- Norway

- /

- Marine and Shipping

- /

- OB:HSHP

If EPS Growth Is Important To You, Himalaya Shipping (OB:HSHP) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Himalaya Shipping (OB:HSHP), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our free stock report includes 2 warning signs investors should be aware of before investing in Himalaya Shipping. Read for free now.How Fast Is Himalaya Shipping Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Himalaya Shipping's EPS went from US$0.039 to US$0.45 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Himalaya Shipping is growing revenues, and EBIT margins improved by 14.1 percentage points to 54%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

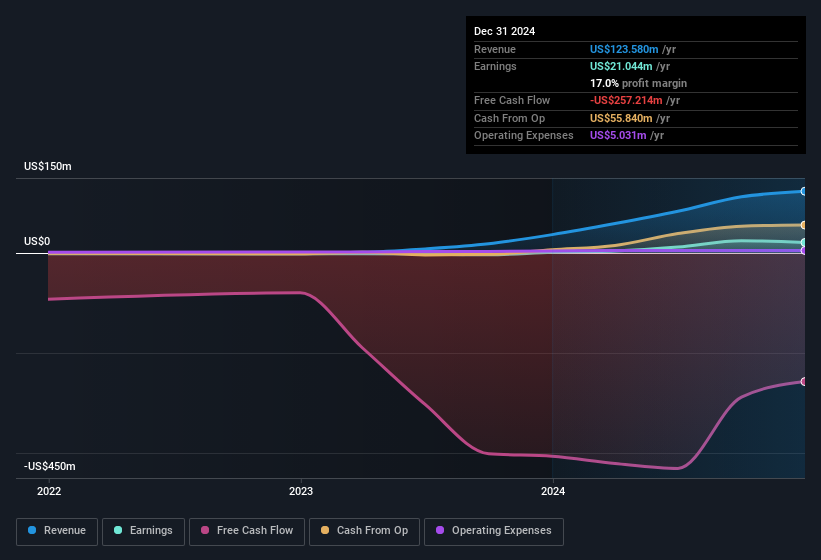

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

View our latest analysis for Himalaya Shipping

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Himalaya Shipping's future profits.

Are Himalaya Shipping Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Himalaya Shipping shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Contracted Chief Executive Officer Lars-Christian Svensen bought US$502k worth of shares at an average price of around US$62.74. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Himalaya Shipping.

The good news, alongside the insider buying, for Himalaya Shipping bulls is that insiders (collectively) have a meaningful investment in the stock. Holding US$771m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That holding amounts to 30% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Should You Add Himalaya Shipping To Your Watchlist?

Himalaya Shipping's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Himalaya Shipping belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Himalaya Shipping (at least 1 which is concerning) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Himalaya Shipping, you'll probably love this curated collection of companies in NO that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Himalaya Shipping might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HSHP

High growth potential with excellent balance sheet.

Market Insights

Community Narratives