Asian Penny Stocks: Spotlight on Heartland Group Holdings and Two More Hidden Gems

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade negotiations and economic uncertainties, investors continue to seek opportunities in diverse regions, including Asia. Penny stocks, though often seen as speculative, remain relevant by highlighting smaller or less-established companies that can offer significant value. By focusing on those with strong financials and potential for growth, investors might discover promising opportunities among these under-the-radar stocks.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.96 | THB10.02B | ✅ 3 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.48 | THB2.69B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.395 | SGD160.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.53 | HK$51.86B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.30 | HK$2.17B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.15 | HK$1.79B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,182 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Heartland Group Holdings (NZSE:HGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heartland Group Holdings Limited, with a market cap of NZ$789.68 million, offers a range of financial services across New Zealand and Australia through its subsidiaries.

Operations: Heartland Group Holdings generates revenue primarily from Motor (NZ$40.09 million), Rural (NZ$29.16 million), Business (NZ$23.83 million), Personal Lending (NZ$3.17 million), Reverse Mortgages (NZ$54.55 million), and the Australian Banking Group (NZ$78.39 million) segments.

Market Cap: NZ$789.68M

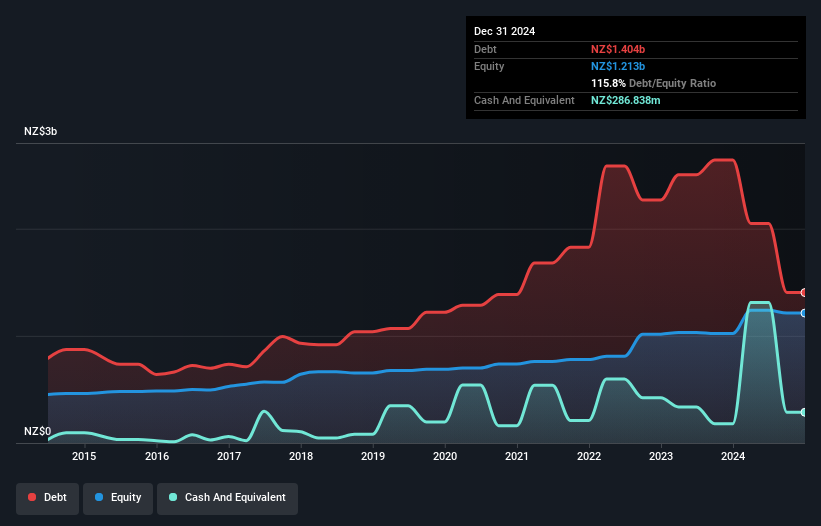

Heartland Group Holdings, with a market cap of NZ$789.68 million, has seen its net profit margins drop to 17.7% from 34.1% last year, and earnings have declined by 52.2%, underperforming the broader banking industry average decline of 3.4%. Despite trading at a significant discount to estimated fair value, concerns about dividend sustainability persist due to low coverage by current earnings and forecasted growth challenges. The company's loan portfolio appears well-managed with appropriate bad loans and funding levels primarily from low-risk customer deposits; however, both the board and management team lack experience with average tenures below two years.

- Jump into the full analysis health report here for a deeper understanding of Heartland Group Holdings.

- Review our growth performance report to gain insights into Heartland Group Holdings' future.

Plan B Media (SET:PLANB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Plan B Media Public Company Limited, along with its subsidiaries, offers advertising media production services in Thailand and has a market cap of THB19.42 billion.

Operations: The company's revenue is primarily derived from Engagement Marketing, which contributes THB9.60 billion, and Advertising Media, adding THB2.08 billion.

Market Cap: THB19.42B

Plan B Media, with a market cap of THB19.42 billion, has shown consistent revenue growth, reporting THB2.26 billion in Q1 2025 compared to THB1.97 billion a year ago. The company's earnings have grown significantly over the past five years by 29.1% annually, although recent growth at 15.3% lags its historical average and matches industry performance. Despite low return on equity at 11.1%, Plan B's financial health is robust with more cash than debt and strong coverage of interest payments by EBIT (8.2x). The board and management team are experienced, providing stability amid strategic changes like capital adjustments and new director appointments.

- Click here and access our complete financial health analysis report to understand the dynamics of Plan B Media.

- Assess Plan B Media's future earnings estimates with our detailed growth reports.

Parkson Retail Asia (SGX:O9E)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Parkson Retail Asia Limited is an investment holding company that operates and manages retail department stores in Malaysia, Vietnam, Myanmar, and Cambodia with a market cap of SGD97.70 million.

Operations: The company does not report distinct revenue segments.

Market Cap: SGD97.7M

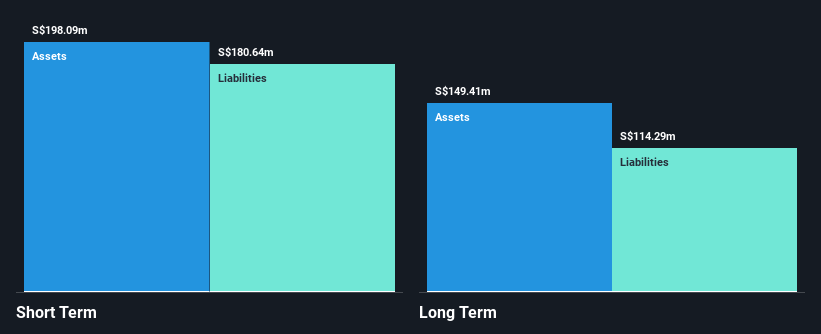

Parkson Retail Asia, with a market cap of SGD97.70 million, has demonstrated significant financial resilience despite recent challenges. The company reported Q1 2025 sales of SGD67.16 million and net income of SGD14.69 million, reflecting growth from the previous year. Its Return on Equity is outstanding at 50.8%, and it maintains high-quality earnings with more cash than total debt, ensuring robust financial health. Short-term assets exceed liabilities, and operating cash flow covers debt well beyond expectations at a very large percentage rate, indicating strong liquidity management amid volatility in share price and profit margins slightly declining over the past year.

- Take a closer look at Parkson Retail Asia's potential here in our financial health report.

- Explore historical data to track Parkson Retail Asia's performance over time in our past results report.

Make It Happen

- Embark on your investment journey to our 1,182 Asian Penny Stocks selection here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PLANB

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives