Xplora Technologies (OB:XPLRA) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Xplora Technologies AS (OB:XPLRA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Xplora Technologies's Net Debt?

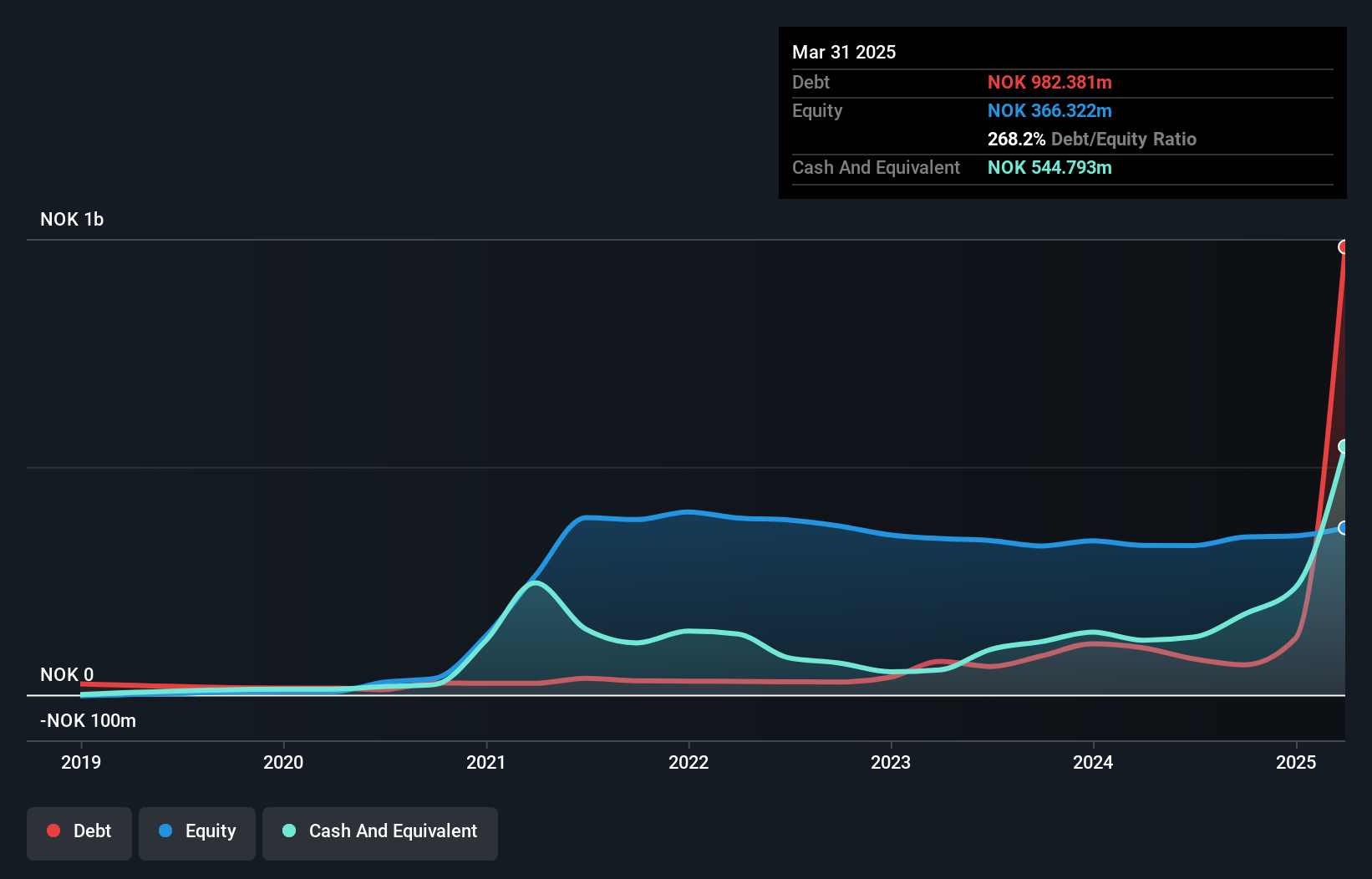

You can click the graphic below for the historical numbers, but it shows that as of March 2025 Xplora Technologies had kr982.4m of debt, an increase on kr103.2m, over one year. On the flip side, it has kr544.8m in cash leading to net debt of about kr437.6m.

A Look At Xplora Technologies' Liabilities

According to the last reported balance sheet, Xplora Technologies had liabilities of kr529.8m due within 12 months, and liabilities of kr1.04b due beyond 12 months. Offsetting these obligations, it had cash of kr544.8m as well as receivables valued at kr222.4m due within 12 months. So it has liabilities totalling kr802.0m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Xplora Technologies is worth kr2.09b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

See our latest analysis for Xplora Technologies

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.51 times and a disturbingly high net debt to EBITDA ratio of 6.8 hit our confidence in Xplora Technologies like a one-two punch to the gut. The debt burden here is substantial. However, the silver lining was that Xplora Technologies achieved a positive EBIT of kr23m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Xplora Technologies's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Xplora Technologies actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Neither Xplora Technologies's ability to cover its interest expense with its EBIT nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Xplora Technologies is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:XPLRA

Xplora Technologies

An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives