As the global markets navigate a period of fluctuating consumer confidence and mixed economic indicators, major stock indexes have shown moderate gains, with technology stocks playing a pivotal role in driving growth. In this dynamic environment, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience and innovation amidst changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★☆☆

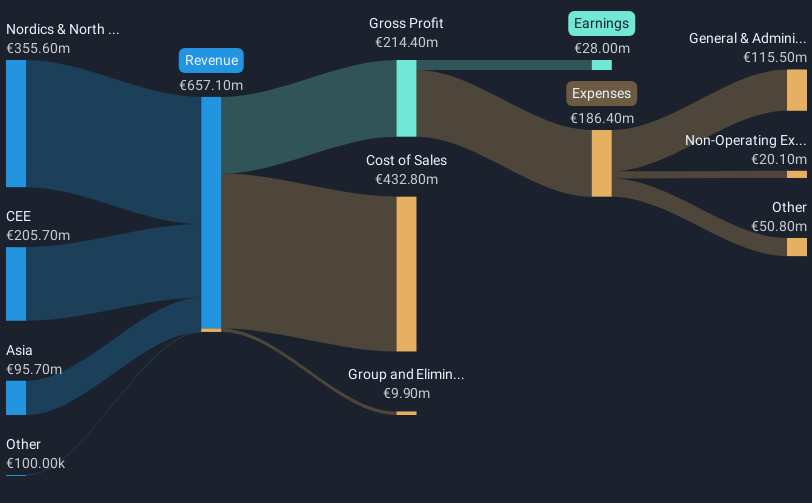

Overview: Kitron ASA is an electronics manufacturing services company with operations across Europe, Asia, and the United States, and has a market capitalization of NOK6.73 billion.

Operations: Kitron ASA focuses on electronics manufacturing services, generating revenue primarily from its EMS segment, which amounts to €685.70 million. The company operates across multiple regions including Europe, Asia, and the United States.

Kitron's recent strategic moves, including a significant IoT manufacturing contract and U.S. Army electronics order, underscore its adaptation to emerging tech demands. With an annual revenue growth forecast at 6.2% and earnings expected to climb by 15.2% annually, Kitron is outpacing the Norwegian market's growth rates significantly. Moreover, the company's commitment to expanding its production capacity in Sweden reflects a proactive approach to scaling operations in response to increasing demand sectors like national defense and logistics monitoring technologies. These developments suggest Kitron is strategically positioning itself within high-growth tech segments despite facing challenges like a high debt level and recent negative earnings growth relative to its industry.

- Click here to discover the nuances of Kitron with our detailed analytical health report.

Evaluate Kitron's historical performance by accessing our past performance report.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

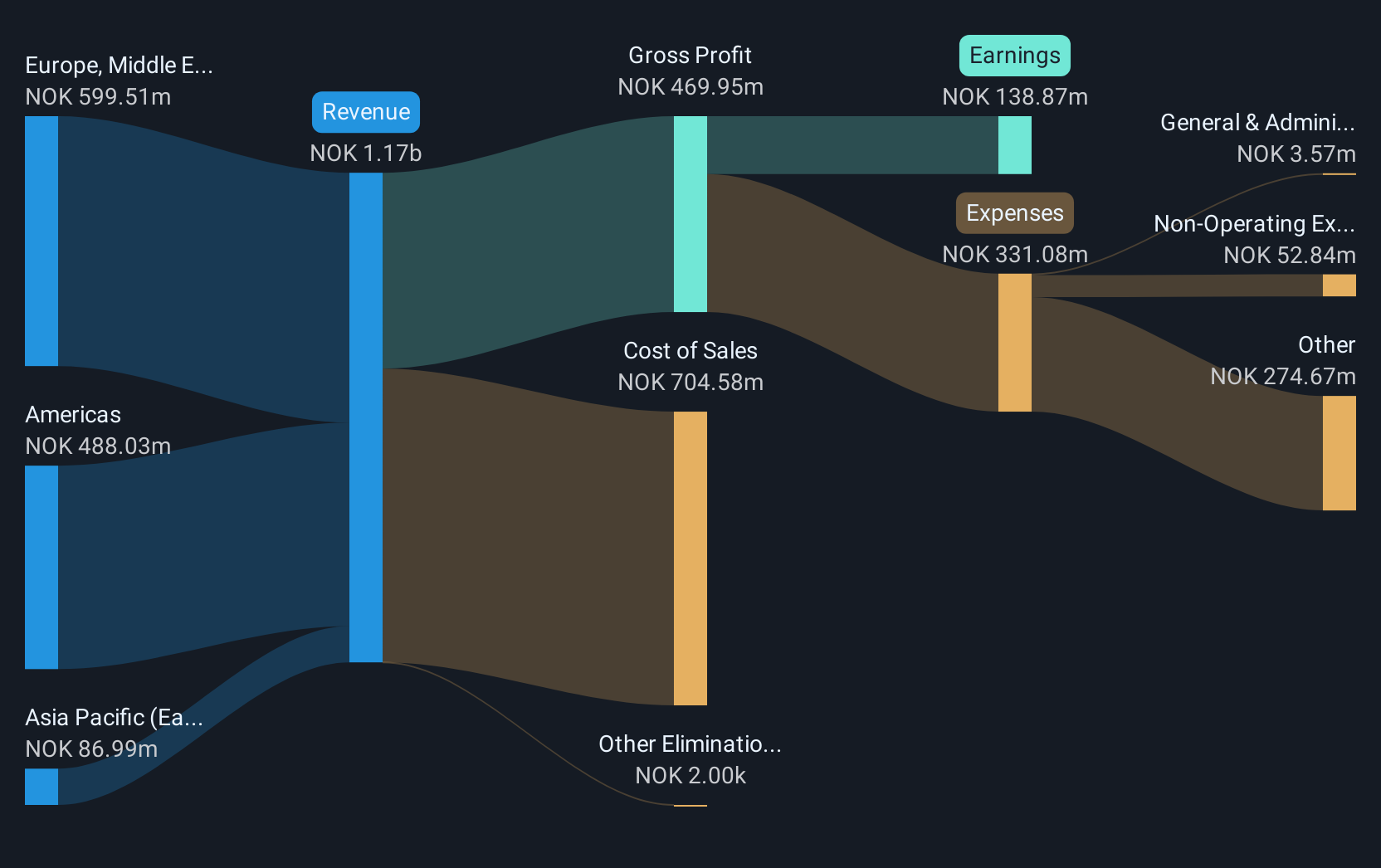

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure globally, with a market capitalization of NOK4.46 billion.

Operations: Pexip Holding ASA generates revenue primarily through the sale of collaboration services, amounting to NOK1.07 billion. The company focuses on providing a comprehensive video conferencing platform and digital infrastructure worldwide.

Pexip Holding, amid a transformative phase, has shown promising financial improvements with a recent shift from losses to profitability. In the third quarter of 2024 alone, sales surged to NOK 228.48 million from NOK 214.86 million in the previous year, and net income flipped to NOK 5.8 million from a loss of NOK 24.19 million—a stark contrast highlighting operational efficiency and market adaptation. The company's projected revenue growth at an annual rate of 12.6% outstrips Norway's average (2.2%), while earnings are expected to skyrocket by approximately 67% annually over the next few years, signaling robust potential in its sector despite current unprofitability issues. Moreover, Pexip's engagement in high-profile industry events like the Morgan Stanley European Technology Conference underscores its active pursuit for broader recognition and investor confidence within tech circles. This strategic positioning is crucial as it navigates through competitive landscapes where innovation and scalability dictate long-term success—factors that could significantly influence its trajectory as it aims for sustained growth and profitability in upcoming years.

- Take a closer look at Pexip Holding's potential here in our health report.

Examine Pexip Holding's past performance report to understand how it has performed in the past.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Growth Rating: ★★★★★☆

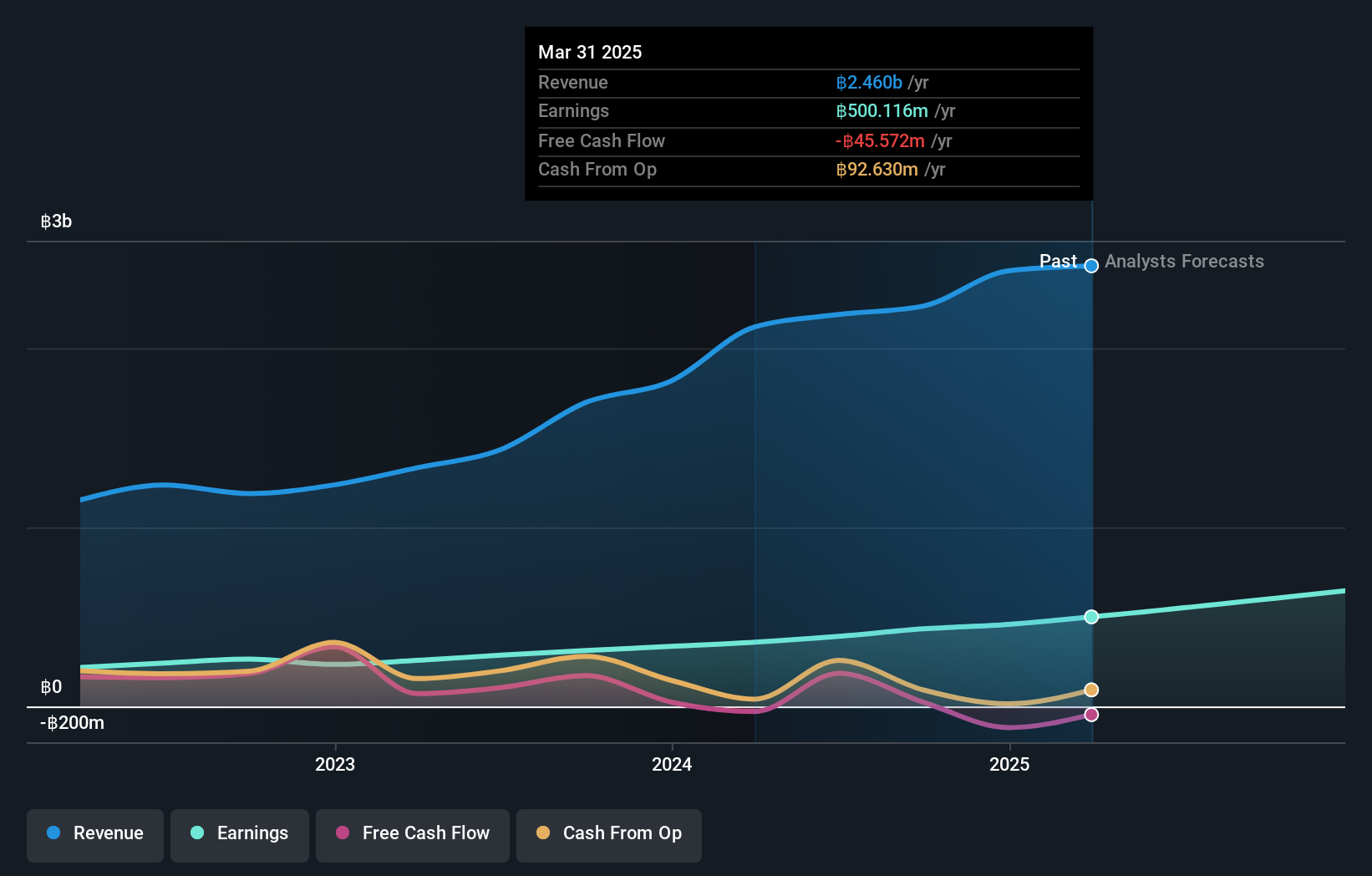

Overview: Ditto (Thailand) Public Company Limited focuses on distributing data and document management solutions within Thailand, with a market capitalization of THB9.85 billion.

Operations: The company generates revenue through three primary segments: Technology Engineering Services (THB1.07 billion), Data and Document Management Solutions (THB692.38 million), and Photocopiers, Printer, and Technology Products (THB475.38 million). Its business model emphasizes the integration of advanced technology solutions for efficient data handling and document management across various sectors in Thailand.

Ditto (Thailand) has demonstrated robust financial performance with third-quarter sales rising to THB 599.67 million from THB 552.06 million the previous year, and net income increasing significantly to THB 138.17 million from THB 96.58 million. This growth trajectory is underscored by a notable annualized revenue increase of 27.8% and earnings growth of 26.8%, outpacing the broader Electronic industry's growth rate of just 7.1%. The company's commitment to innovation and market expansion was evident at the Opportunity Day Q3/2024 presentation, positioning Ditto favorably in a competitive landscape where rapid adaptation and strategic foresight are crucial for sustained success.

Key Takeaways

- Click through to start exploring the rest of the 1264 High Growth Tech and AI Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure worldwide.

Flawless balance sheet with reasonable growth potential.