- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:MFB

We Like My Food Bag Group's (NZSE:MFB) Returns And Here's How They're Trending

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. And in light of that, the trends we're seeing at My Food Bag Group's (NZSE:MFB) look very promising so lets take a look.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on My Food Bag Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.33 = NZ$27m ÷ (NZ$103m - NZ$23m) (Based on the trailing twelve months to September 2021).

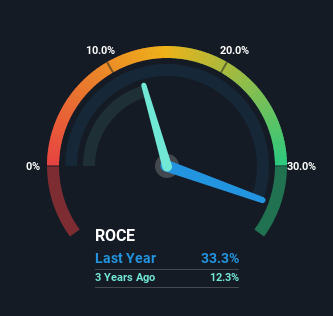

So, My Food Bag Group has an ROCE of 33%. That's a fantastic return and not only that, it outpaces the average of 14% earned by companies in a similar industry.

See our latest analysis for My Food Bag Group

In the above chart we have measured My Food Bag Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for My Food Bag Group.

The Trend Of ROCE

My Food Bag Group is showing promise given that its ROCE is trending up and to the right. More specifically, while the company has kept capital employed relatively flat over the last three years, the ROCE has climbed 170% in that same time. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

The Key Takeaway

To sum it up, My Food Bag Group is collecting higher returns from the same amount of capital, and that's impressive. And since the stock has fallen 34% over the last year, there might be an opportunity here. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One more thing to note, we've identified 2 warning signs with My Food Bag Group and understanding them should be part of your investment process.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MFB

My Food Bag Group

Engages in creating and delivering meal kits, pre-prepared ready-to-heat meals, and grocery items in New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026