As global markets continue to ride a wave of optimism fueled by hopes for softer tariffs and enthusiasm around artificial intelligence, major indices like the S&P 500 have reached record highs, while growth stocks have outperformed value shares. In this environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on emerging trends such as AI infrastructure development and resilient manufacturing activity.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Norbit ASA is a company that offers technology products and solutions, with a market capitalization of NOK6.46 billion.

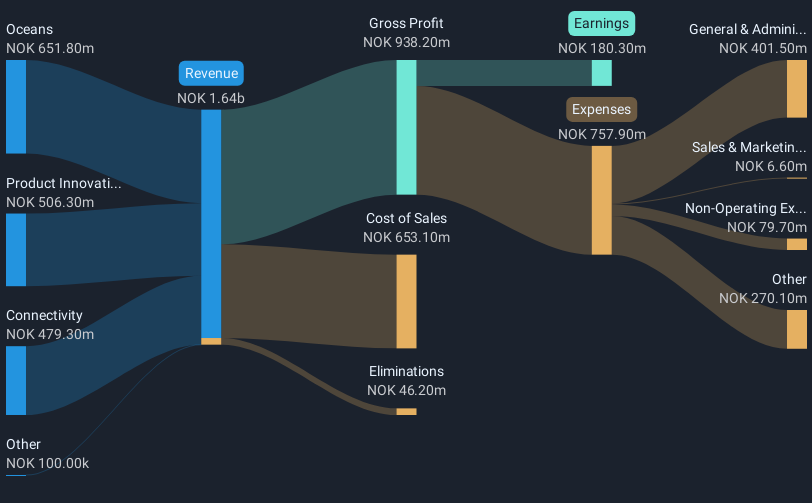

Operations: Norbit ASA generates revenue primarily from three segments: Oceans, Connectivity, and Product Innovation and Realization (PIR), with the Oceans segment contributing NOK651.80 million and PIR adding NOK506.30 million. The Connectivity segment accounts for NOK479.30 million in revenue.

Amidst a challenging tech landscape, Norbit stands out with its robust earnings growth and strategic R&D investments. With an impressive annual earnings growth forecast at 34.7%, significantly outpacing the Norwegian market's 9%, the company is poised for substantial financial gains. Revenue trends also show promise, growing at 17.1% annually, again beating the national average of just 2%. This performance is underpinned by a recent surge in sales to NOK 371.9 million in Q3 2024 from NOK 328.6 million in the same period last year, reflecting strong market demand. Moreover, Norbit's commitment to innovation is evident from its R&D focus, crucial for maintaining competitive edge in high-tech sectors like electronics where it operates. The firm’s strategic emphasis on research not only fuels future growth but also enhances product offerings—key in retaining and expanding its customer base amidst rapidly evolving technological standards.

- Unlock comprehensive insights into our analysis of Norbit stock in this health report.

Review our historical performance report to gain insights into Norbit's's past performance.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

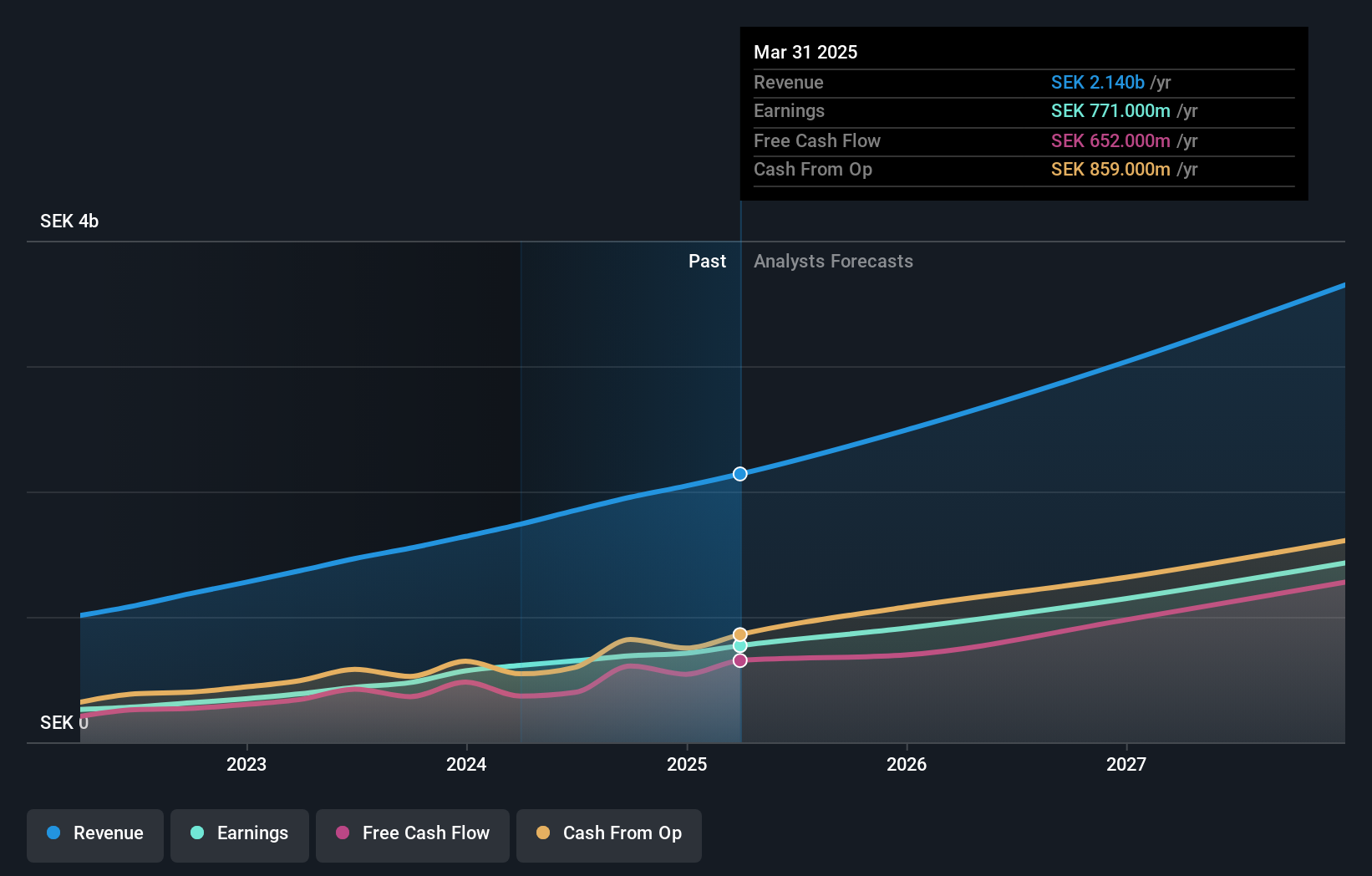

Overview: Fortnox AB (publ) offers financial and administrative software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of SEK44.21 billion.

Operations: The company generates revenue primarily from core products, businesses, and accounting firms, with significant contributions from marketplaces and financial services. Core products lead the revenue streams at SEK768 million.

Fortnox demonstrates a compelling trajectory in the tech sector, with its earnings and revenue growth outstripping broader market averages. Over the past year, earnings soared by 45%, surpassing the software industry's growth of 40.1%. This robust performance is supported by an aggressive R&D strategy, crucial for maintaining a competitive edge in rapidly evolving tech landscapes. Notably, Fortnox's revenue is expected to climb at 17.6% annually, significantly ahead of Sweden's overall market growth rate of just 1%. Moreover, with an anticipated annual profit growth rate of 23.9%, Fortnox is well-positioned to capitalize on future technological advancements and market opportunities.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

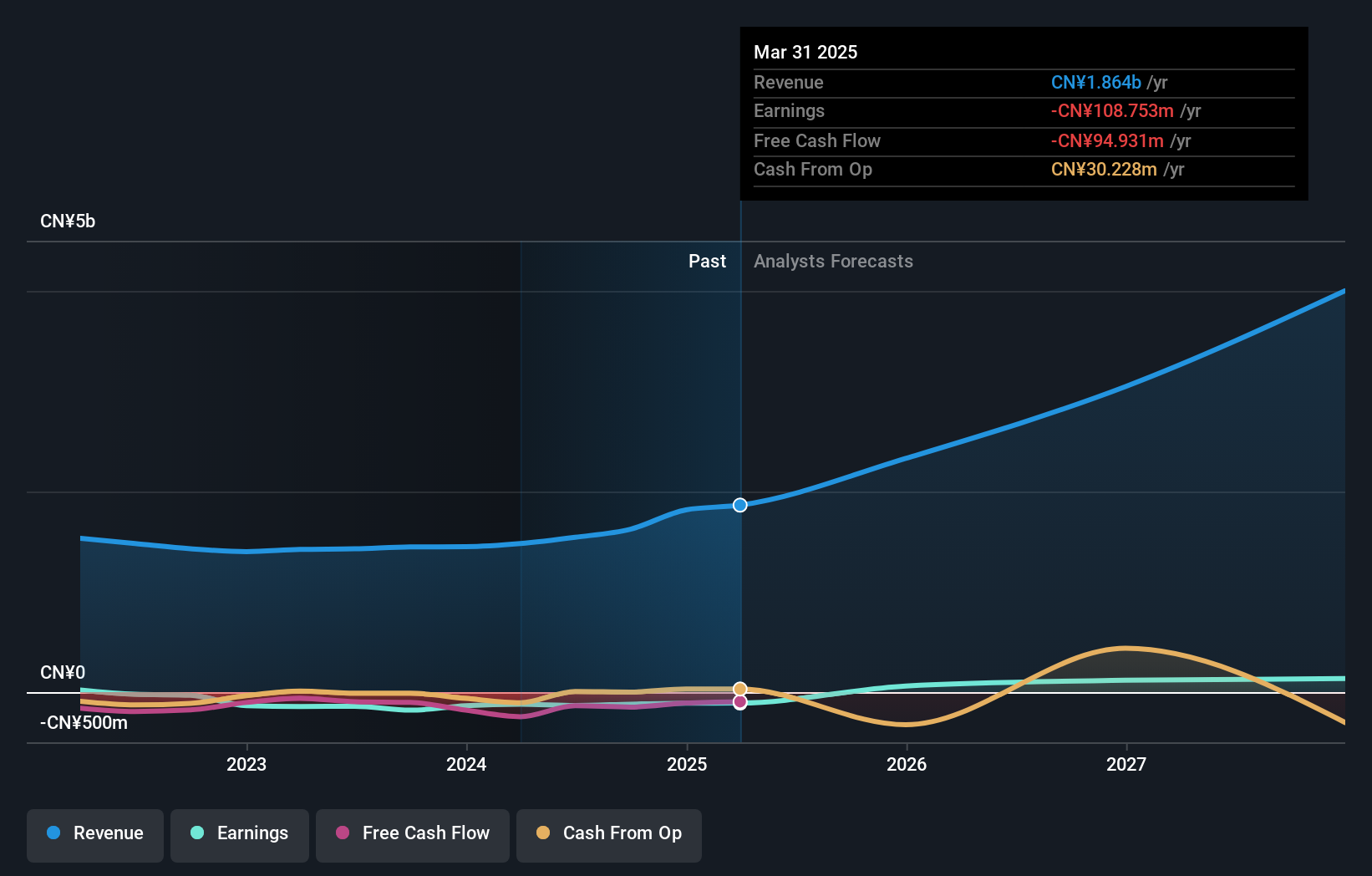

Overview: Hanwang Technology Co., Ltd. specializes in handwriting recognition, optical character recognition, and handwriting input products for both domestic and international markets, with a market cap of CN¥6.09 billion.

Operations: The company generates revenue primarily through the sale of handwriting recognition, optical character recognition, and handwriting input products across domestic and international markets. It operates with a market cap of CN¥6.09 billion.

Hanwang TechnologyLtd has demonstrated a notable presence in the tech landscape, particularly with its groundbreaking EMC-Touch chip and Penstar digital notebook, unveiled at CES 2025. These innovations underscore Hanwang's deep expertise in touch technology, contributing to its 25.3% annual revenue growth forecast, significantly outstripping the Chinese market's 13.3%. Despite current unprofitability, the firm is poised for a turnaround with expected profit growth of 86.31% annually over the next three years, signaling robust future prospects amidst high market volatility.

Turning Ideas Into Actions

- Reveal the 1230 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives