- China

- /

- Medical Equipment

- /

- SHSE:688314

Discovering Undiscovered Gems With Potential In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have shown significant movement, with the Russell 2000 Index leading gains but still trailing its record highs from November 2021. Amidst this backdrop of potential regulatory and tax changes under a new administration, investors are increasingly interested in identifying lesser-known stocks that could benefit from these evolving economic conditions. In this environment, a good stock might be characterized by strong fundamentals and the ability to capitalize on anticipated policy shifts or market trends that favor growth and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Elmera Group (OB:ELMRA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elmera Group ASA, with a market cap of NOK3.99 billion, operates in Norway where it and its subsidiaries focus on the purchase, sale, and portfolio management of electrical power for households, private and public companies, and municipalities.

Operations: Elmera Group generates revenue primarily through the purchase, sale, and portfolio management of electrical power in Norway. The company's financial performance is influenced by its cost structure, with notable trends in its net profit margin.

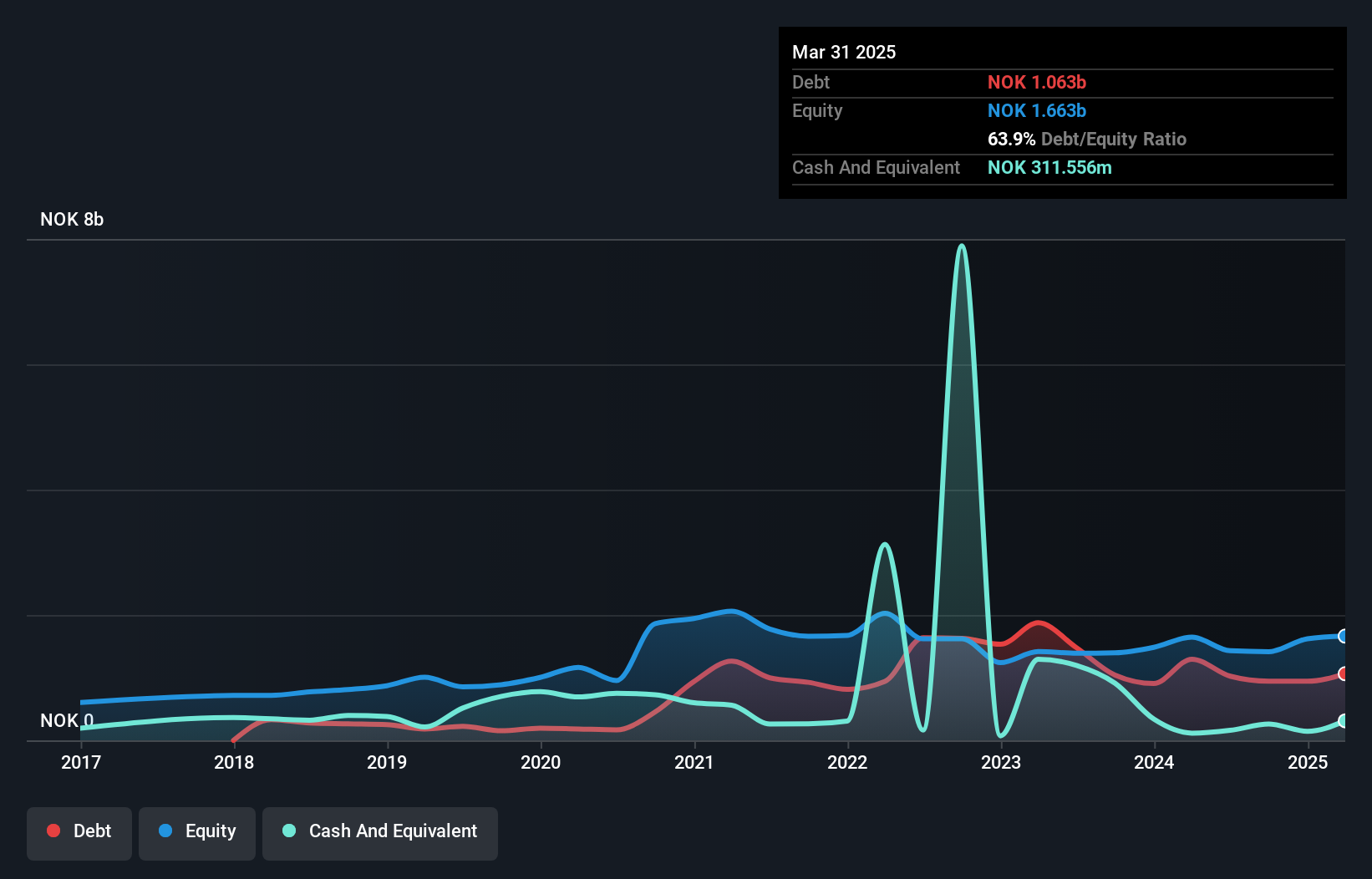

Elmera Group, a small company in the electric utilities sector, has shown impressive earnings growth of 293.5% over the past year, outpacing the industry's -9.1%. Despite this growth, Elmera carries a high net debt to equity ratio of 48.2%, which has risen from 17.2% to 66.6% in five years, indicating increased leverage. The company trades at a significant discount of about 86.8% below its estimated fair value and maintains positive free cash flow with recent figures showing NOK 965 million as of December 2023. Its interest payments are well covered by EBIT at a multiple of 3.6x, suggesting manageable debt servicing capabilities amidst ongoing expansion efforts through M&A activities and refinancing initiatives totaling NOK 8 billion for enhanced liquidity and operational flexibility.

Kontour (Xi'an) Medical Technology (SHSE:688314)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kontour (Xi'an) Medical Technology Co., Ltd. specializes in the development and production of surgical and medical equipment, with a market capitalization of CN¥2.51 billion.

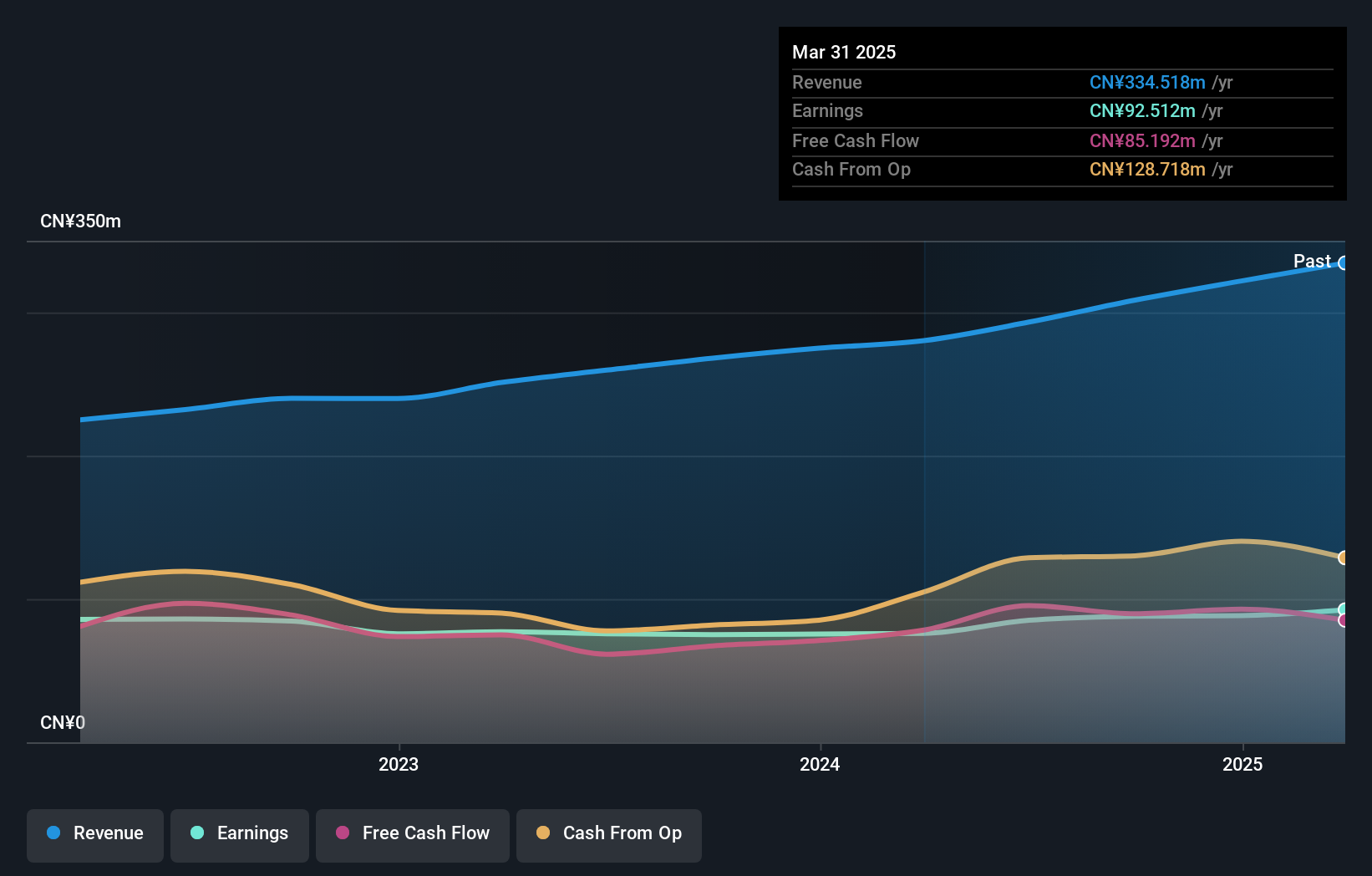

Operations: Kontour generates revenue primarily from its surgical and medical equipment segment, amounting to CN¥308.54 million.

Kontour Medical Technology, a promising player in the medical equipment sector, has demonstrated robust earnings growth of 17% over the past year, outpacing the industry's -8.8%. The company reported sales of CNY 240.12 million for nine months ending September 2024, up from CNY 206.6 million a year ago, with net income rising to CNY 76.71 million from CNY 64.35 million. Despite an increased debt-to-equity ratio from 4% to 5.8% over five years, Kontour remains financially sound with more cash than total debt and a favorable price-to-earnings ratio of 28.6x against the CN market's average of 36.3x.

- Click here to discover the nuances of Kontour (Xi'an) Medical Technology with our detailed analytical health report.

Understand Kontour (Xi'an) Medical Technology's track record by examining our Past report.

Mimaki Engineering (TSE:6638)

Simply Wall St Value Rating: ★★★★★★

Overview: Mimaki Engineering Co., Ltd. develops, manufactures, and sells computer devices and software in Japan and internationally with a market capitalization of ¥45.09 billion.

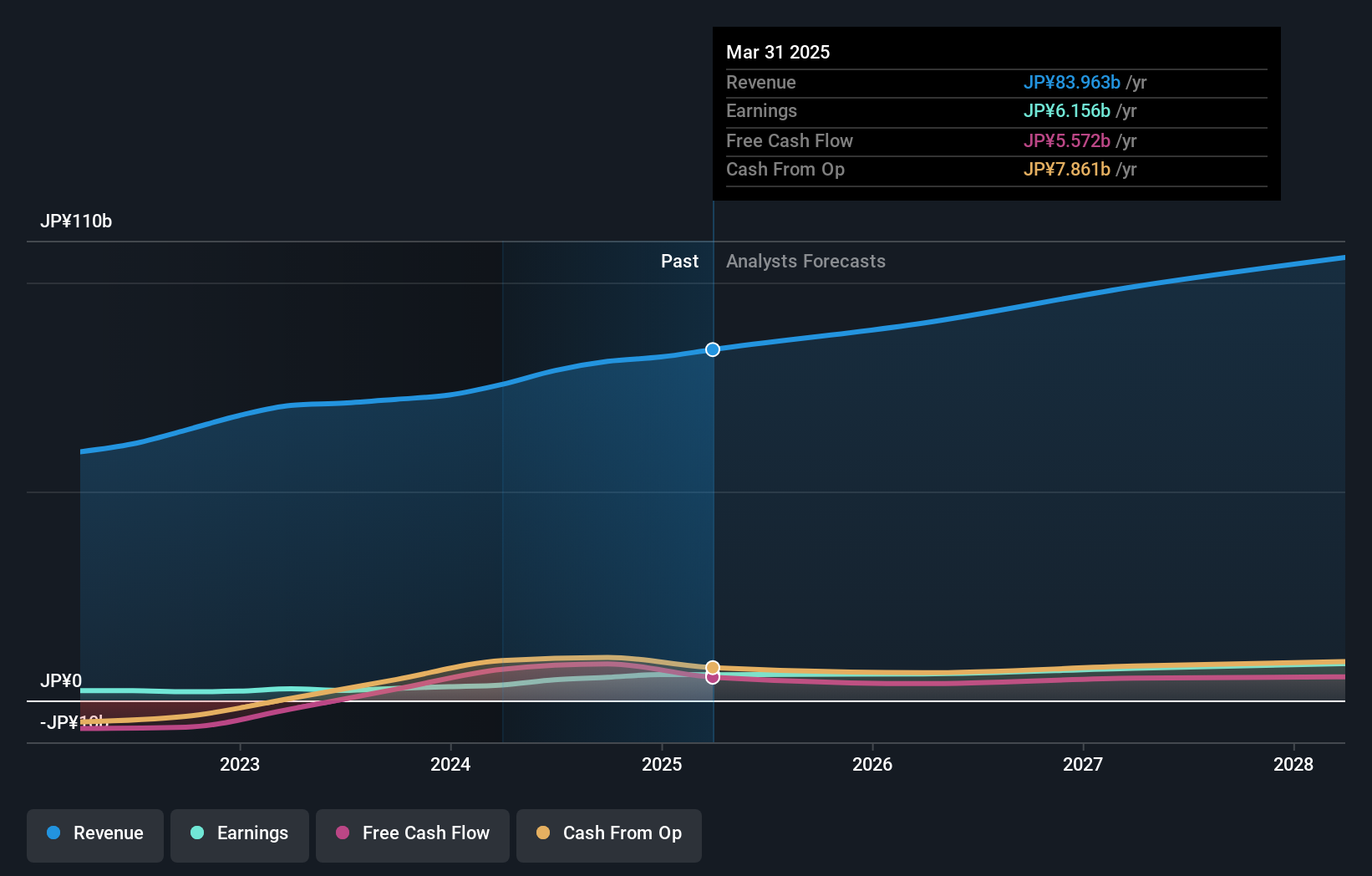

Operations: Mimaki Engineering generates revenue primarily from the Japan/Asia/Oceania region, amounting to ¥64.91 billion, followed by Europe/Middle East/Africa at ¥24.99 billion, and North America and Latin America at ¥23.28 billion.

Mimaki Engineering, a nimble player in the tech sector, stands out with its impressive earnings growth of 106.7% over the past year, far surpassing the industry's 5.6%. Trading at a substantial discount of 64.1% below its estimated fair value, it appears attractively priced relative to peers. The company's debt situation has improved significantly over five years, with a debt-to-equity ratio now at 83.8%, down from 129.5%. Furthermore, Mimaki's net debt to equity ratio is considered satisfactory at 24.3%, and its interest payments are well covered by EBIT—23 times over—indicating robust financial health despite recent share price volatility.

Seize The Opportunity

- Gain an insight into the universe of 4664 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kontour (Xi'an) Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688314

Kontour (Xi'an) Medical Technology

Kontour (Xi'an) Medical Technology Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives