- Norway

- /

- Marine and Shipping

- /

- OB:WAWI

Here's Why We Think Wallenius Wilhelmsen (OB:WAWI) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Wallenius Wilhelmsen (OB:WAWI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

We've discovered 2 warning signs about Wallenius Wilhelmsen. View them for free.How Fast Is Wallenius Wilhelmsen Growing Its Earnings Per Share?

Over the last three years, Wallenius Wilhelmsen has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Wallenius Wilhelmsen's EPS has risen over the last 12 months, growing from US$2.02 to US$2.30. This amounts to a 14% gain; a figure that shareholders will be pleased to see.

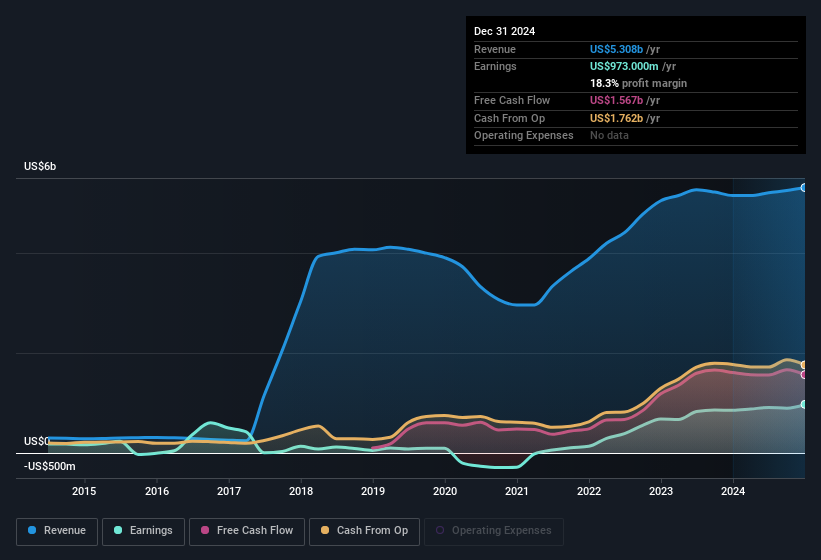

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Wallenius Wilhelmsen achieved similar EBIT margins to last year, revenue grew by a solid 3.1% to US$5.3b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Wallenius Wilhelmsen

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Wallenius Wilhelmsen?

Are Wallenius Wilhelmsen Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Wallenius Wilhelmsen insiders both bought and sold shares over the last twelve months, but they did end up spending US$296k more on stock than they received from selling it. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. We also note that it was the Independent Chairman of the Board, Rune Bjerke, who made the biggest single acquisition, paying kr543k for shares at about kr109 each.

The good news, alongside the insider buying, for Wallenius Wilhelmsen bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$137m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 0.4%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Wallenius Wilhelmsen Worth Keeping An Eye On?

As previously touched on, Wallenius Wilhelmsen is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. Even so, be aware that Wallenius Wilhelmsen is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Wallenius Wilhelmsen, you'll probably love this curated collection of companies in NO that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wallenius Wilhelmsen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WAWI

Wallenius Wilhelmsen

Engages in the logistics and transportation business worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives