- China

- /

- Electrical

- /

- SZSE:002141

Undervalued Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong bank earnings propelling stocks higher, investors are increasingly looking for opportunities that combine value with growth potential. Penny stocks, a term often associated with smaller or newer companies, continue to offer intriguing possibilities for those willing to explore beyond the mainstream indices. By focusing on companies with solid financials and growth prospects, investors can uncover hidden gems in this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$42.36B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.00 | HK$634.79M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Millennium & Copthorne Hotels New Zealand (NZSE:MCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Millennium & Copthorne Hotels New Zealand Limited owns, operates, manages, leases, and franchises hotels in New Zealand and Australia with a market cap of NZ$279.52 million.

Operations: The company's revenue is primarily derived from hotel operations at NZ$109.52 million, supplemented by residential land development at NZ$32.85 million, residential property development at NZ$25.98 million, and investment property generating NZ$2.58 million.

Market Cap: NZ$279.52M

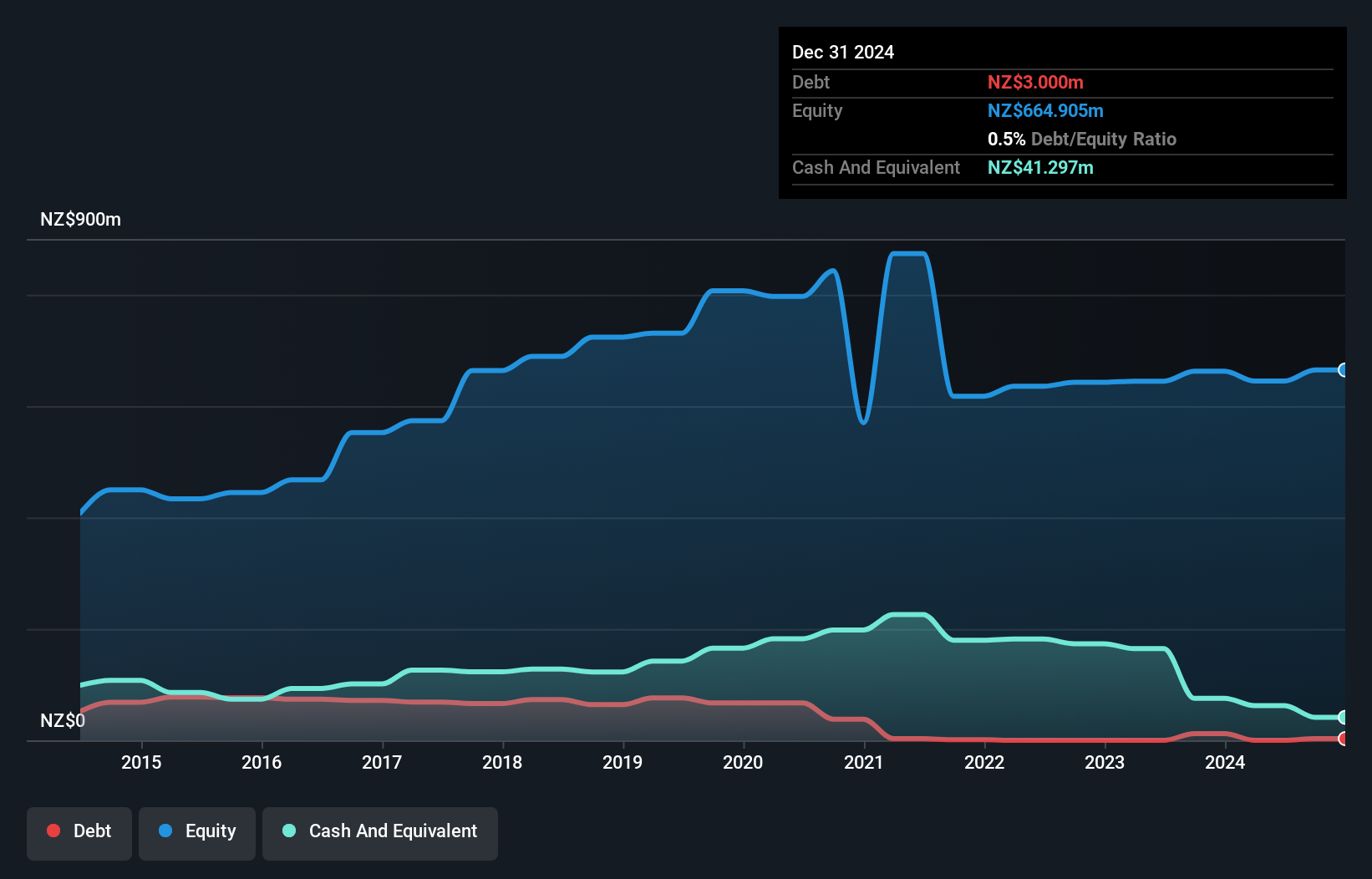

Millennium & Copthorne Hotels New Zealand Limited operates with a market cap of NZ$279.52 million, deriving revenue primarily from hotel operations and residential developments. Despite being debt-free and having assets that cover liabilities, the company faces challenges with declining earnings growth and reduced profit margins compared to last year. Its return on equity is low at 1.3%, while share price volatility remains high. Recently, CDL Hotels Holdings proposed acquiring the remaining stake in MCK for NZ$57.2 million, subject to regulatory approvals, which could impact its future market dynamics if completed by May 2025.

- Click to explore a detailed breakdown of our findings in Millennium & Copthorne Hotels New Zealand's financial health report.

- Examine Millennium & Copthorne Hotels New Zealand's past performance report to understand how it has performed in prior years.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company specializing in the discovery, development, and commercialization of cancer targeted therapies and immunotherapies in China and internationally, with a market cap of HK$4.05 billion.

Operations: Lepu Biopharma generates revenue of CN¥205.08 million from the sale of pharmaceutical products and the research and development of new drugs.

Market Cap: HK$4.05B

Lepu Biopharma, with a market cap of HK$4.05 billion, is navigating the challenging landscape of biopharmaceuticals by focusing on cancer therapies. Despite being unprofitable, the company shows potential with forecasted revenue growth of 65.6% annually and a history of reducing losses by 27.6% per year over five years. Its short-term assets (CN¥744.1M) exceed long-term liabilities (CN¥553.2M), though they fall short against short-term liabilities (CN¥985.8M). The management team and board are experienced, which may aid in strategic decisions amid recent changes like appointing Ernst & Young as auditors for 2024.

- Navigate through the intricacies of Lepu Biopharma with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Lepu Biopharma's future.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Infund Holding Co., Ltd. operates in the micro enameled wire and veterinary vaccine sectors in China, with a market cap of CN¥1.73 billion.

Operations: Infund Holding Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥1.73B

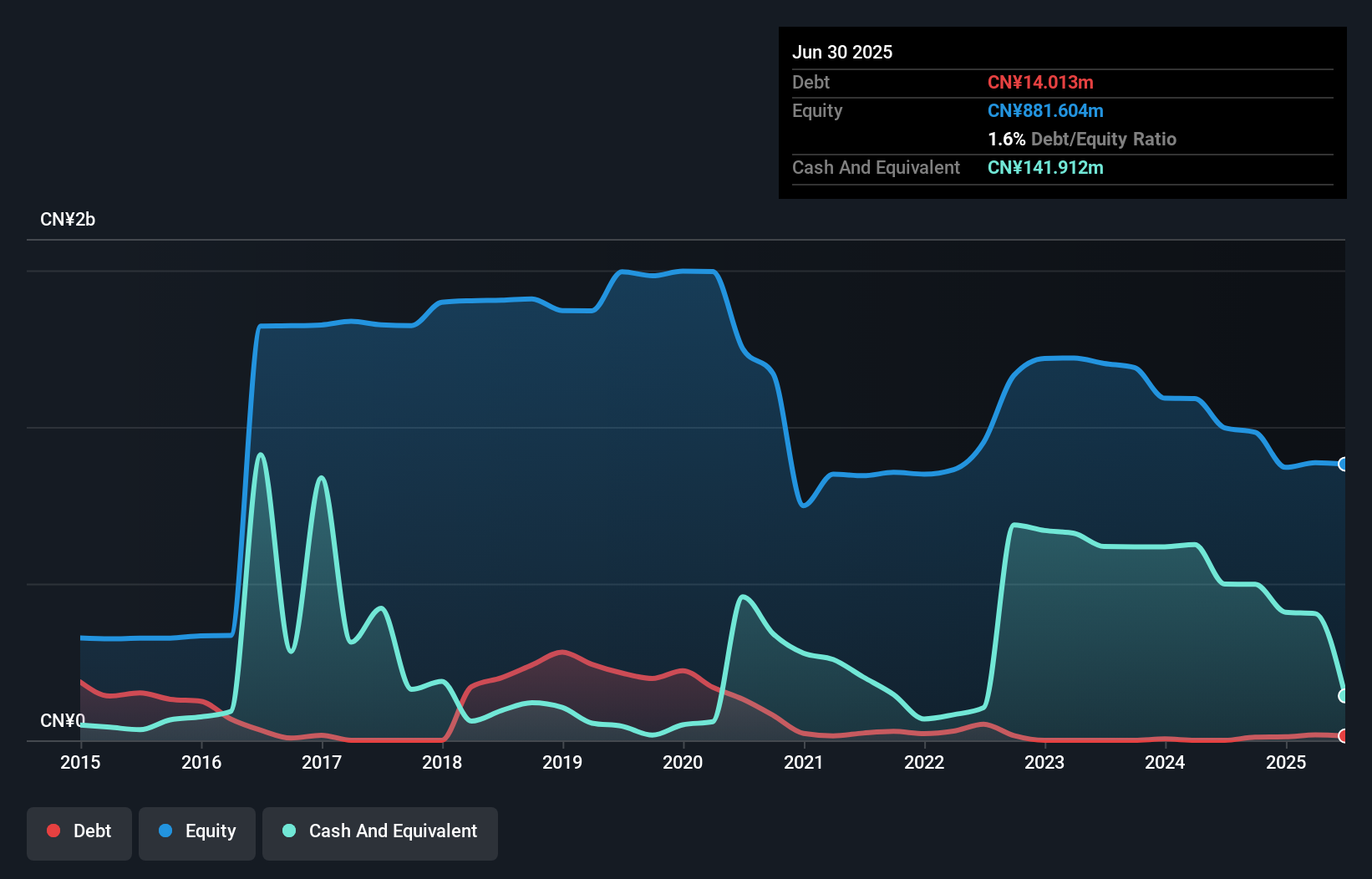

Infund Holding Co., Ltd., with a market cap of CN¥1.73 billion, operates in the micro enameled wire and veterinary vaccine sectors in China. Despite being unprofitable, it has reduced losses by 24.2% annually over five years and maintains more cash than total debt, indicating financial prudence. Its short-term assets (CN¥681.4M) comfortably cover both short- and long-term liabilities, suggesting solid liquidity management. Recent events include a completed acquisition of a 27.41% stake by new investors for approximately CN¥270 million, potentially impacting future strategic directions positively amidst stable weekly volatility at 8%.

- Unlock comprehensive insights into our analysis of Infund Holding stock in this financial health report.

- Learn about Infund Holding's historical performance here.

Seize The Opportunity

- Access the full spectrum of 5,707 Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002141

Infund Holding

Engages in the micro enameled wire and veterinary vaccine businesses in China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives