As global markets continue to experience robust gains, with major indices like the S&P 500 and Russell 2000 reaching record highs, investor sentiment remains buoyed by domestic policy shifts and geopolitical developments. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience in the face of economic uncertainties and possess innovative potential to capitalize on evolving market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

SmartCraft (OB:SMCRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market capitalization of NOK4.74 billion.

Operations: SmartCraft ASA generates revenue by delivering specialized software solutions to the construction sector in Norway, Sweden, and Finland. The company's financial performance is reflected in its market capitalization of NOK4.74 billion.

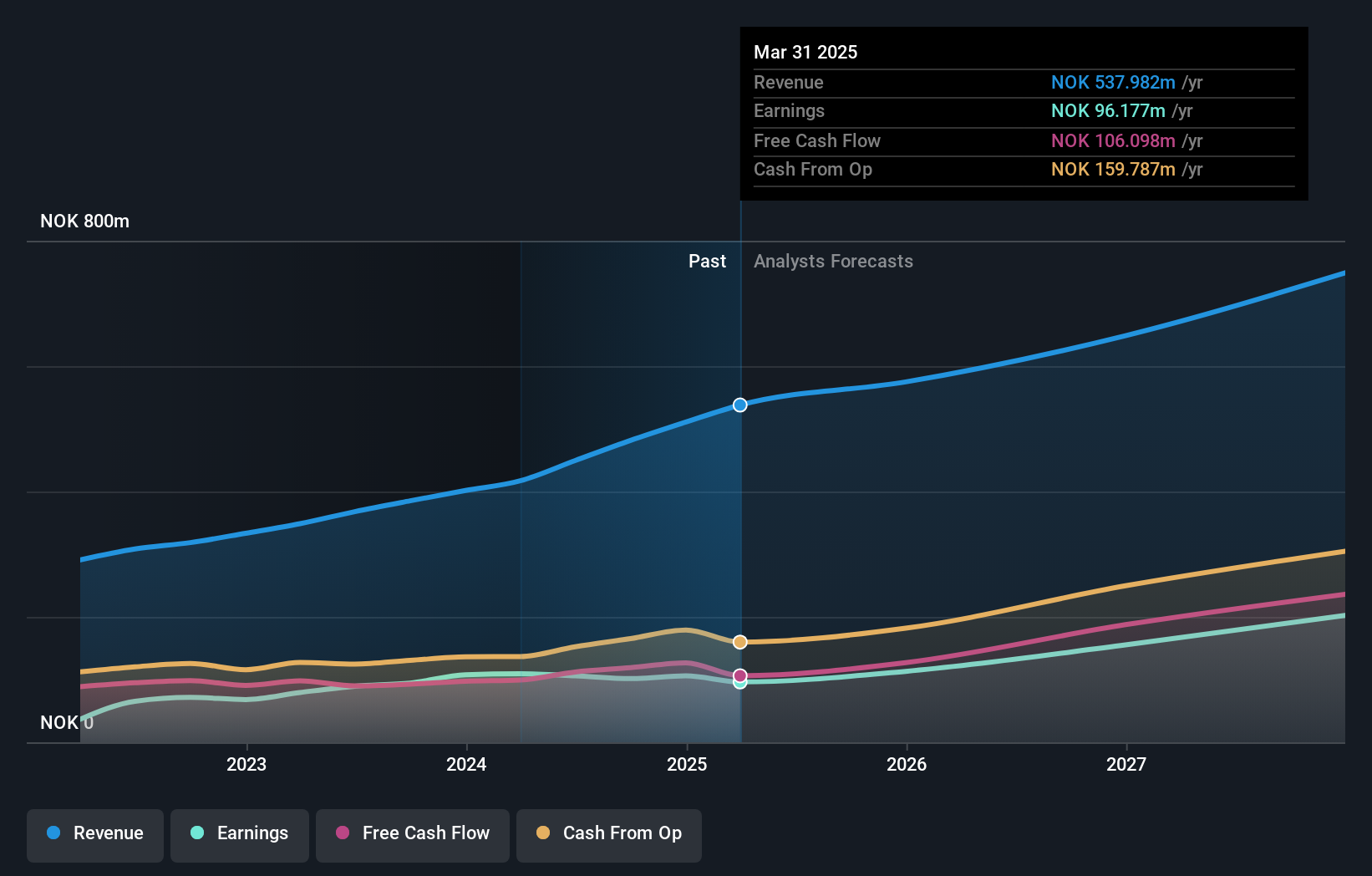

SmartCraft ASA, a participant in the competitive tech landscape, recently showcased its capabilities at the Pareto Securities Annual Nordic TechSaas Conference. Despite a challenging quarter where net income dipped to NOK 21.76 million from NOK 26.03 million year-over-year, SmartCraft reported a robust revenue increase to NOK 131.85 million from NOK 99.66 million in the same period last year, marking a significant growth trajectory. The company's commitment to innovation is evident in its R&D spending trends which are crucial for sustaining its competitive edge and responding to dynamic market demands. Looking ahead, SmartCraft is poised for promising growth with an expected annual earnings increase of 26.7%, outpacing the Norwegian market's forecast of 9.7%. However, it's essential to note that while their earnings over the past five years have surged by an impressive 45.4% annually, recent performance suggests more moderate growth compared to industry leaders. This context underscores SmartCraft's potential amidst challenges and highlights their strategic focus on leveraging R&D investments to fuel future innovations and market expansion.

- Click here to discover the nuances of SmartCraft with our detailed analytical health report.

Gain insights into SmartCraft's historical performance by reviewing our past performance report.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the research, development, production, and sale of new display device testing equipment in China with a market capitalization of CN¥7.99 billion.

Operations: SEICHI Technologies specializes in developing and selling advanced testing equipment for new display devices, primarily targeting the Chinese market. The company's revenue is driven by its focus on innovative technology solutions in the display sector.

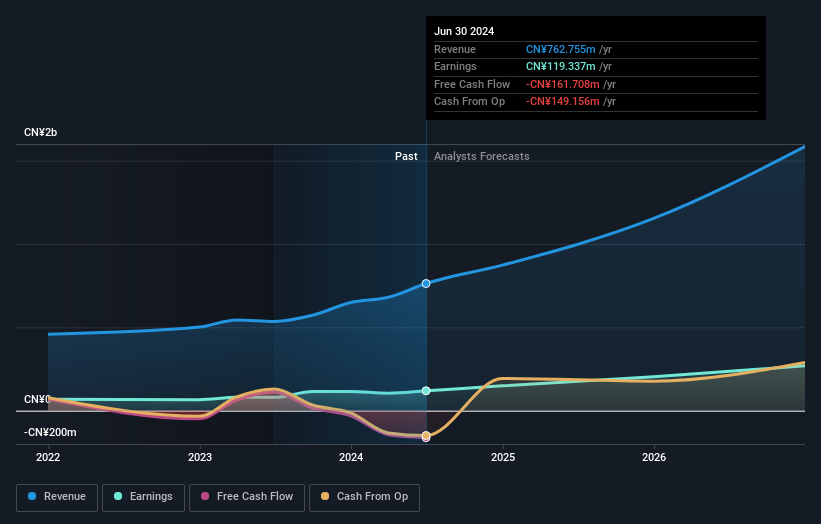

Shenzhen SEICHI Technologies has demonstrated a robust growth trajectory, with revenue soaring by 52.5% to CNY 566.2 million from CNY 371.32 million year-over-year as of September 2024. This surge is underpinned by significant R&D investments, which are crucial for maintaining its competitive edge in the rapidly evolving tech sector. Despite a slight dip in net income to CNY 51.38 million from CNY 54.85 million, the firm's aggressive expansion strategy is evident in its earnings forecast, projecting an annual growth rate of 42.6%. Additionally, SEICHI's commitment to shareholder returns is highlighted by its recent completion of a share repurchase program totaling CNY 44.76 million for 1,000,000 shares, reinforcing confidence in its financial health and future prospects.

- Take a closer look at Shenzhen SEICHI Technologies' potential here in our health report.

Gain insights into Shenzhen SEICHI Technologies' past trends and performance with our Past report.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Games System Co., Ltd. is involved in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$270.53 billion.

Operations: The company generates revenue primarily through its Online Games Division, contributing NT$10.11 billion, and its Business Game Division, which adds NT$7.13 billion.

Amid a dynamic tech landscape, International Games SystemLtd. has marked its presence with impressive financial metrics and strategic market movements. The company's third-quarter sales surged to TWD 4.7 billion, up from TWD 3.6 billion in the previous year, reflecting a robust annual growth rate of 20.9%. This performance is complemented by an even stronger growth in net income, which climbed to TWD 2.17 billion from TWD 1.75 billion, translating into a notable increase of 21.2% year-over-year—outpacing the broader Taiwanese market's growth rates significantly. Furthermore, International Games SystemLtd.'s inclusion in the FTSE All-World Index underscores its expanding influence and recognition within global markets, positioning it as a formidable player amidst fierce industry competition and rapid technological advancements.

- Click here and access our complete health analysis report to understand the dynamics of International Games SystemLtd.

Understand International Games SystemLtd's track record by examining our Past report.

Taking Advantage

- Click through to start exploring the rest of the 1286 High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, and Finland.

Excellent balance sheet with reasonable growth potential.