As global markets navigate a complex landscape with fluctuating consumer confidence and mixed economic indicators, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, often associated with smaller or newer companies, remain an intriguing option despite their somewhat outdated name. When these stocks exhibit strong financial health and solid fundamentals, they can offer potential growth opportunities at lower price points.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,827 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and other international markets, with a market cap of €173.78 million.

Operations: The company's revenue primarily comes from its Medical Labs & Research segment, generating €4.36 million.

Market Cap: €173.78M

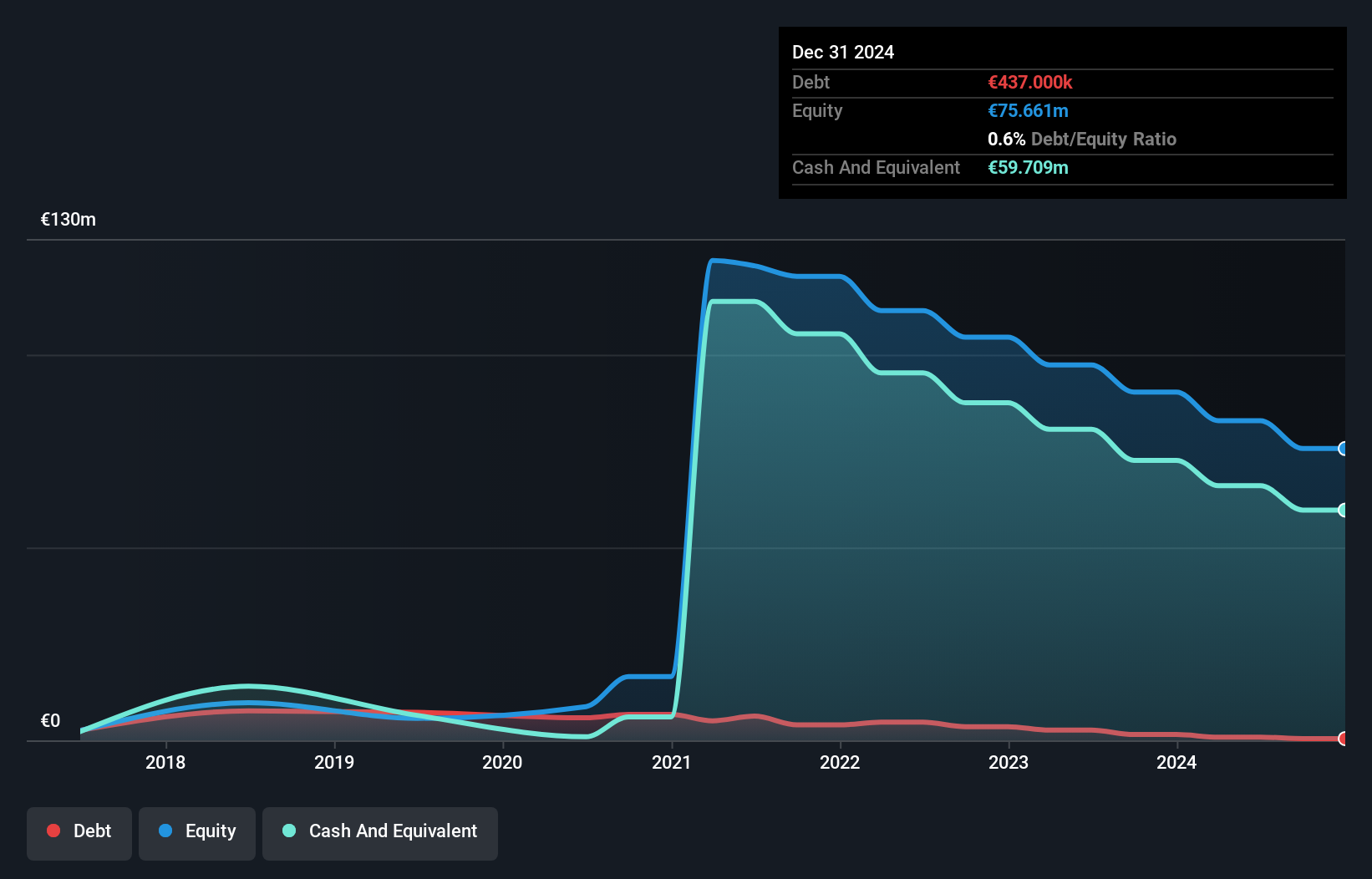

Nightingale Health Oyj, despite being unprofitable with losses increasing over the past five years, boasts a strong cash position exceeding its total debt and a cash runway extending beyond three years. Recent strategic moves include expanding operations into Singapore and securing a commercial agreement with Boston Heart Diagnostics in the U.S., enhancing its global footprint. The management team is seasoned, supporting these growth initiatives. While revenue remains modest at €4 million, it is forecast to grow significantly. Share price volatility and lack of profitability are key concerns for investors considering this stock in the penny stock space.

- Click to explore a detailed breakdown of our findings in Nightingale Health Oyj's financial health report.

- Review our growth performance report to gain insights into Nightingale Health Oyj's future.

Scana (OB:SCANA)

Simply Wall St Financial Health Rating: ★★★★★★

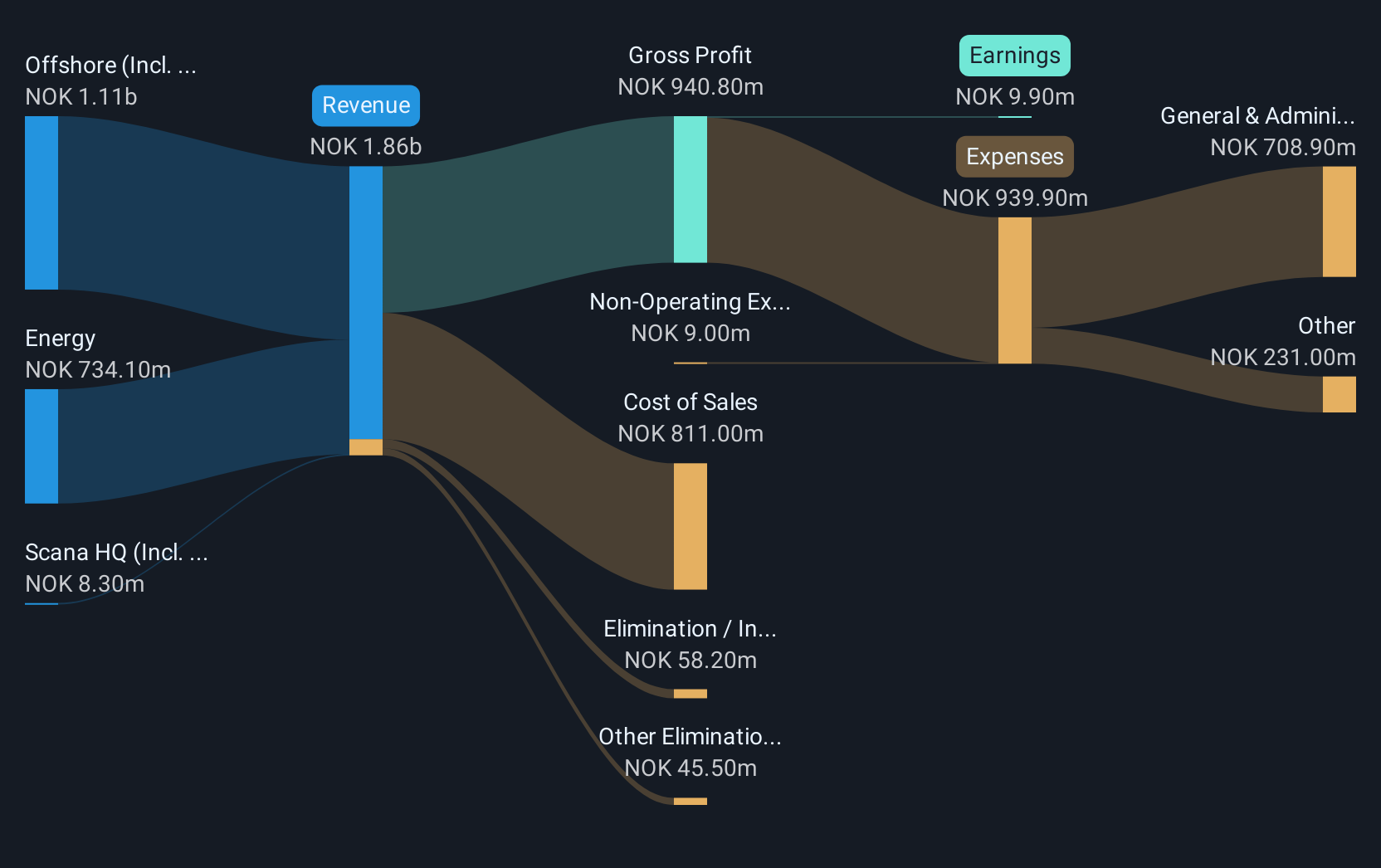

Overview: Scana ASA operates in the offshore, energy, and maritime sectors across Norway and various global regions with a market capitalization of NOK1.33 billion.

Operations: The company's revenue is derived from the Energy segment, generating NOK833 million, and the Offshore Segment, contributing NOK863.7 million.

Market Cap: NOK1.33B

Scana ASA, with a market capitalization of NOK1.33 billion, operates in the offshore, energy, and maritime sectors. The company has demonstrated strong earnings growth of 101.3% over the past year, surpassing industry averages. Despite shareholder dilution over the past year and significant insider selling recently, Scana trades at a substantial discount to its estimated fair value. Its financial health is underscored by satisfactory debt levels and high-quality earnings; short-term assets exceed both short- and long-term liabilities comfortably. Recent management changes include the resignation of Chief Business Officer Oddbjørn Haukøy as Scana targets strategic growth in Namibia.

- Unlock comprehensive insights into our analysis of Scana stock in this financial health report.

- Assess Scana's future earnings estimates with our detailed growth reports.

Culturecom Holdings (SEHK:343)

Simply Wall St Financial Health Rating: ★★★★★☆

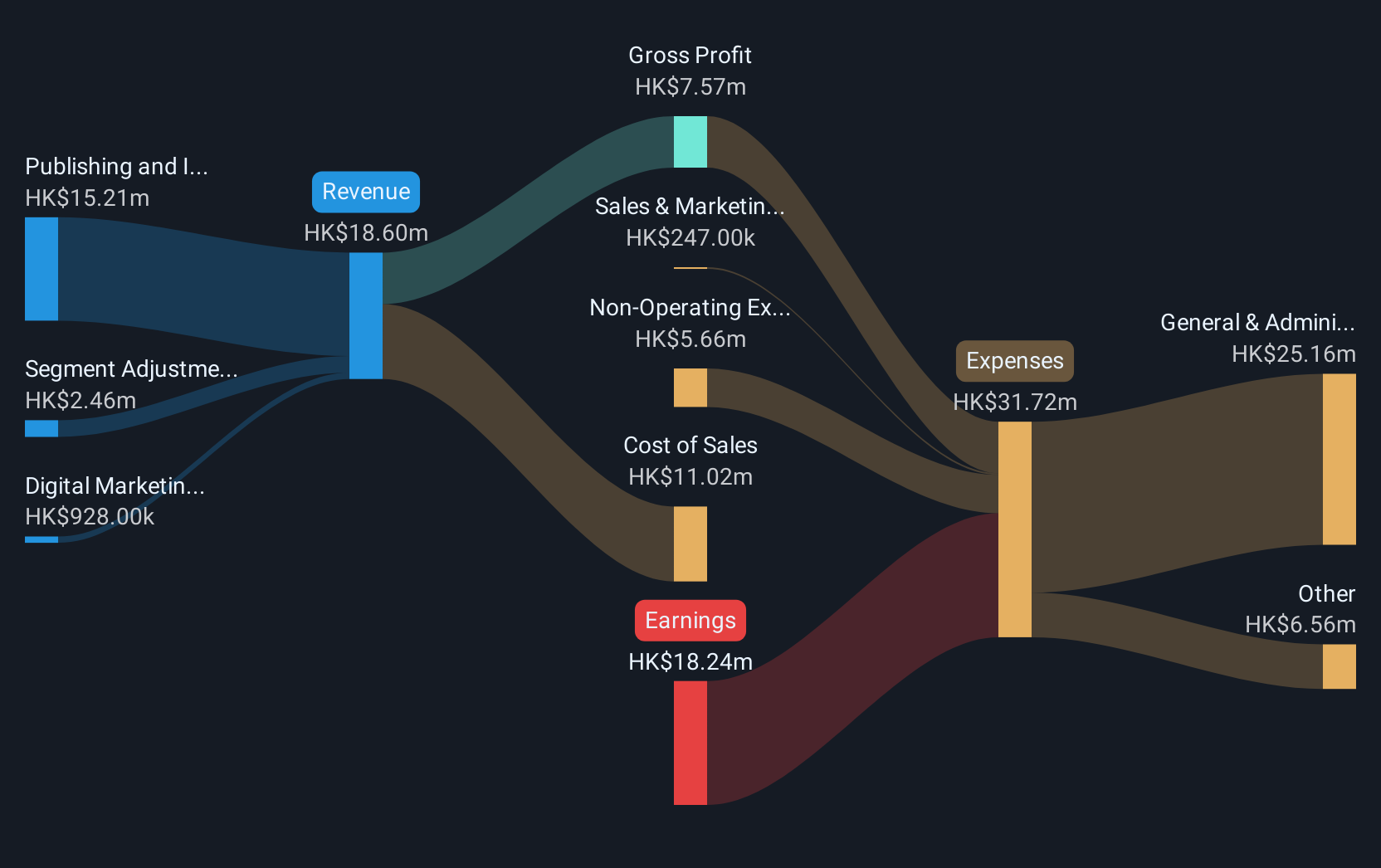

Overview: Culturecom Holdings Limited is an investment holding company that operates as a comic book publisher and media content provider in Hong Kong and the People's Republic of China, with a market cap of HK$317.04 million.

Operations: The company's revenue is primarily generated from Publishing and Intellectual Properties Licensing, which accounts for HK$15.21 million, followed by Digital Marketing contributing HK$0.93 million.

Market Cap: HK$317.04M

Culturecom Holdings Limited, with a market cap of HK$317.04 million, primarily generates revenue from Publishing and Intellectual Properties Licensing. Despite being unprofitable, the company has reduced its losses over the past five years by 17.1% annually and maintains a sufficient cash runway for over a year. Its short-term assets significantly exceed liabilities, highlighting financial stability despite an increased debt-to-equity ratio to 3.1%. Recent earnings for the half-year showed sales of HK$7.79 million with a net loss reduction to HK$11.38 million compared to the previous year, indicating gradual improvement in financial performance amidst ongoing challenges.

- Jump into the full analysis health report here for a deeper understanding of Culturecom Holdings.

- Gain insights into Culturecom Holdings' past trends and performance with our report on the company's historical track record.

Next Steps

- Embark on your investment journey to our 5,827 Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SCANA

Scana

Provides technology and services for the offshore and energy industries in Norway, other European countries, the United States, Asia, and Africa.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives