- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1501

November 2024's Estimated Undervalued Stock Selections For Savvy Investors

Reviewed by Simply Wall St

In the wake of a notable rally in U.S. stocks, driven by expectations of economic growth and tax reforms following the recent election, global markets are experiencing significant shifts. With major indices like the S&P 500 reaching record highs, investors are eyeing opportunities that align with these evolving market dynamics. In this context, identifying undervalued stocks becomes crucial as they may offer potential value amid changing economic policies and interest rate adjustments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.53 | CN¥18.84 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| Decisive Dividend (TSXV:DE) | CA$6.18 | CA$12.23 | 49.5% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53700.00 | ₩106760.01 | 49.7% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| Pinterest (NYSE:PINS) | US$29.98 | US$59.53 | 49.6% |

| GRCS (TSE:9250) | ¥1500.00 | ¥2976.24 | 49.6% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩36900.00 | ₩73388.97 | 49.7% |

Let's explore several standout options from the results in the screener.

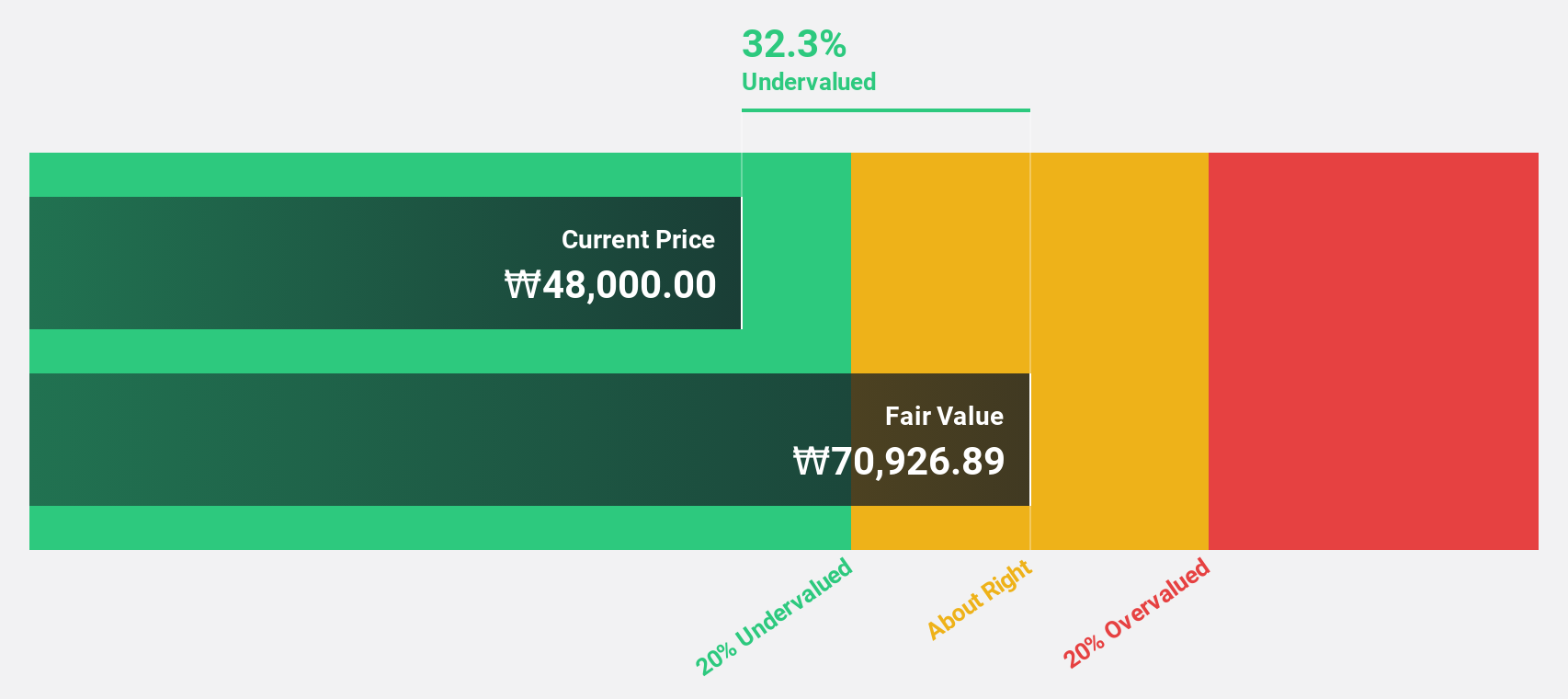

Studio Dragon (KOSDAQ:A253450)

Overview: Studio Dragon Corporation is a drama studio that produces and provides drama content for traditional and new media platforms, with a market cap of ₩1.28 trillion.

Operations: The company generates revenue of ₩580.60 billion from its Television Programming & Distribution segment.

Estimated Discount To Fair Value: 38.8%

Studio Dragon is trading at ₩42,450, significantly below its estimated fair value of ₩69,417.9. While revenue growth of 14.5% annually lags behind the 20% mark, it surpasses the Korean market's average of 9.9%. Earnings are projected to grow substantially at 42.6% per year compared to the market's 29%. Despite a decline in profit margins from last year and low future ROE forecasts, Studio Dragon remains undervalued based on cash flows.

- Our expertly prepared growth report on Studio Dragon implies its future financial outlook may be stronger than recent results.

- Take a closer look at Studio Dragon's balance sheet health here in our report.

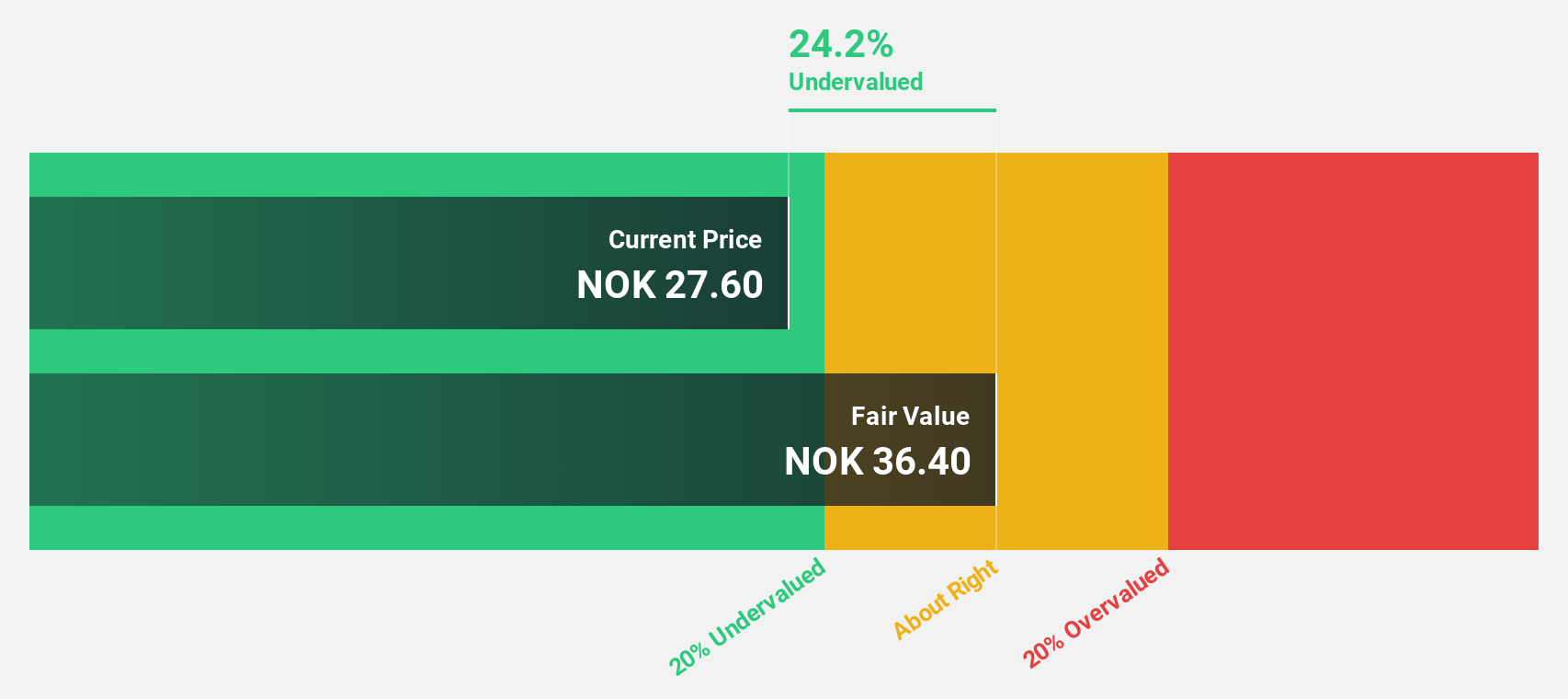

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry in Norway, Sweden, and Finland, with a market capitalization of NOK5.06 billion.

Operations: Revenue Segments (in millions of NOK):

Estimated Discount To Fair Value: 23%

SmartCraft is trading at NOK 30.2, below its estimated fair value of NOK 39.2, suggesting it is undervalued based on cash flows. Despite a decline in net income from last year, the company's revenue growth of 15.4% annually outpaces the Norwegian market's average of 2.2%. Earnings are expected to grow significantly at 26.9% per year over the next three years, though insider selling has been significant recently and future ROE forecasts remain low at 15.5%.

- Our comprehensive growth report raises the possibility that SmartCraft is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of SmartCraft.

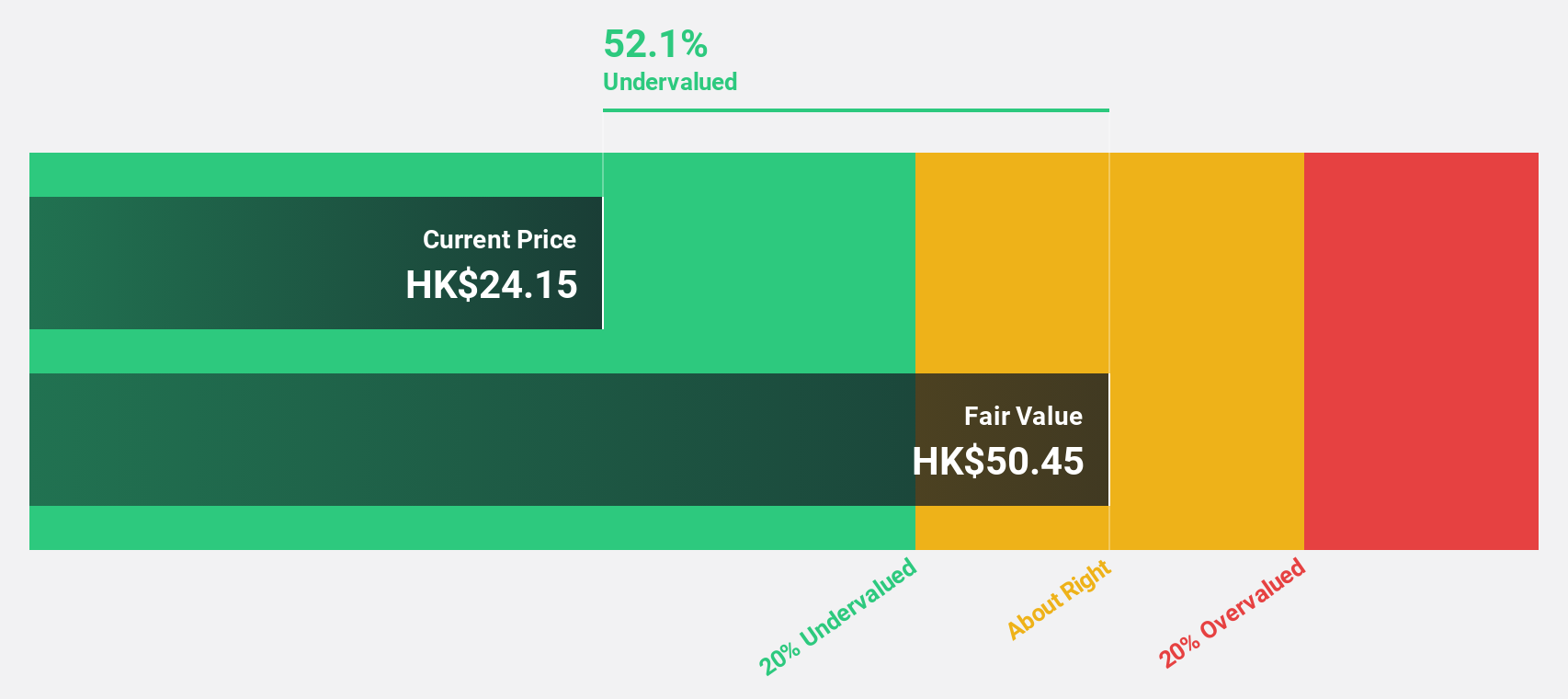

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the medical instruments sector and has a market capitalization of HK$5.09 billion.

Operations: The company generates revenue from its Cardiovascular Interventional Business, amounting to CN¥718.71 million.

Estimated Discount To Fair Value: 47.1%

Shanghai INT Medical Instruments is trading at HK$28.9, significantly below its fair value estimate of HK$54.68, highlighting its undervaluation based on cash flows. Despite shareholder dilution over the past year, earnings grew by 5.3%, with revenue and earnings forecast to grow substantially faster than the Hong Kong market at 28.7% and 27.2% per year respectively. Recent half-year results show sales increased to CNY 392.32 million from CNY 339.76 million, with net income rising to CNY 100.54 million.

- According our earnings growth report, there's an indication that Shanghai INT Medical Instruments might be ready to expand.

- Click here to discover the nuances of Shanghai INT Medical Instruments with our detailed financial health report.

Taking Advantage

- Unlock our comprehensive list of 906 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1501

Shanghai INT Medical Instruments

Engages in the research and development, manufacture, and sale of cardiovascular interventional medical devices in Mainland China, Europe, the United States, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives