Amidst a backdrop of U.S. stocks nearing record highs, driven by optimism around potential trade deals and significant investments in artificial intelligence infrastructure, the global markets are experiencing a wave of enthusiasm for growth stocks over value shares. As the market sentiment leans positively towards innovation and technological advancement, identifying high-growth tech stocks with strong fundamentals and exposure to burgeoning sectors like AI can be pivotal for investors looking to capitalize on these trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

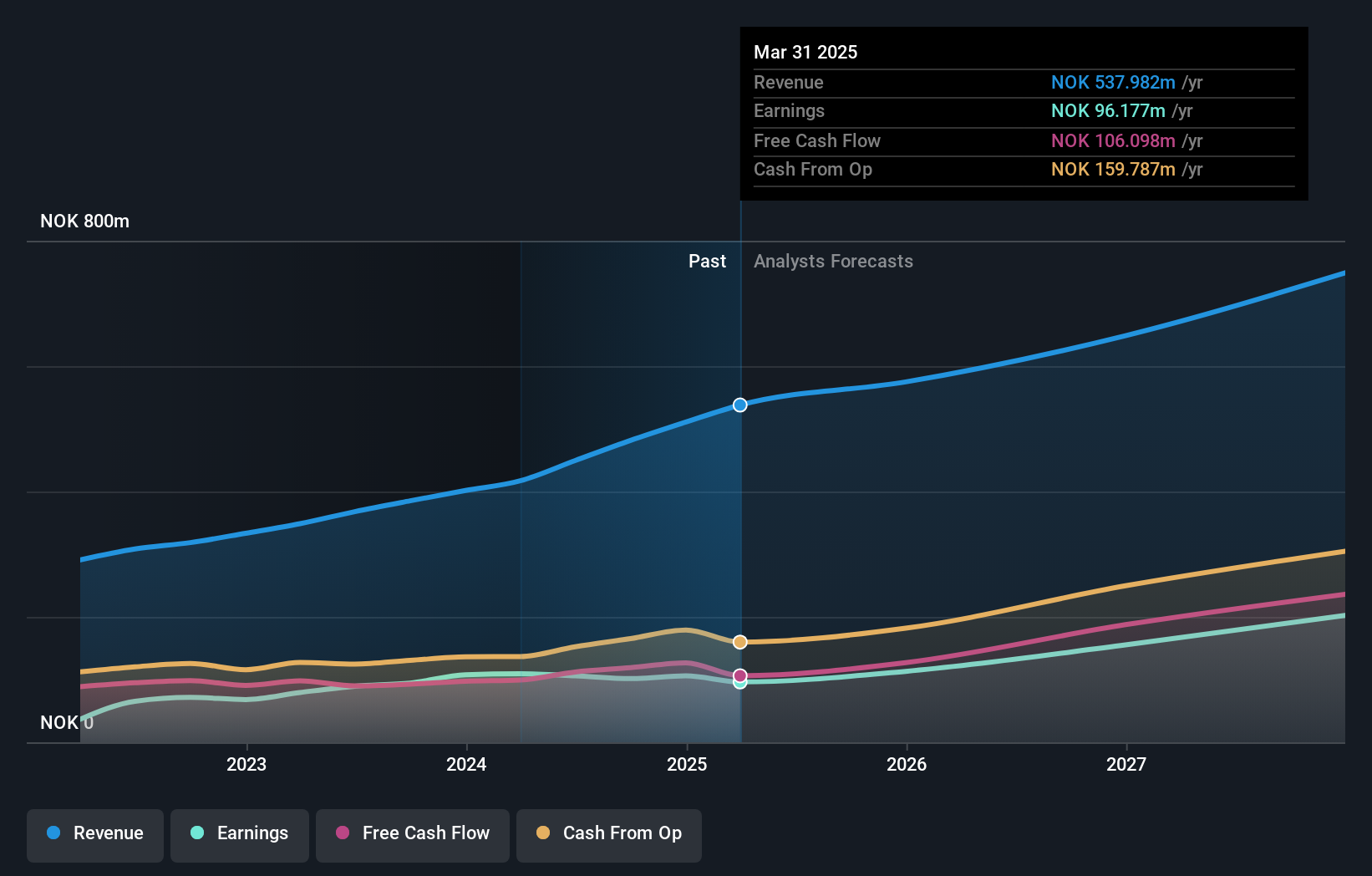

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market capitalization of NOK4.84 billion.

Operations: The company generates revenue by providing specialized software solutions to the construction sector in Norway, Sweden, and Finland.

SmartCraft ASA, a Norwegian tech firm, is navigating a complex landscape with mixed financial indicators. Despite not outperforming the software industry's earnings growth rate of 17.7% last year, SmartCraft's earnings have expanded by 45.4% annually over the past five years, showcasing robust long-term growth. The company's revenue is also on an upward trajectory, increasing at 15.3% per year and surpassing Norway's market average of 2%. However, challenges persist as its Return on Equity is projected to be modest at 15.1% in three years' time. Recent strategic moves include high-level executive changes and active participation in key industry conferences in Stockholm and Copenhagen, signaling ongoing adjustments to maintain competitiveness and relevance in the evolving tech sector.

- Click here to discover the nuances of SmartCraft with our detailed analytical health report.

Gain insights into SmartCraft's historical performance by reviewing our past performance report.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

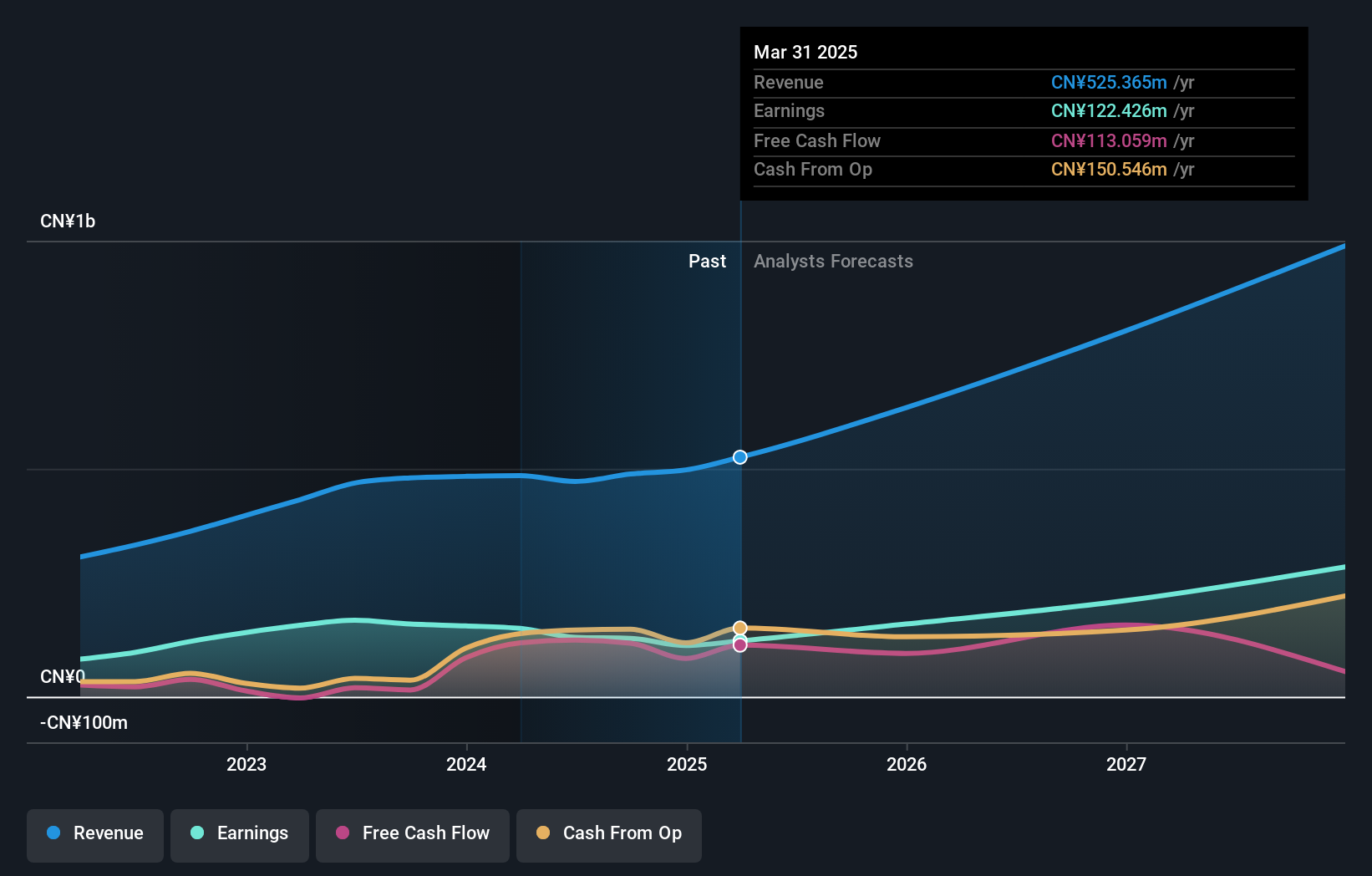

Overview: Siglent Technologies Co., Ltd. engages in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market capitalization of CN¥4.46 billion.

Operations: Siglent Technologies focuses on the electronic test and measurement equipment sector, offering products and services across China and international markets. The company generates revenue through the sale of its equipment, which is supported by research, development, production, and servicing activities.

Siglent Technologies has demonstrated a promising trajectory with its annual revenue growth at 22%, outpacing the Chinese market average of 13.3%. The firm's commitment to innovation is evident from its R&D spending, which stands robustly, reflecting in the recent earnings report for the nine months ending September 2024 where sales reached CNY 354.64 million. Despite a dip in net income to CNY 91.65 million from CNY 119.02 million year-over-year, Siglent continues to invest in technology advancements, underscoring potential for future growth amid competitive pressures and market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Siglent TechnologiesLtd.

Gain insights into Siglent TechnologiesLtd's past trends and performance with our Past report.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

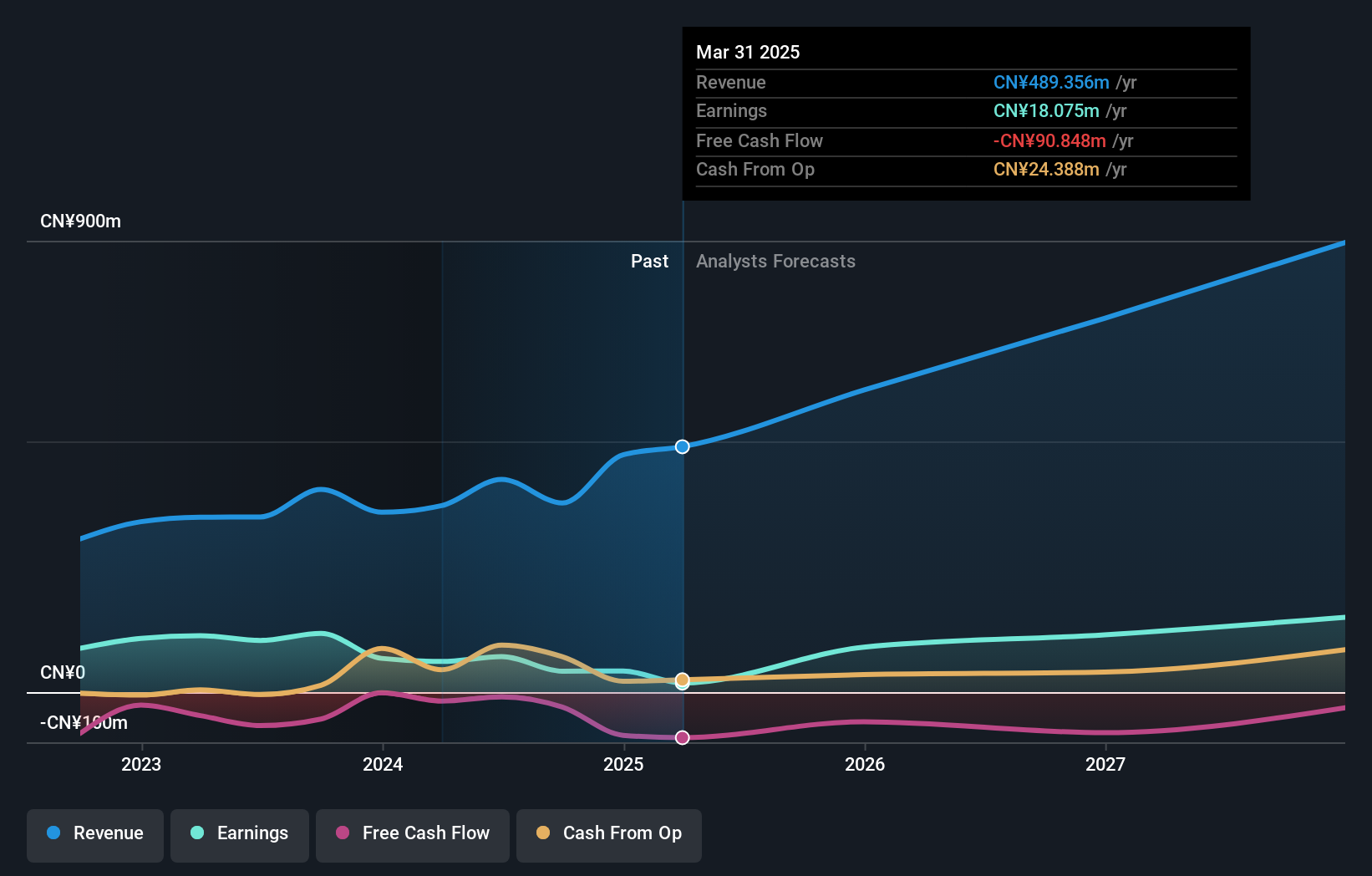

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥3.63 billion.

Operations: Sansec Technology Co., Ltd. specializes in developing and producing cryptographic products aimed at enhancing internet information security within China. The company generates revenue primarily from its commercial cryptographic solutions, though specific segment figures are not provided.

Sansec Technology has navigated a challenging landscape, evidenced by a revenue increase to CNY 254.66 million from CNY 236.21 million year-over-year, despite a significant drop in net income from CNY 39.7 million to CNY 14.16 million in the same period. This resilience is underscored by its aggressive R&D spending aimed at fostering innovation and maintaining competitiveness in the fast-evolving tech sector. With earnings projected to grow at an annual rate of 44.1%, Sansec's strategic focus on expanding its technological capabilities could position it well for future growth, especially considering its recent exclusion from the S&P Global BMI Index which might have impacted investor perceptions temporarily.

- Navigate through the intricacies of Sansec Technology with our comprehensive health report here.

Evaluate Sansec Technology's historical performance by accessing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 1231 High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, and Finland.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives