3 Stocks That Might Be Estimated Up To 45.3% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by record highs for major U.S. stock indexes, the divergence between growth and value stocks was particularly pronounced, with growth shares significantly outperforming their value counterparts. Amidst this mixed market performance and geopolitical events having limited impact on U.S. markets, investors may find potential opportunities in undervalued stocks that are estimated to be trading up to 45.3% below their intrinsic value. Identifying such stocks involves assessing factors like strong fundamentals and potential for future earnings growth despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥28.18 | CN¥56.17 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | US$122.36 | US$244.39 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP288.85 | CLP577.11 | 49.9% |

| Acerinox (BME:ACX) | €10.03 | €20.04 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1446.00 | ¥2882.86 | 49.8% |

| U.S. Physical Therapy (NYSE:USPH) | US$94.06 | US$187.03 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.60 | A$9.14 | 49.7% |

| Equifax (NYSE:EFX) | US$265.29 | US$529.48 | 49.9% |

| Almacenes Éxito (BVC:EXITO) | COP2190.00 | COP4369.08 | 49.9% |

Let's review some notable picks from our screened stocks.

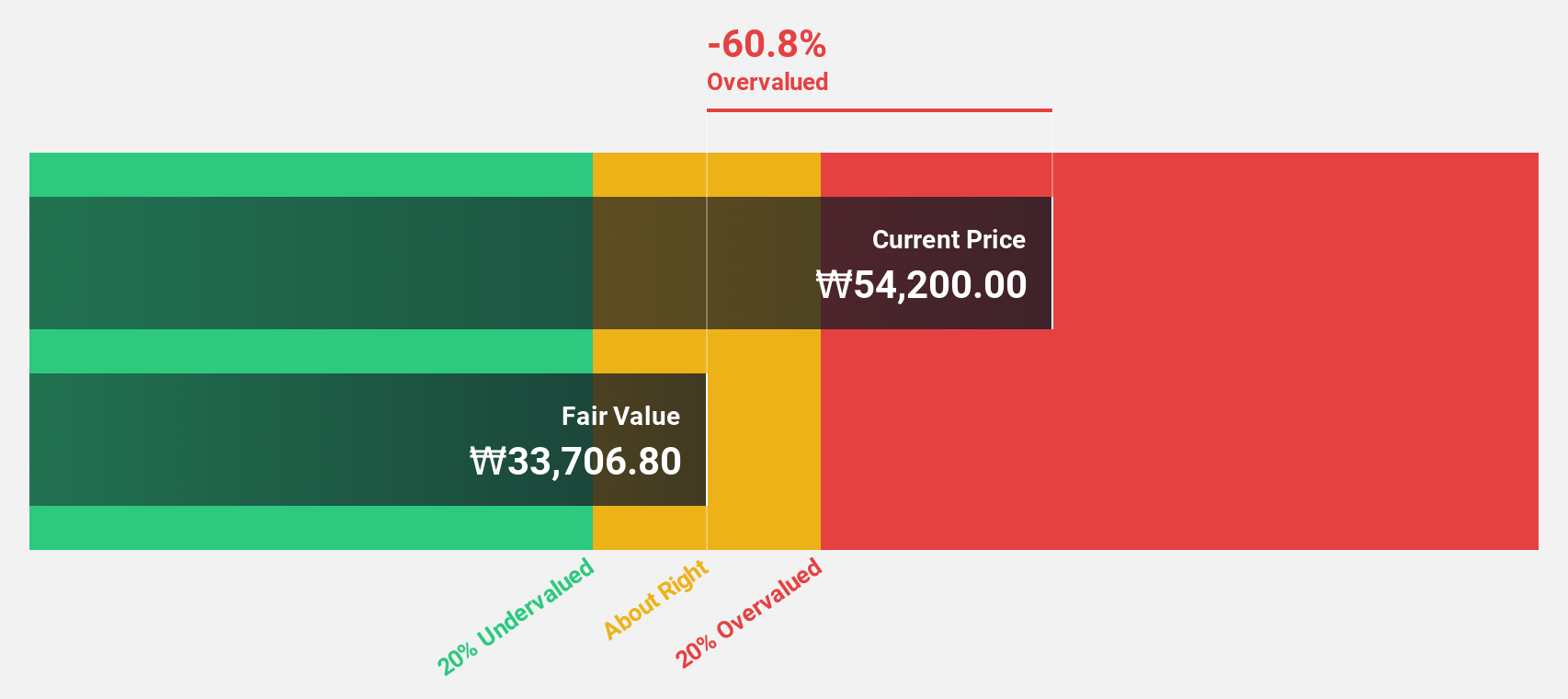

Hanwha Systems (KOSE:A272210)

Overview: Hanwha Systems Co., Ltd. manufactures and sells various military equipment in South Korea and internationally, with a market cap of ₩3.97 trillion.

Operations: The company's revenue segments are comprised of the ICT Division at ₩685.09 billion, New Business at ₩11.53 billion, and Defense Sector at ₩1.96 trillion.

Estimated Discount To Fair Value: 45.3%

Hanwha Systems is trading at ₩21,850, significantly below its estimated fair value of ₩39,956.81, indicating it may be undervalued based on cash flows. Despite a decline in profit margins from 11.6% to 5.2%, earnings are expected to grow significantly over the next three years at 29.64% annually, outpacing the Korean market's growth rate. However, a volatile share price and low dividend coverage by free cash flows present potential concerns for investors.

- Insights from our recent growth report point to a promising forecast for Hanwha Systems' business outlook.

- Navigate through the intricacies of Hanwha Systems with our comprehensive financial health report here.

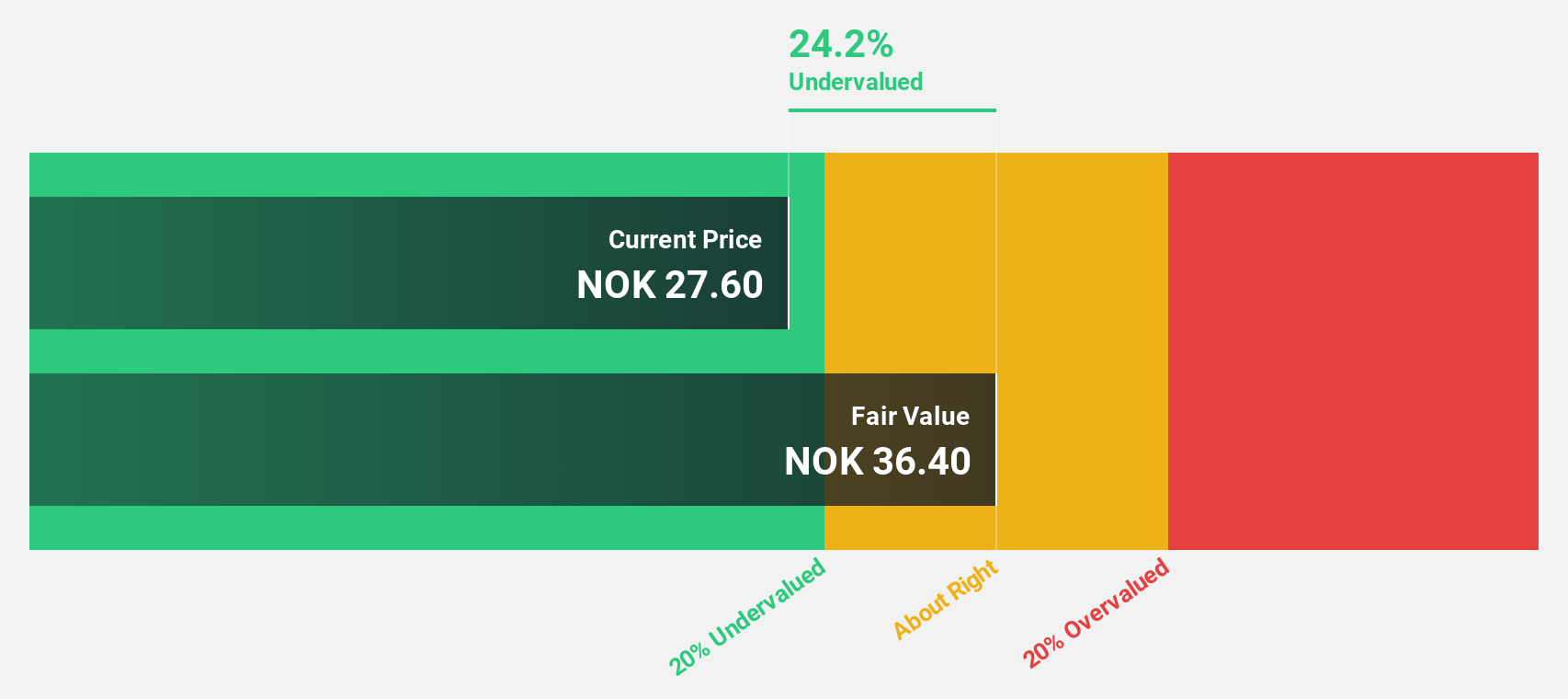

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, and Finland, with a market cap of NOK4.97 billion.

Operations: SmartCraft ASA's revenue is generated from its software solutions designed for the construction sector in Norway, Sweden, and Finland.

Estimated Discount To Fair Value: 21.5%

SmartCraft is trading at NOK 29.7, more than 20% below its estimated fair value of NOK 37.85, highlighting potential undervaluation based on cash flows. While revenue growth is projected at 15.3% annually, slower than some benchmarks, earnings are expected to rise significantly by over 25% per year, surpassing the Norwegian market's average growth rate. Recent earnings show increased sales but a slight decline in net income and EPS compared to last year.

- According our earnings growth report, there's an indication that SmartCraft might be ready to expand.

- Dive into the specifics of SmartCraft here with our thorough financial health report.

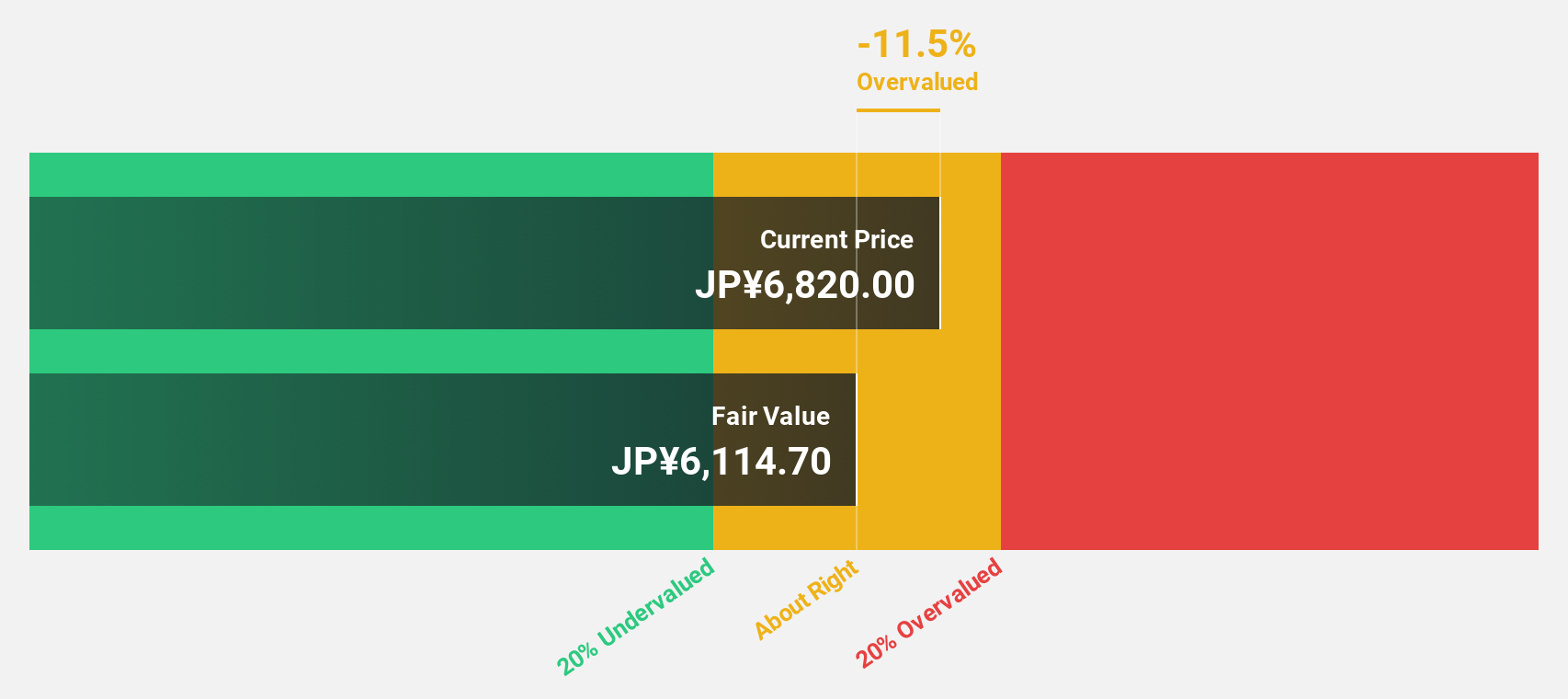

Meiko Electronics (TSE:6787)

Overview: Meiko Electronics Co., Ltd. designs, manufactures, and sells printed circuit boards (PCBs) and auxiliary electronics across Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally with a market cap of ¥235.01 billion.

Operations: The company's revenue segments include the design, manufacture, and sale of printed circuit boards (PCBs) and auxiliary electronics across various regions including Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally.

Estimated Discount To Fair Value: 14.9%

Meiko Electronics is trading at ¥9,300, approximately 14.9% below its estimated fair value of ¥10,921.97, suggesting potential undervaluation based on cash flows. While revenue growth is forecasted at 12.2% annually—outpacing the Japanese market average—earnings are expected to grow significantly by 21.5% per year over the next three years. Despite a high debt level and recent share price volatility, Meiko has revised earnings guidance upward for fiscal year 2024 amidst increased dividends for Q2 2024.

- The growth report we've compiled suggests that Meiko Electronics' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Meiko Electronics.

Where To Now?

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 917 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, and Finland.

Excellent balance sheet with reasonable growth potential.