- Norway

- /

- Marine and Shipping

- /

- OB:WAWI

Wallenius Wilhelmsen ASA (OB:WAWI) Held Back By Insufficient Growth Even After Shares Climb 27%

Wallenius Wilhelmsen ASA (OB:WAWI) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

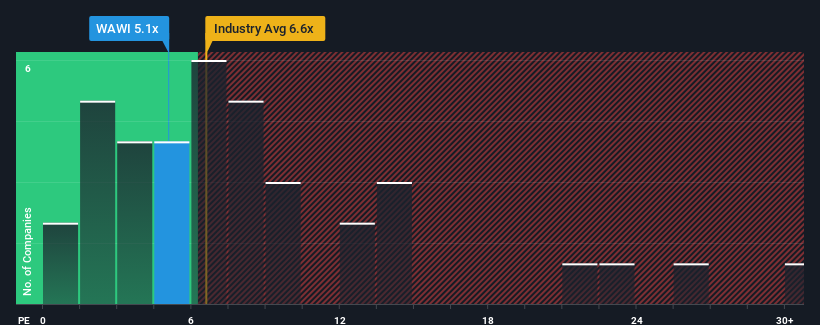

In spite of the firm bounce in price, Wallenius Wilhelmsen may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.1x, since almost half of all companies in Norway have P/E ratios greater than 12x and even P/E's higher than 23x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Wallenius Wilhelmsen certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Wallenius Wilhelmsen

Is There Any Growth For Wallenius Wilhelmsen?

The only time you'd be truly comfortable seeing a P/E as depressed as Wallenius Wilhelmsen's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 3.2% per annum as estimated by the four analysts watching the company. With the market predicted to deliver 22% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Wallenius Wilhelmsen's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Wallenius Wilhelmsen's P/E

Wallenius Wilhelmsen's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Wallenius Wilhelmsen maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Wallenius Wilhelmsen has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Wallenius Wilhelmsen. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wallenius Wilhelmsen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WAWI

Wallenius Wilhelmsen

Engages in the logistics and transportation business worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives