- Norway

- /

- Marine and Shipping

- /

- OB:HAUTO

Is Now The Time To Put Höegh Autoliners (OB:HAUTO) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Höegh Autoliners (OB:HAUTO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Höegh Autoliners

How Fast Is Höegh Autoliners Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. In impressive fashion, Höegh Autoliners' EPS grew from US$0.95 to US$1.99, over the previous 12 months. It's not often a company can achieve year-on-year growth of 110%. The best case scenario? That the business has hit a true inflection point.

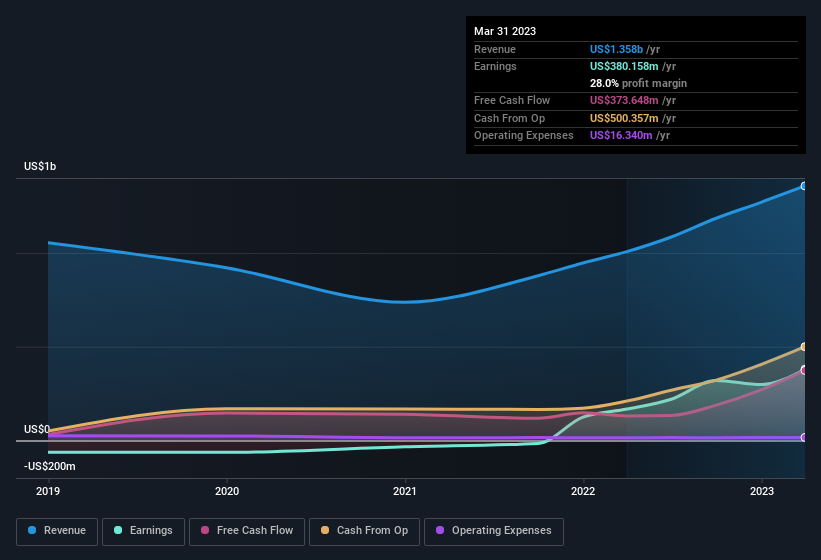

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Höegh Autoliners shareholders can take confidence from the fact that EBIT margins are up from 11% to 28%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Höegh Autoliners' future EPS 100% free.

Are Höegh Autoliners Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Höegh Autoliners insiders spent US$1.5m on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Chief Executive Officer Andreas Enger who made the biggest single purchase, worth kr739k, paying kr61.56 per share.

Does Höegh Autoliners Deserve A Spot On Your Watchlist?

Höegh Autoliners' earnings per share have been soaring, with growth rates sky high. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over Höegh Autoliners could be in your best interest. Even so, be aware that Höegh Autoliners is showing 2 warning signs in our investment analysis , and 1 of those is significant...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Höegh Autoliners, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Höegh Autoliners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HAUTO

Höegh Autoliners

Provides ocean transportation services within the roll-on roll-off (RoRo) cargoes on deep sea and short sea markets in Norway.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)