Investors are selling off House of Control Group (OB:HOC), lack of profits no doubt contribute to shareholders one-year loss

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by House of Control Group AS (OB:HOC) shareholders over the last year, as the share price declined 37%. That's disappointing when you consider the market returned 28%. Because House of Control Group hasn't been listed for many years, the market is still learning about how the business performs. The share price has dropped 46% in three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for House of Control Group

House of Control Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, House of Control Group increased its revenue by 44%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 37%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

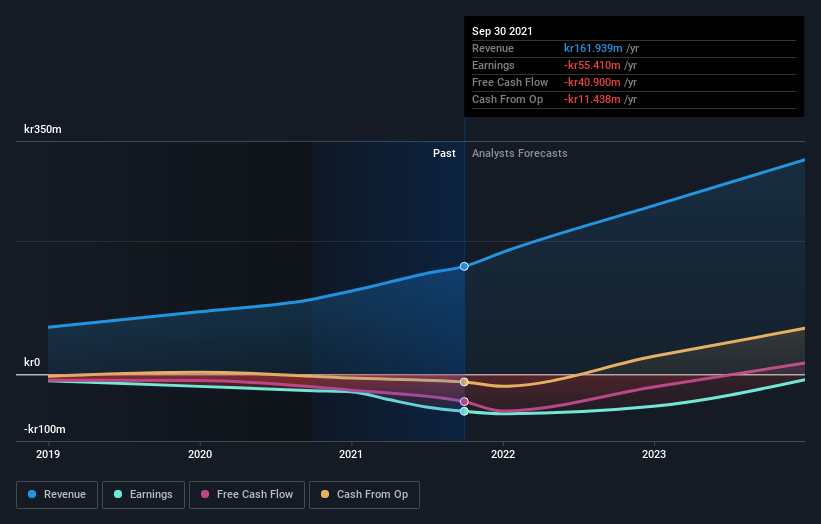

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think House of Control Group will earn in the future (free profit forecasts).

A Different Perspective

Given that the market gained 28% in the last year, House of Control Group shareholders might be miffed that they lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 46% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. It's always interesting to track share price performance over the longer term. But to understand House of Control Group better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for House of Control Group you should be aware of.

House of Control Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

Valuation is complex, but we're here to simplify it.

Discover if House of Control Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:HOC

House of Control Group

House Of Control Group AS develops and sells Software as a Service (SaaS) solutions in the areas of finance and accounting primarily in Norway, Sweden, and Denmark.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives