European Equities That May Be Trading Below Their Estimated Value In October 2025

Reviewed by Simply Wall St

As of October 2025, European markets have shown mixed performance, with the pan-European STOXX Europe 600 Index inching higher amid dovish signals from U.S. Federal Reserve officials and easing trade tensions between the U.S. and China. While major indices like France's CAC 40 have rallied, others such as Germany's DAX have faced declines, reflecting varied economic conditions across the region. In this context of fluctuating market dynamics, identifying undervalued stocks can be crucial for investors seeking opportunities in equities that may be trading below their estimated value due to temporary market inefficiencies or broader economic factors.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mo-BRUK (WSE:MBR) | PLN298.00 | PLN581.73 | 48.8% |

| Micro Systemation (OM:MSAB B) | SEK62.80 | SEK122.98 | 48.9% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.13 | 49.7% |

| Kitron (OB:KIT) | NOK61.15 | NOK121.16 | 49.5% |

| DSV (CPSE:DSV) | DKK1351.00 | DKK2657.52 | 49.2% |

| doValue (BIT:DOV) | €2.816 | €5.53 | 49.1% |

| DigiTouch (BIT:DGT) | €1.94 | €3.79 | 48.8% |

| ArcticZymes Technologies (OB:AZT) | NOK30.00 | NOK59.59 | 49.7% |

| Allegro.eu (WSE:ALE) | PLN33.74 | PLN66.43 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK85.20 | NOK169.70 | 49.8% |

We'll examine a selection from our screener results.

Netcompany Group (CPSE:NETC)

Overview: Netcompany Group A/S delivers business-critical IT solutions to private and public sectors across various countries, including Denmark, Norway, the UK, and others, with a market cap of DKK13.22 billion.

Operations: The company's revenue is derived from two main segments: Public, contributing DKK4.70 billion, and Private, accounting for DKK2.05 billion.

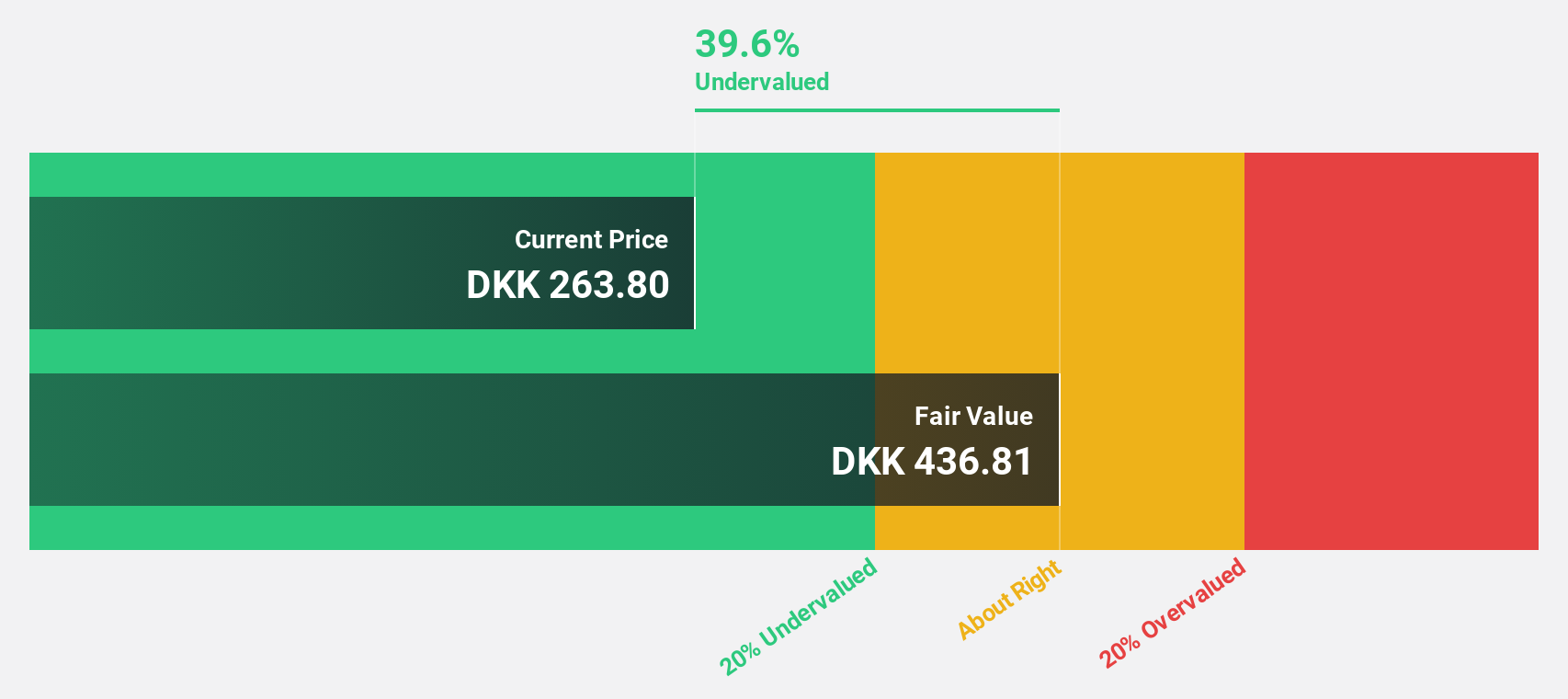

Estimated Discount To Fair Value: 28.1%

Netcompany Group appears undervalued based on cash flows, trading at DKK 285, which is 28.1% below its estimated fair value of DKK 396.39. Despite a recent dip in net income to DKK 55.7 million for Q2 2025 from DKK 119.5 million the previous year, earnings are forecasted to grow significantly at an annual rate of over 32%, outpacing the Danish market's growth expectations and indicating potential for strong future performance.

- Our growth report here indicates Netcompany Group may be poised for an improving outlook.

- Get an in-depth perspective on Netcompany Group's balance sheet by reading our health report here.

STIF Société anonyme (ENXTPA:ALSTI)

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market cap of €350.75 million.

Operations: Unfortunately, the provided text does not contain specific revenue segment details for STIF Société anonyme.

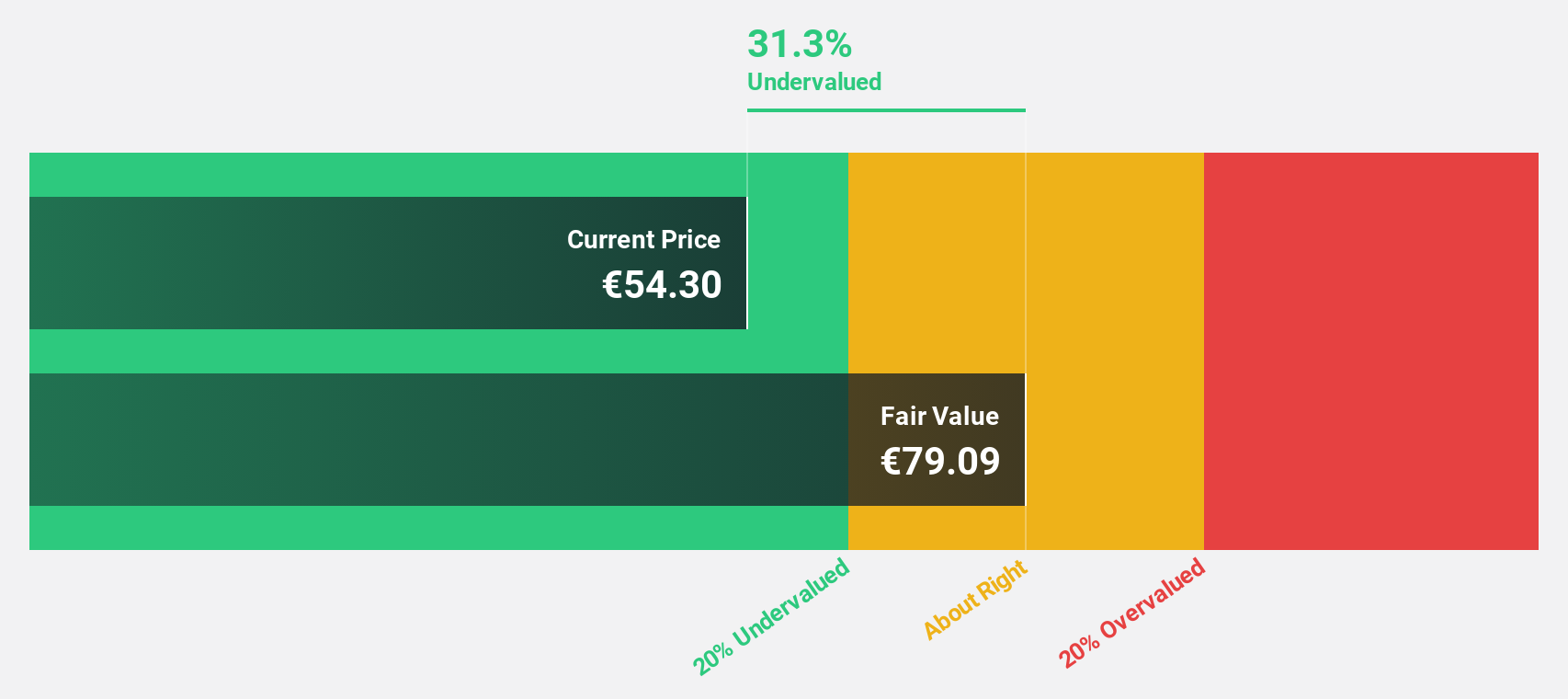

Estimated Discount To Fair Value: 31.9%

STIF Société anonyme is trading at €68.3, significantly below its estimated fair value of €100.24, suggesting it is undervalued based on cash flows. Recent earnings show robust growth with net income rising to €6.4 million from €3.4 million year-over-year. The company is in exclusive talks to acquire a majority stake in BOSS PRODUCTS, which could expand its market presence in North America and enhance revenue streams if finalized successfully.

- Upon reviewing our latest growth report, STIF Société anonyme's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of STIF Société anonyme.

Kitron (OB:KIT)

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries including Norway, Sweden, and the United States, with a market cap of NOK12.19 billion.

Operations: The company's revenue segment consists of Electronics Manufacturing Services (EMS), generating €642.50 million.

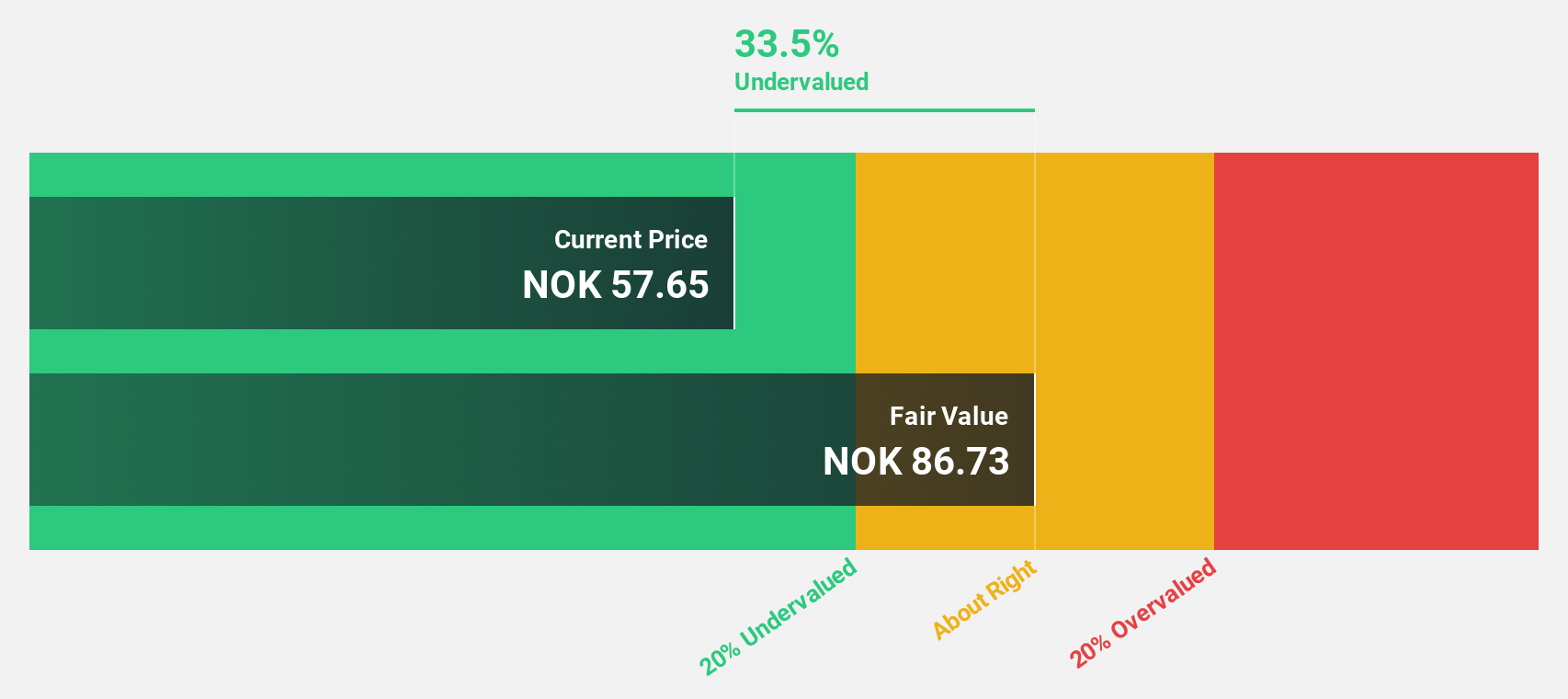

Estimated Discount To Fair Value: 49.5%

Kitron is trading at NOK 61.15, significantly below its estimated fair value of NOK 121.16, highlighting its undervaluation based on cash flows. The company has initiated a share buyback program authorized by shareholders to repurchase shares up to NOK 1.98 million in nominal value. Despite high debt levels, Kitron's earnings are forecasted to grow significantly over the next three years, outpacing the Norwegian market with expected annual profit growth of 25.6%.

- Our earnings growth report unveils the potential for significant increases in Kitron's future results.

- Navigate through the intricacies of Kitron with our comprehensive financial health report here.

Make It Happen

- Discover the full array of 214 Undervalued European Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netcompany Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NETC

Netcompany Group

Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives