- Norway

- /

- Marine and Shipping

- /

- OB:ODF

We Think Some Shareholders May Hesitate To Increase Odfjell SE's (OB:ODF) CEO Compensation

The share price of Odfjell SE (OB:ODF) has struggled to grow by much over the last few years and probably has to do with the fact that earnings growth has gone backwards. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 05 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Odfjell

How Does Total Compensation For Kristian Morch Compare With Other Companies In The Industry?

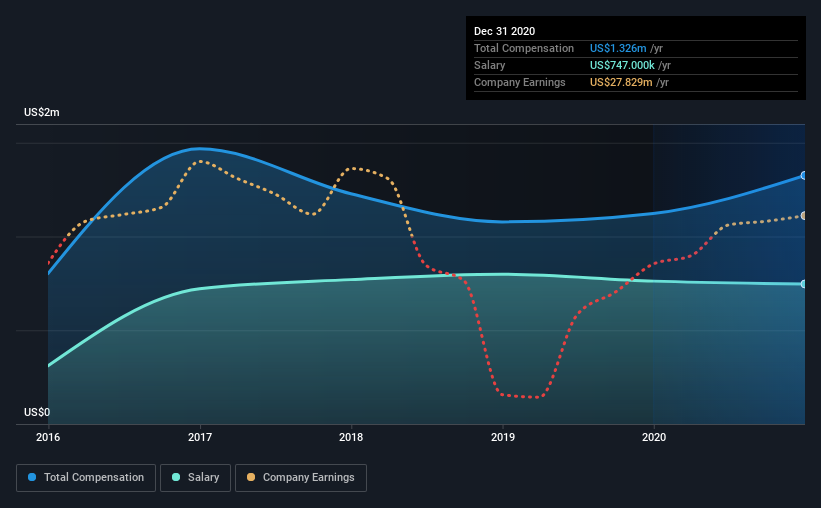

According to our data, Odfjell SE has a market capitalization of kr2.3b, and paid its CEO total annual compensation worth US$1.3m over the year to December 2020. That's a notable increase of 18% on last year. In particular, the salary of US$747.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from kr822m to kr3.3b, we found that the median CEO total compensation was US$210k. This suggests that Kristian Morch is paid more than the median for the industry. What's more, Kristian Morch holds kr7.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$747k | US$762k | 56% |

| Other | US$579k | US$361k | 44% |

| Total Compensation | US$1.3m | US$1.1m | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. Our data reveals that Odfjell allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Odfjell SE's Growth

Over the last three years, Odfjell SE has shrunk its earnings per share by 33% per year. It achieved revenue growth of 7.6% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Odfjell SE Been A Good Investment?

With a total shareholder return of 0.3% over three years, Odfjell SE has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The flat share price growth combined with the the fact that earnings have failed to grow makes us wonder whether the share price will have any further strong momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Odfjell that investors should be aware of in a dynamic business environment.

Switching gears from Odfjell, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Odfjell or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:ODF

Odfjell

Provides services for the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products in North America, South America, Norway, the Netherlands, rest of Europe, the Middle East, Asia, Africa, and Australasia.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives