European Opportunities: Airthings And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

As European markets navigate a landscape marked by easing inflation and potential interest rate cuts, investors are keenly observing opportunities that may arise amidst these shifts. Penny stocks, often associated with smaller or newer companies, continue to capture attention due to their potential for growth at accessible price points. While the term might seem antiquated, the investment prospects they offer remain significant, particularly when these stocks boast strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.33 | SEK2.23B | ✅ 4 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.93 | SEK523.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.44 | SEK209.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.95 | €62.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 450 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Airthings (OB:AIRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Airthings ASA is a hardware-enabled software company that develops products and systems for monitoring indoor air quality, radon, and energy efficiency globally, with a market cap of NOK268.06 million.

Operations: Airthings ASA has not reported any specific revenue segments.

Market Cap: NOK268.06M

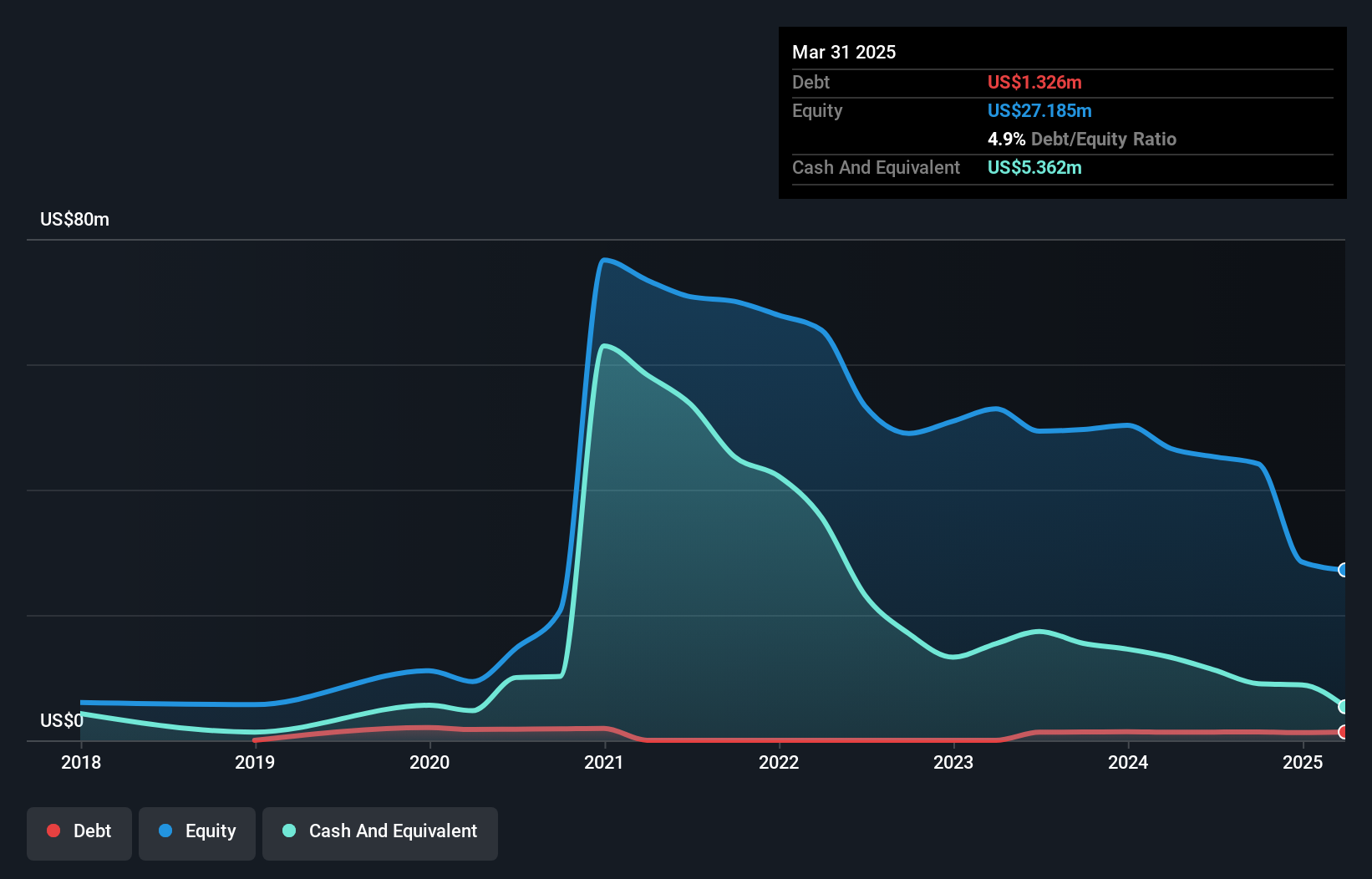

Airthings ASA, a hardware-enabled software company, has shown a reduction in its debt to equity ratio over the past five years, now standing at 4.9%, indicating improved financial management. Despite this positive development, the company remains unprofitable with increasing losses and a negative return on equity of -74.64%. Recent earnings results revealed a net loss of US$3.4 million for Q1 2025 against revenues of US$9.21 million, slightly down from last year’s figures. Airthings' forecasted revenue growth is modest at 14.11% annually; however, it faces challenges such as high share price volatility and an inexperienced board and management team with average tenures under two years each.

- Navigate through the intricacies of Airthings with our comprehensive balance sheet health report here.

- Gain insights into Airthings' outlook and expected performance with our report on the company's earnings estimates.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK2.23 billion.

Operations: The company generates revenue primarily from its National Broadband Service segment, which amounts to SEK1.77 billion.

Market Cap: SEK2.23B

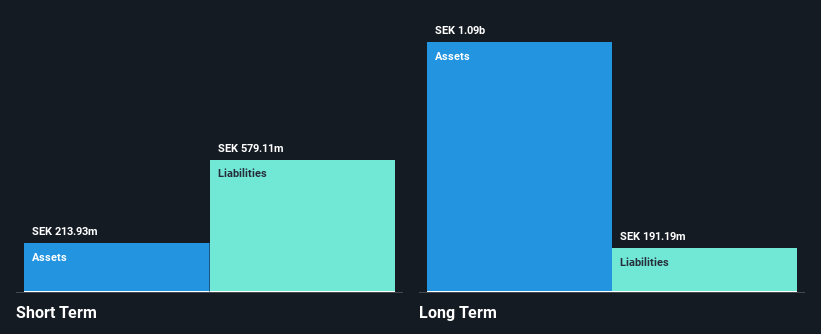

Bredband2 i Skandinavien AB demonstrates financial stability with its EBIT covering interest payments 13.1 times, indicating sound debt management. The company has shown consistent earnings growth, surpassing the telecom industry average, and maintains a high return on equity of 20.3%. Despite increased debt to equity from 0% to 5% over five years, it holds more cash than total debt and covers long-term liabilities with short-term assets. Recent earnings for Q1 2025 showed sales growth but stable net income compared to last year. However, significant insider selling occurred in the past quarter amidst trading at a substantial discount to estimated fair value.

- Jump into the full analysis health report here for a deeper understanding of Bredband2 i Skandinavien.

- Examine Bredband2 i Skandinavien's earnings growth report to understand how analysts expect it to perform.

Isofol Medical (OM:ISOFOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Isofol Medical AB (publ) is a clinical-stage biotech company with a market cap of SEK192.04 million.

Operations: Isofol Medical AB (publ) currently has no reported revenue segments.

Market Cap: SEK192.04M

Isofol Medical AB, a pre-revenue biotech firm with a SEK192.04 million market cap, is advancing its cancer treatment candidate arfolitixorin through clinical trials. Recent developments include FDA's approval for a Pre-IND meeting and the initiation of a phase Ib/II study in Germany. Despite no significant revenue streams, Isofol has reduced losses over five years and maintains sufficient cash runway for 1.8 years if free cash flow grows at historical rates. While debt-free with short-term assets covering liabilities, the company faces volatility in share price and an inexperienced management team, suggesting potential risks for investors in penny stocks.

- Click to explore a detailed breakdown of our findings in Isofol Medical's financial health report.

- Review our historical performance report to gain insights into Isofol Medical's track record.

Summing It All Up

- Dive into all 450 of the European Penny Stocks we have identified here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ISOFOL

Flawless balance sheet low.

Market Insights

Community Narratives