- New Zealand

- /

- Diversified Financial

- /

- NZSE:IFT

Does Infratil (NZSE:IFT) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Infratil (NZSE:IFT), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Infratil with the means to add long-term value to shareholders.

See our latest analysis for Infratil

How Fast Is Infratil Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Infratil grew its EPS from NZ$0.13 to NZ$1.77, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

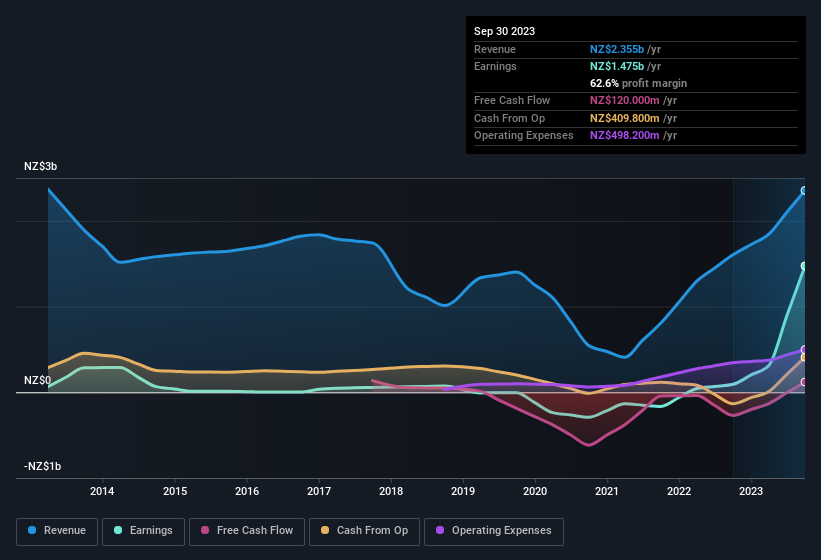

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Infratil's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Infratil achieved similar EBIT margins to last year, revenue grew by a solid 47% to NZ$2.4b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Infratil's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Infratil Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Infratil insiders spent a whopping NZ$12m on stock in just one year, without so much as a single sale. Knowing this, Infratil will have have all eyes on them in anticipation for the what could happen in the near future. Zooming in, we can see that the biggest insider purchase was by company insider Paul Joseph Newfield for NZ$6.1m worth of shares, at about NZ$10.12 per share.

Along with the insider buying, another encouraging sign for Infratil is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at NZ$182m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Infratil Deserve A Spot On Your Watchlist?

Infratil's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Infratil belongs near the top of your watchlist. Even so, be aware that Infratil is showing 4 warning signs in our investment analysis , and 2 of those make us uncomfortable...

Keen growth investors love to see insider buying. Thankfully, Infratil isn't the only one. You can see a a curated list of New Zealander companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:IFT

Infratil

An infrastructure investment firm specializing in digital Infrastructure, renewables, and social infrastructure.

Low risk with questionable track record.

Market Insights

Community Narratives