As global markets navigate the challenges posed by rising U.S. Treasury yields, which have pressured equities and led to a mixed performance across major indices, investors are paying close attention to the tech sector where growth stocks have shown resilience. In this environment, identifying high-growth tech stocks involves looking for companies with strong fundamentals that can capitalize on technological advancements and maintain robust performance even amid broader market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.21% | 70.72% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market capitalization of NOK5.01 billion.

Operations: SmartCraft ASA generates revenue by offering specialized software solutions to the construction sector in Norway, Sweden, and Finland. The company focuses on optimizing construction processes through its digital tools.

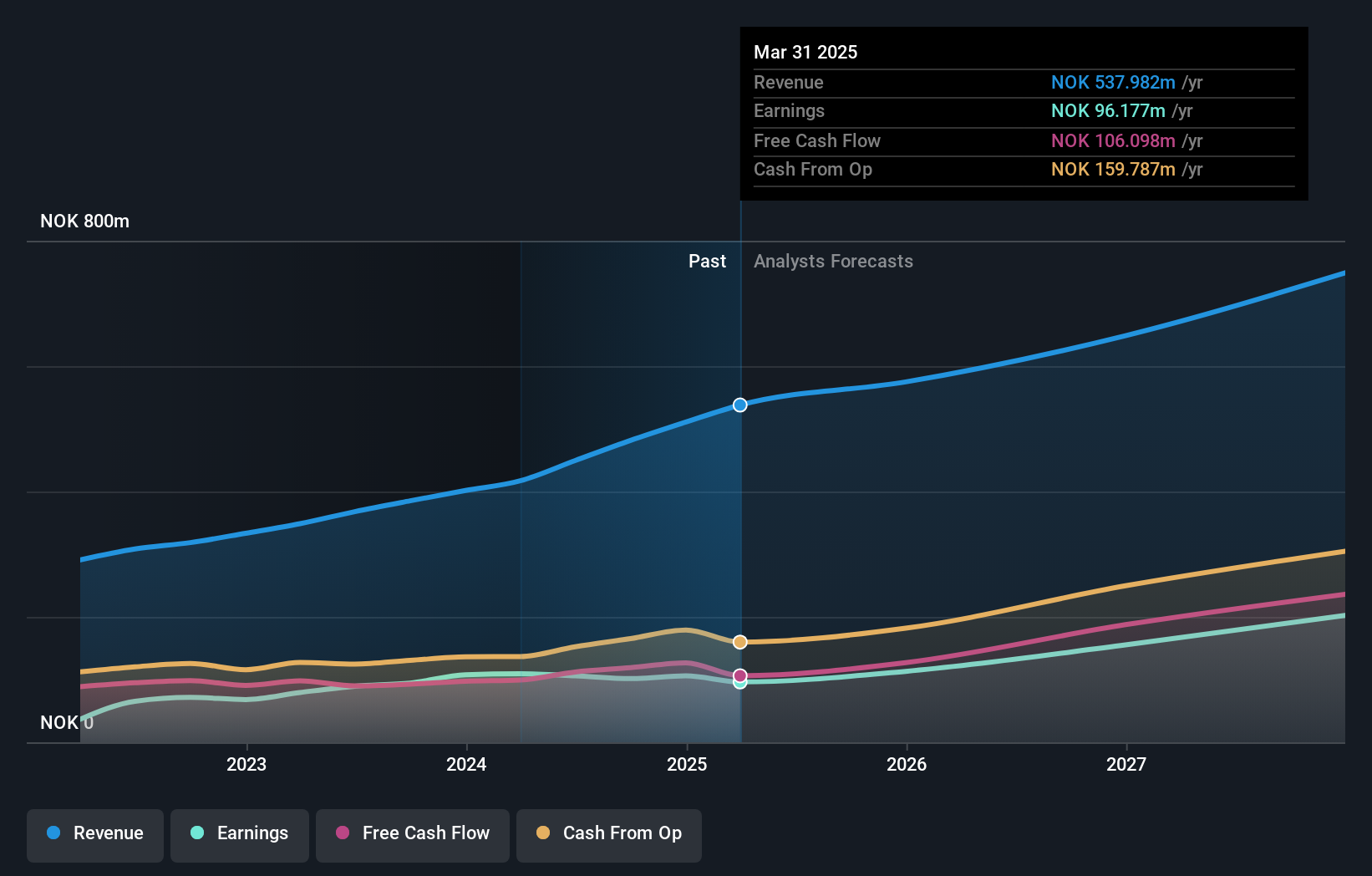

SmartCraft ASA has demonstrated robust growth, outpacing the software industry with an 18.5% increase in earnings over the past year compared to the industry's average of 11.2%. This momentum is expected to continue, with forecasts predicting a 22.7% annual growth in earnings over the next three years, significantly above Norway's market average of 10.3%. Despite some challenges like significant insider selling in recent months, SmartCraft's strategic focus on innovation and expansion is evident from its R&D investments, aligning well with its revenue growth forecast at an impressive rate of 16.8% annually—faster than the broader Norwegian market's 2.1%. These factors position SmartCraft favorably within a competitive landscape as it leverages technological advancements to enhance its offerings and market presence.

- Click to explore a detailed breakdown of our findings in SmartCraft's health report.

Examine SmartCraft's past performance report to understand how it has performed in the past.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Games System Co., Ltd. is engaged in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$294.48 billion.

Operations: The company generates revenue primarily through its Online Games Division, contributing NT$8.99 billion, and the Business Game Division, which adds NT$7.13 billion.

International Games System Ltd. has recently been added to the FTSE All-World Index, reflecting its growing global presence and investor recognition. With a revenue growth forecast of 21.7% per year, the company outpaces the Taiwanese market average of 12.3%, underscoring its robust position in the entertainment sector despite not leading it. This performance is supported by significant R&D investments, which have fueled an earnings increase projected at 21.5% annually—well above Taiwan's market forecast of 19%. These financial dynamics are complemented by recent earnings reports showing a surge in both sales and net income, demonstrating effective operational execution and potential for continued expansion in high-stakes gaming markets.

Comarch (WSE:CMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Comarch S.A. is a global provider of IT solutions, specializing in the design, implementation, and integration of these technologies, with a market capitalization of PLN2.68 billion.

Operations: The company's primary revenue stream is derived from its IT segment, with significant contributions from Poland (PLN1.57 billion) and other countries (PLN484.57 million), alongside notable operations in the DACH region (PLN330.62 million). Additional income sources include smaller segments such as sports, medicine, and investment.

Comarch, navigating through a challenging tech landscape, has demonstrated resilience with a revenue growth forecast of 4.8% per year, outpacing the Polish market's average of 4.3%. Despite recent setbacks including being dropped from the S&P Global BMI Index, the company's commitment to innovation is evident in its R&D spending which supports projected earnings growth of 24.6% annually—significantly higher than Poland's market forecast of 14.9%. This investment in technology and product development positions Comarch to potentially rebound and capture emerging opportunities in IT solutions, even as it faces delisting pressures following a tender offer aimed at privatization.

- Unlock comprehensive insights into our analysis of Comarch stock in this health report.

Gain insights into Comarch's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1277 more companies for you to explore.Click here to unveil our expertly curated list of 1280 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CMR

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives