- Sweden

- /

- Industrials

- /

- OM:KARNEL B

Undiscovered European Gems for October 2025

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape with dovish signals from the U.S. Federal Reserve and varying performances across major indices, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying stocks with strong fundamentals and resilience to economic fluctuations can be key to uncovering hidden gems in Europe's diverse market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 6.00% | 71.62% | 80.06% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

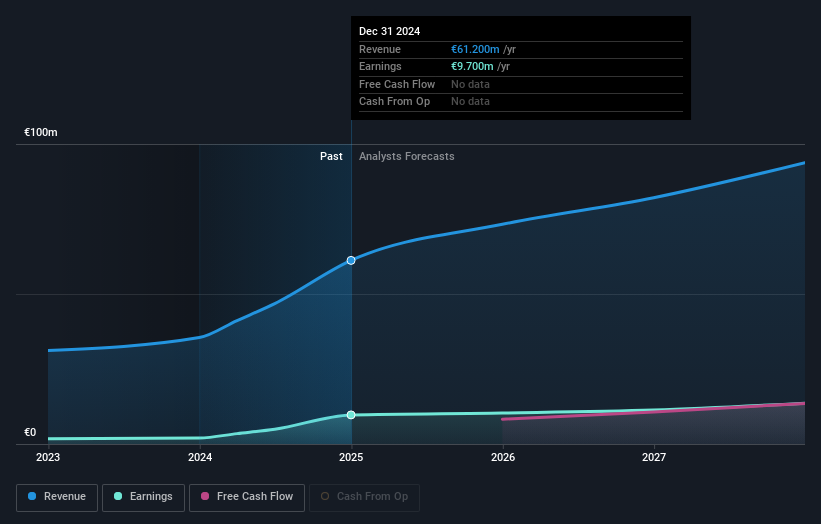

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market cap of €350.75 million.

Operations: STIF Société anonyme generates revenue primarily through the sale of components for handling bulk products. The company's cost structure includes expenses related to manufacturing and distribution. It has reported a net profit margin of 12% in recent financial periods, reflecting its ability to manage costs effectively relative to its revenue streams.

STIF Société anonyme, a small European player, has shown impressive growth with earnings surging 157.8% in the past year, significantly outpacing the Machinery industry's -31.6%. Recently added to the S&P Global BMI Index, it reported half-year sales of €36.7 million and net income of €6.4 million, both up from last year’s figures. The company is in talks to acquire a larger stake in BOSS PRODUCTS, enhancing its footprint in North America. With interest payments well-covered by EBIT at 108 times and trading at 31.9% below fair value estimates, STIF offers intriguing potential for investors seeking opportunities beyond mainstream options.

- Dive into the specifics of STIF Société anonyme here with our thorough health report.

Explore historical data to track STIF Société anonyme's performance over time in our Past section.

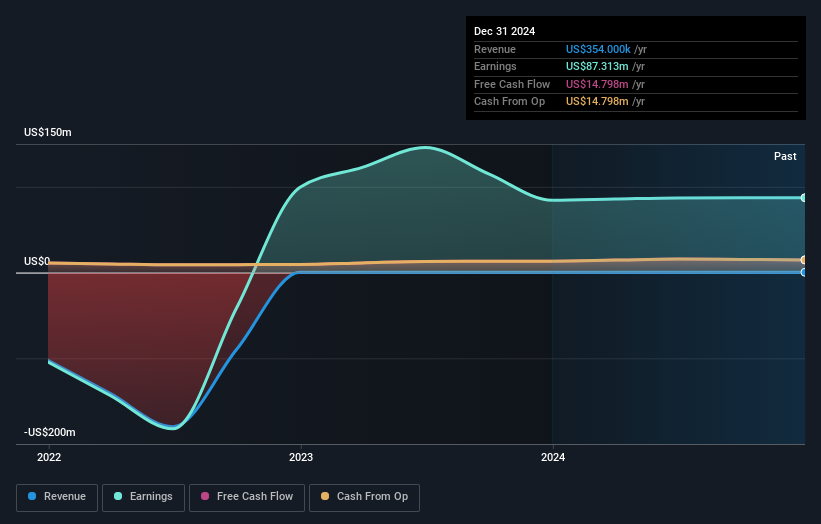

Treasure (OB:TRE)

Simply Wall St Value Rating: ★★★★★★

Overview: Treasure ASA operates primarily through its 11% interest in Hyundai Glovis Co., with a market capitalization of NOK7.06 billion.

Operations: Treasure ASA's financial performance is closely linked to its 11% stake in Hyundai Glovis Co. The company's revenue is primarily derived from its investment interest, with the market capitalization standing at NOK7.06 billion.

Treasure, a nimble player in the logistics sector, shines with its robust financial health and strategic positioning. With zero debt on its books for five years, it offers a strong foundation for growth. Despite generating less than US$1 million in revenue ($414K), it boasts high-quality earnings and an impressive 24.4% earnings growth over the past year, outpacing the industry’s -4%. Its price-to-earnings ratio of 6.5x is attractive compared to the Norwegian market's 12.2x. Recent results show net income soaring to US$67.87 million from US$46.79 million last year, reflecting solid operational performance and potential for future expansion.

- Delve into the full analysis health report here for a deeper understanding of Treasure.

Gain insights into Treasure's historical performance by reviewing our past performance report.

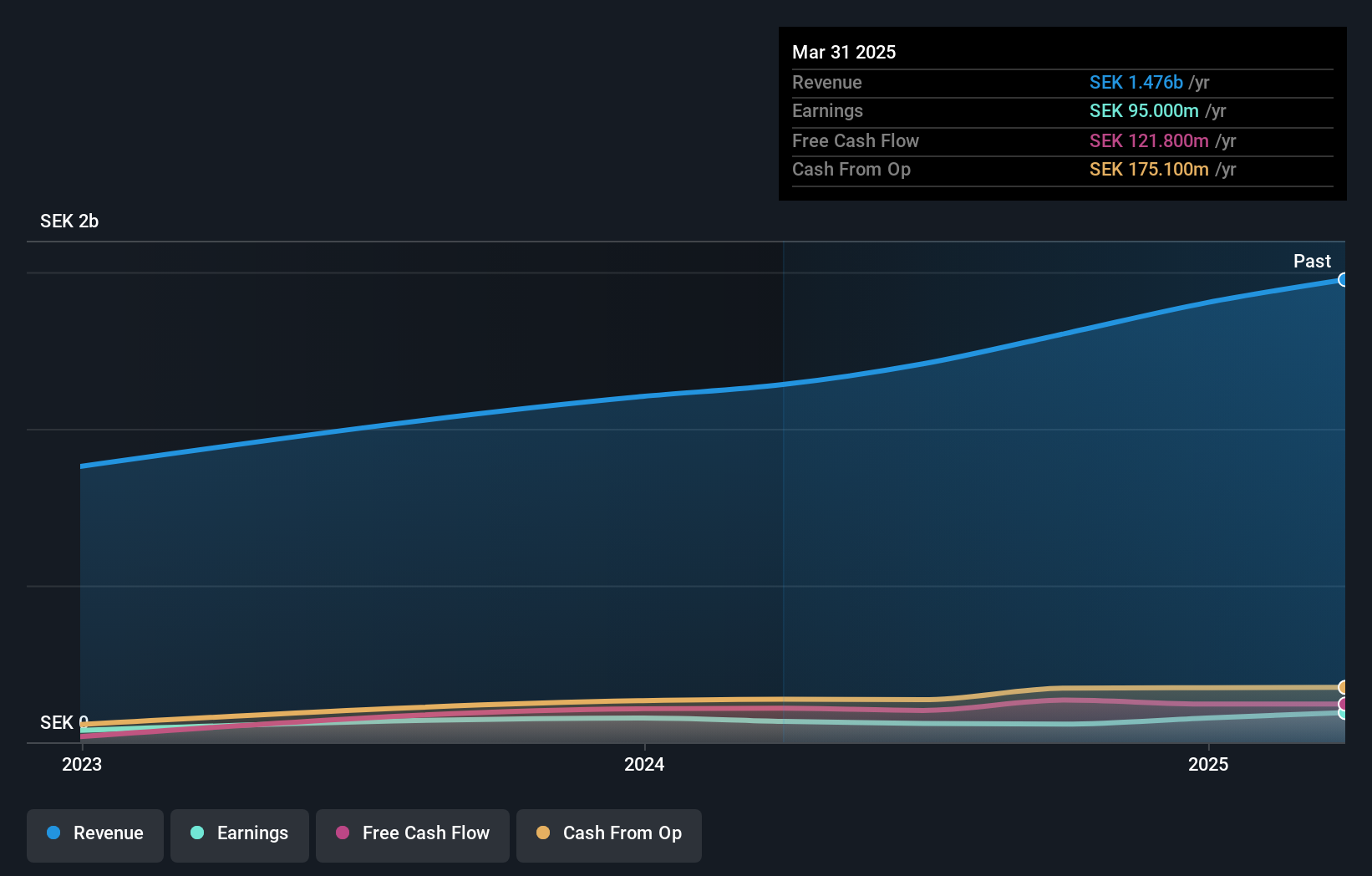

Karnell Group (OM:KARNEL B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karnell Group AB (publ) is a private equity firm focusing on investments in add-on acquisitions and expansion of small and medium-sized companies, with a market cap of SEK3.27 billion.

Operations: Karnell Group generates revenue primarily through strategic investments in small and medium-sized enterprises, focusing on add-on acquisitions and expansion. The firm operates with a market cap of SEK3.27 billion.

Karnell Group has shown impressive earnings growth of 94% over the past year, significantly outpacing the Industrials industry average of 5.9%. With a net debt to equity ratio at a satisfactory 28%, it demonstrates sound financial management. Trading at approximately 13% below its estimated fair value, Karnell offers potential upside for investors. The company's interest payments are well covered by EBIT at 6.7 times, reflecting robust operational performance. Recent executive changes include CFO Lars Neret's planned departure, with recruitment for his successor underway, which could bring fresh perspectives to their strategic direction.

- Get an in-depth perspective on Karnell Group's performance by reading our health report here.

Assess Karnell Group's past performance with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 325 European Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karnell Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KARNEL B

Karnell Group

A private equity firm specializing investments in add-on acquisitions, expansion and small and medium-sized companies.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives