- Norway

- /

- Electric Utilities

- /

- OB:SKAND

We Ran A Stock Scan For Earnings Growth And Skandia GreenPower (OB:SKAND) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Skandia GreenPower (OB:SKAND). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Skandia GreenPower's Improving Profits

In the last three years Skandia GreenPower's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Skandia GreenPower's EPS shot up from kr0.10 to kr0.13; a result that's bound to keep shareholders happy. That's a commendable gain of 27%.

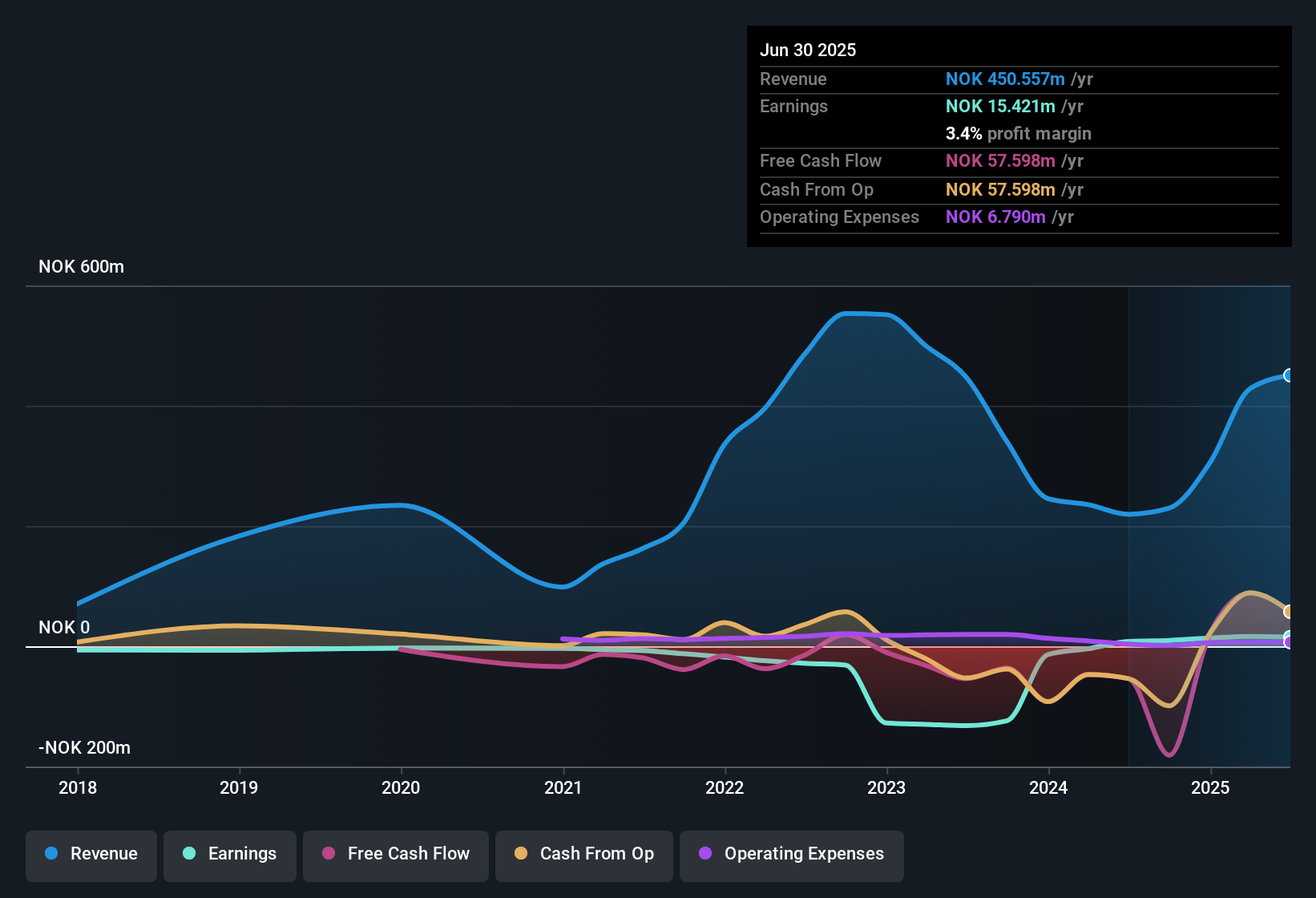

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Skandia GreenPower maintained stable EBIT margins over the last year, all while growing revenue 105% to kr451m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

View our latest analysis for Skandia GreenPower

Since Skandia GreenPower is no giant, with a market capitalisation of kr197m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Skandia GreenPower Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Skandia GreenPower shares, in the last year. So it's definitely nice that Director Lars Dypvik bought kr239k worth of shares at an average price of around kr1.56. It seems that at least one insider is prepared to show the market there is potential within Skandia GreenPower.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Skandia GreenPower insiders own more than a third of the company. Owning 50% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Of course, Skandia GreenPower is a very small company, with a market cap of only kr197m. So despite a large proportional holding, insiders only have kr99m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tommie Rudi, is paid less than the median for similar sized companies. For companies with market capitalisations under kr2.0b, like Skandia GreenPower, the median CEO pay is around kr3.6m.

Skandia GreenPower's CEO took home a total compensation package worth kr2.4m in the year leading up to December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Skandia GreenPower To Your Watchlist?

For growth investors, Skandia GreenPower's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. Still, you should learn about the 3 warning signs we've spotted with Skandia GreenPower.

The good news is that Skandia GreenPower is not the only stock with insider buying. Here's a list of small cap, undervalued companies in NO with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SKAND

Skandia GreenPower

Engages in the provision of electricity and energy-saving services in Norway.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.