- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:MFB

Here's Why It's Unlikely That My Food Bag Group Limited's (NZSE:MFB) CEO Will See A Pay Rise This Year

Key Insights

- My Food Bag Group's Annual General Meeting to take place on 13th of August

- Salary of NZ$546.0k is part of CEO Mark Winter's total remuneration

- Total compensation is 195% above industry average

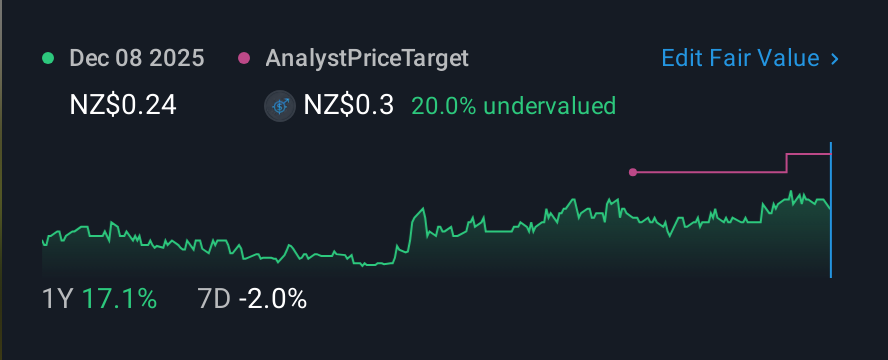

- Over the past three years, My Food Bag Group's EPS fell by 33% and over the past three years, the total loss to shareholders 65%

The results at My Food Bag Group Limited (NZSE:MFB) have been quite disappointing recently and CEO Mark Winter bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 13th of August. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for My Food Bag Group

How Does Total Compensation For Mark Winter Compare With Other Companies In The Industry?

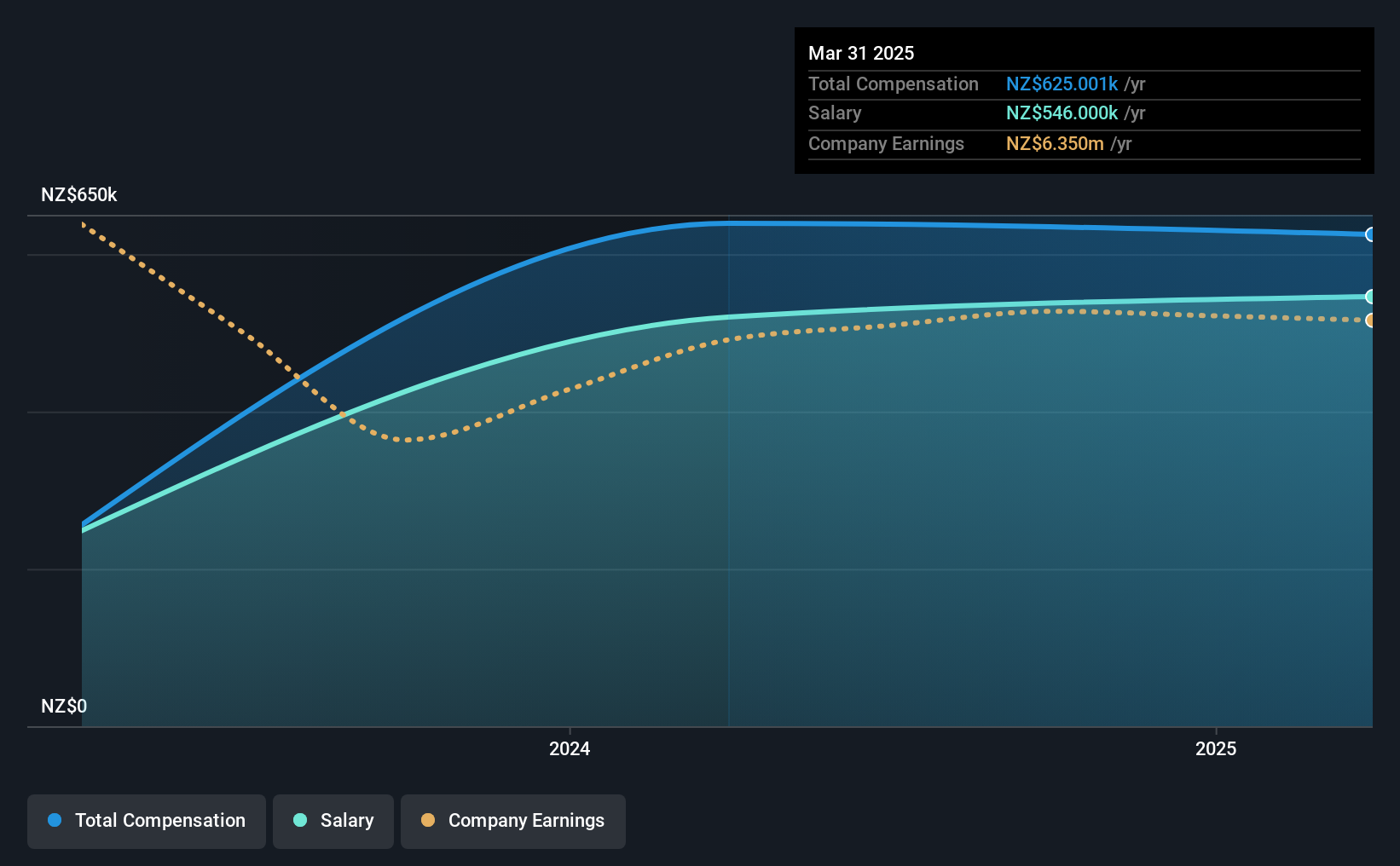

According to our data, My Food Bag Group Limited has a market capitalization of NZ$59m, and paid its CEO total annual compensation worth NZ$625k over the year to March 2025. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at NZ$546.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the New Zealand Consumer Retailing industry with market capitalizations below NZ$337m, reported a median total CEO compensation of NZ$212k. This suggests that Mark Winter is paid more than the median for the industry. What's more, Mark Winter holds NZ$396k worth of shares in the company in their own name.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | NZ$546k | NZ$520k | 87% |

| Other | NZ$79k | NZ$119k | 13% |

| Total Compensation | NZ$625k | NZ$639k | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. My Food Bag Group pays out 87% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

My Food Bag Group Limited's Growth

Over the last three years, My Food Bag Group Limited has shrunk its earnings per share by 33% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

The decline in EPS is a bit concerning. And the flat revenue is seriously uninspiring. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has My Food Bag Group Limited Been A Good Investment?

With a total shareholder return of -65% over three years, My Food Bag Group Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for My Food Bag Group that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MFB

My Food Bag Group

Engages in creating and delivering meal kits, pre-prepared ready-to-heat meals, and grocery items in New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026