- Norway

- /

- Marine and Shipping

- /

- OB:KCC

Does Klaveness Combination Carriers (OB:KCC) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Klaveness Combination Carriers ASA (OB:KCC) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Klaveness Combination Carriers

What Is Klaveness Combination Carriers's Debt?

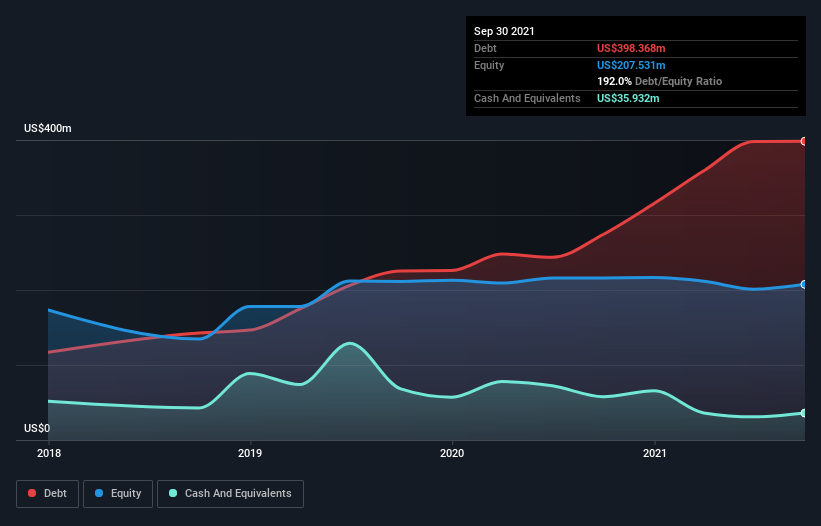

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Klaveness Combination Carriers had US$398.4m of debt, an increase on US$274.0m, over one year. However, it also had US$35.9m in cash, and so its net debt is US$362.4m.

How Strong Is Klaveness Combination Carriers' Balance Sheet?

We can see from the most recent balance sheet that Klaveness Combination Carriers had liabilities of US$124.0m falling due within a year, and liabilities of US$298.9m due beyond that. On the other hand, it had cash of US$35.9m and US$29.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$357.9m.

Given this deficit is actually higher than the company's market capitalization of US$255.2m, we think shareholders really should watch Klaveness Combination Carriers's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Klaveness Combination Carriers shareholders face the double whammy of a high net debt to EBITDA ratio (7.3), and fairly weak interest coverage, since EBIT is just 1.6 times the interest expense. This means we'd consider it to have a heavy debt load. Investors should also be troubled by the fact that Klaveness Combination Carriers saw its EBIT drop by 14% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Klaveness Combination Carriers can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Klaveness Combination Carriers saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Klaveness Combination Carriers's net debt to EBITDA left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. And even its level of total liabilities fails to inspire much confidence. We think the chances that Klaveness Combination Carriers has too much debt a very significant. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 6 warning signs with Klaveness Combination Carriers (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Klaveness Combination Carriers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:KCC

Klaveness Combination Carriers

Owns and operates combination carriers for the dry bulk shipping and product tanker industries in the Middle East, Australia, Oceania, North East Asia, South America, North America, Europe, Africa, Southeast Asia, and South Asia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives