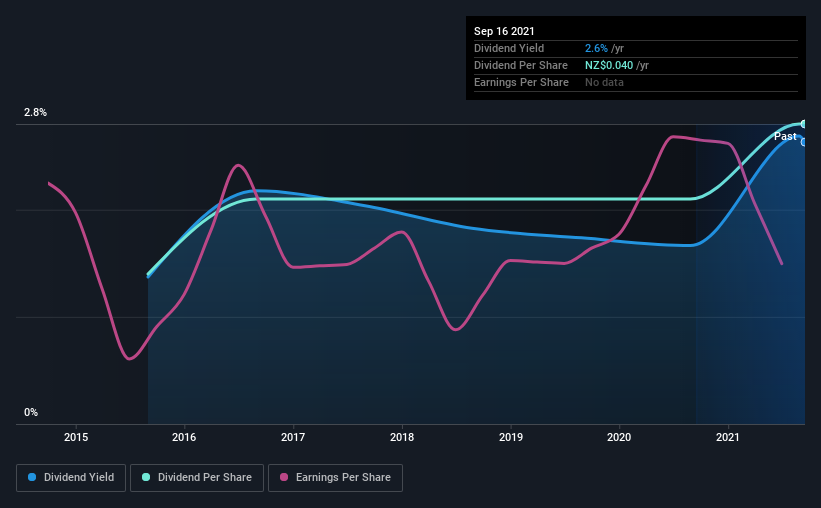

The board of Foley Wines Limited (NZSE:FWL) has announced that it will be increasing its dividend by 33% on the 22nd of October to NZ$0.047. This takes the dividend yield from 2.6% to 3.1%, which shareholders will be pleased with.

View our latest analysis for Foley Wines

Foley Wines' Earnings Easily Cover the Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last dividend, Foley Wines is earning enough to cover the payment, but the it makes up 169% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

If the company can't turn things around, EPS could fall by 9.1% over the next year. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 93%, meaning that most of the company's earnings is being paid out to shareholders.

Foley Wines Doesn't Have A Long Payment History

It is great to see that Foley Wines has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The dividend has gone from NZ$0.02 in 2015 to the most recent annual payment of NZ$0.04. This means that it has been growing its distributions at 12% per annum over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

Dividend Growth May Be Hard To Come By

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. In the last five years, Foley Wines' earnings per share has shrunk at approximately 9.1% per annum. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Foley Wines is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for Foley Wines that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:FWL

Foley Wines

An integrated wine company, produces, markets, and sells wines in New Zealand.

Good value with adequate balance sheet.

Market Insights

Community Narratives