- Norway

- /

- Marine and Shipping

- /

- OB:ODF

If EPS Growth Is Important To You, Odfjell (OB:ODF) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Odfjell (OB:ODF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Odfjell with the means to add long-term value to shareholders.

See our latest analysis for Odfjell

How Fast Is Odfjell Growing Its Earnings Per Share?

In the last three years Odfjell's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Odfjell's EPS skyrocketed from US$2.24 to US$2.84, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 27%.

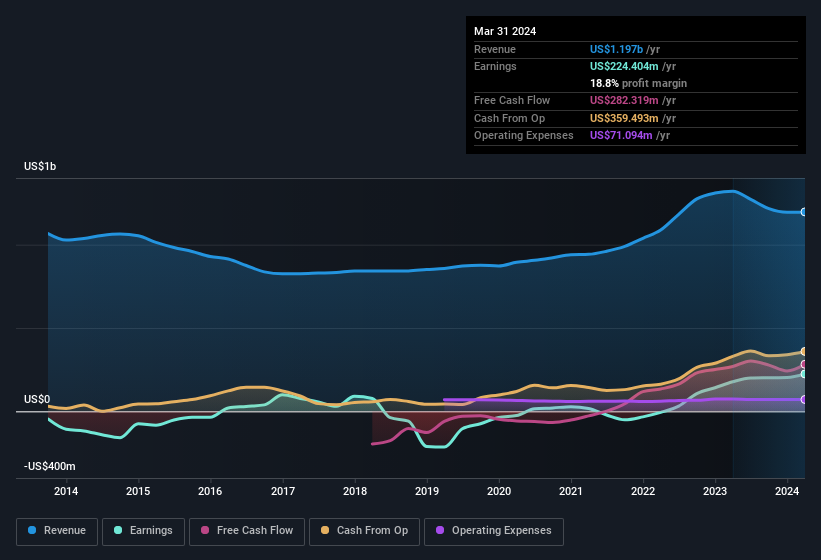

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Odfjell's EBIT margins have actually improved by 6.3 percentage points in the last year, to reach 25%, but, on the flip side, revenue was down 9.3%. While not disastrous, these figures could be better.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Odfjell?

Are Odfjell Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Odfjell insiders own a significant number of shares certainly is appealing. Actually, with 45% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. At the current share price, that insider holding is worth a staggering US$5.8b. That means they have plenty of their own capital riding on the performance of the business!

Is Odfjell Worth Keeping An Eye On?

For growth investors, Odfjell's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Odfjell you should be aware of.

Although Odfjell certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Norwegian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ODF

Odfjell

Provides services for the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products in North America, South America, Norway, the Netherlands, rest of Europe, the Middle East, Asia, Africa, and Australasia.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives