Discovering Promising Stocks With Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances across major indices, with growth stocks leading the charge and small-cap stocks like those in the Russell 2000 experiencing a pullback, investors are closely watching economic indicators such as job growth and interest rate decisions. In this dynamic environment, identifying promising stocks with potential involves looking for companies that can leverage current economic trends and market conditions to their advantage.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 15.90% | 6.43% | -13.73% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

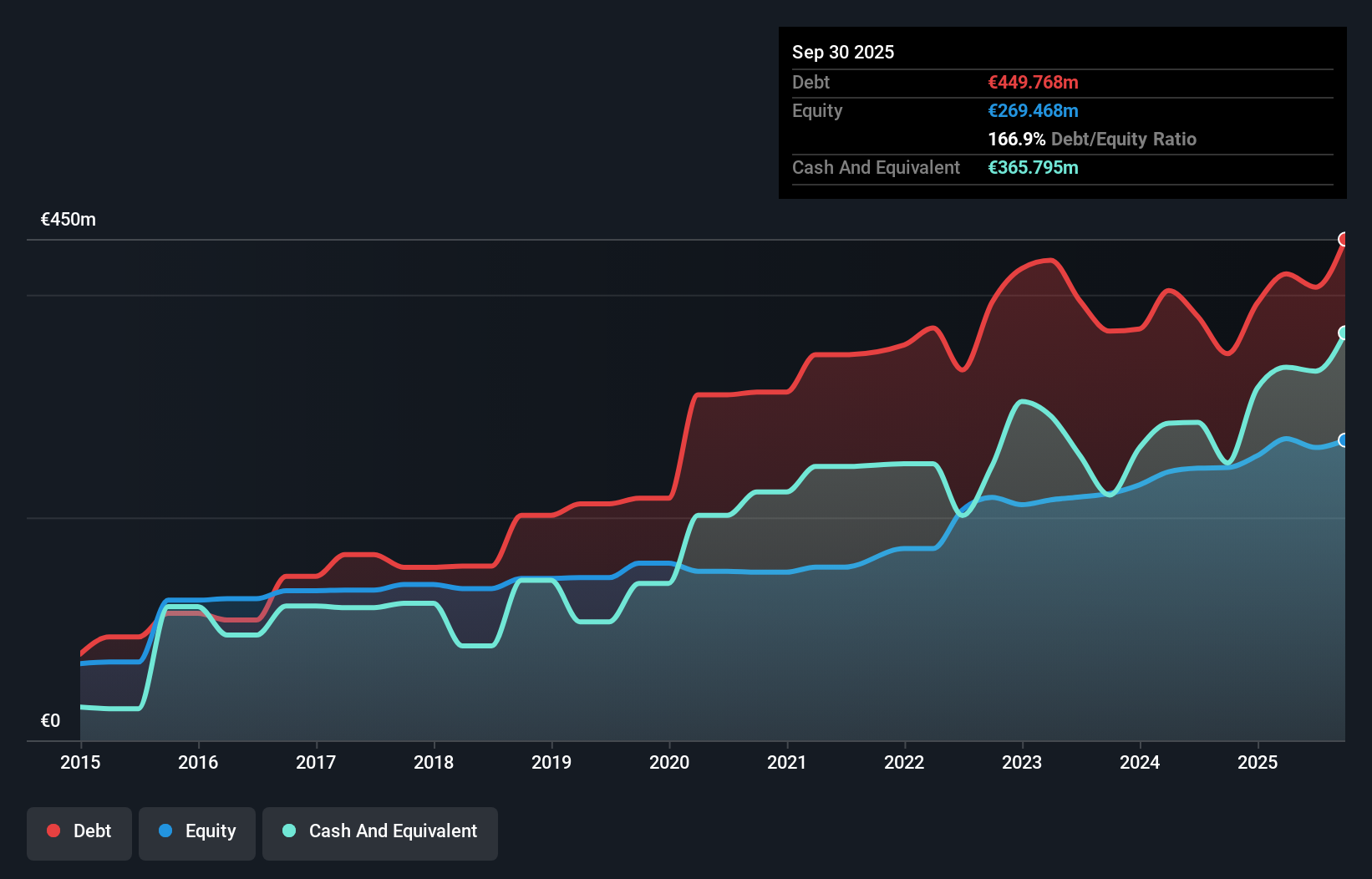

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LU-VE S.p.A. is an Italian company that specializes in producing and marketing heat exchangers and air-cooled equipment, with a market capitalization of approximately €637.32 million.

Operations: LU-VE S.p.A. generates its revenue primarily from two segments: Components (€283.49 million) and Cooling Systems (€296.15 million).

LU-VE, a niche player in the building industry, has shown resilience with its earnings growing 1.7% over the past year, outpacing the industry average of 0.4%. The company's EBIT covers interest payments 13 times over, indicating solid financial health despite a high net debt to equity ratio of 40%. Recent earnings reports reveal sales at €436.81 million for nine months ending September 2024, slightly down from €463.52 million previously. LU-VE's net income remained stable at €25.77 million compared to last year's €25.91 million, reflecting high-quality earnings and positive free cash flow amidst challenging market conditions.

- Unlock comprehensive insights into our analysis of LU-VE stock in this health report.

Examine LU-VE's past performance report to understand how it has performed in the past.

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving public and private sector clients in Norway, Sweden, and internationally, with a market cap of NOK7.71 billion.

Operations: Bouvet ASA generates revenue primarily from IT consultancy services, totaling NOK3.87 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Bouvet, a nimble player in the IT sector, has shown impressive performance with earnings growth of 13.6% over the past year, outpacing the industry average. The company operates debt-free and boasts high-quality past earnings. Recent financial results highlight strong sales of NOK 878 million for Q3 2024, up from NOK 778 million last year, with net income rising to NOK 78 million from NOK 63 million. Bouvet's robust free cash flow and strategic dividend increase reflect confidence in its ongoing profitability and potential for sustained growth amidst industry challenges.

- Get an in-depth perspective on Bouvet's performance by reading our health report here.

Gain insights into Bouvet's historical performance by reviewing our past performance report.

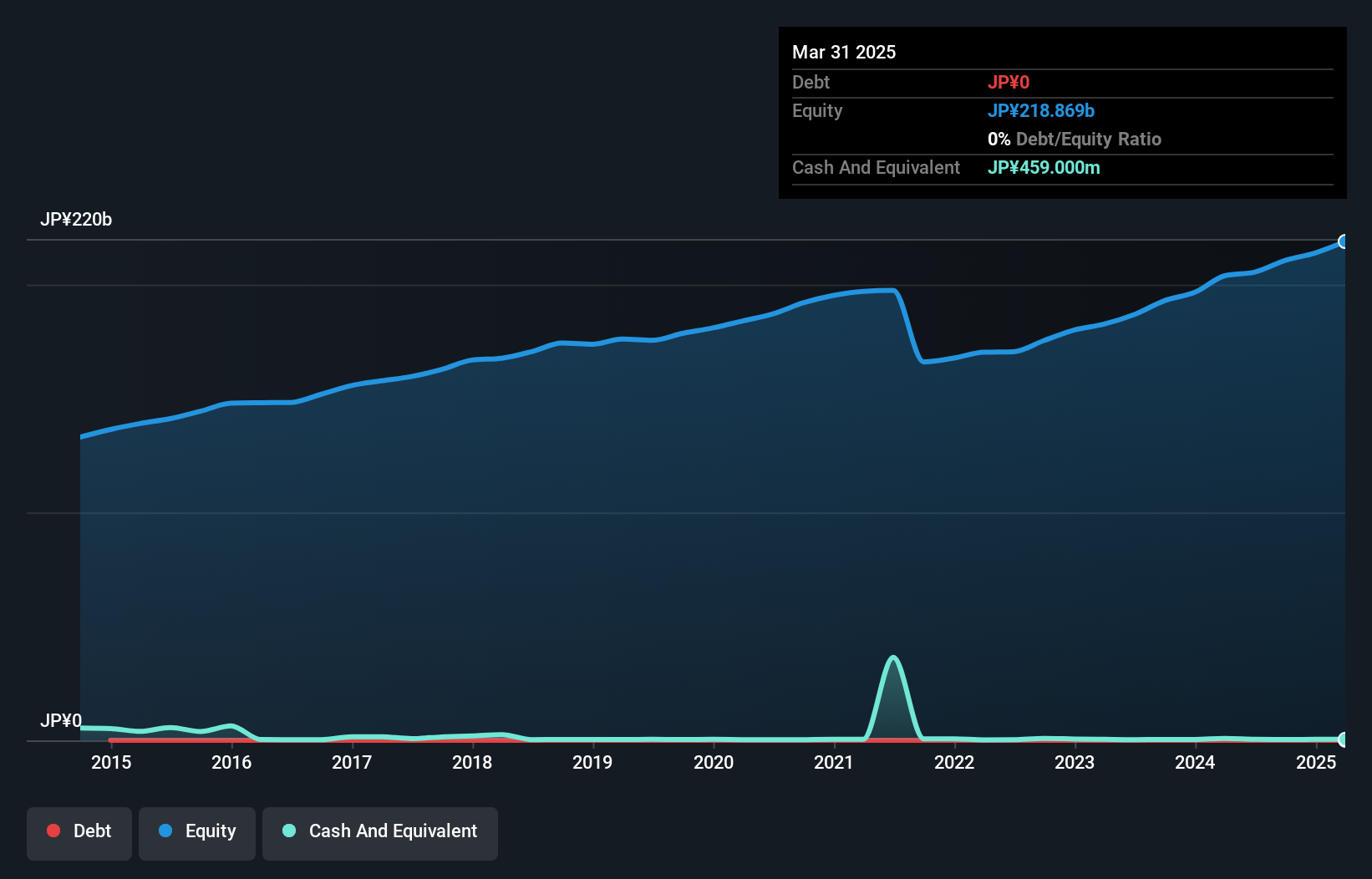

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitsubishi Shokuhin Co., Ltd. is a company involved in the wholesale distribution of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries both in Japan and internationally, with a market cap of ¥219.04 billion.

Operations: The company generates revenue through its wholesale distribution operations, focusing on processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries. With a market cap of ¥219.04 billion, it operates both domestically in Japan and internationally.

Mitsubishi Shokuhin, a nimble player in the consumer retailing space, has shown promising growth with earnings rising 13% over the past year, outpacing the industry average of 11.8%. The company appears to be trading at a slight discount of 1.1% below its estimated fair value, suggesting potential room for appreciation. With no debt on its balance sheet for five years and high-quality earnings reported consistently, it seems well-positioned financially. Recently, it announced a dividend increase to ¥90 per share and projects net sales of ¥2.13 trillion for FY2025 alongside an operating profit forecast of ¥31.5 billion.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4622 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouvet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BOUV

Bouvet

Provides IT and digital communication consultancy services for public and private sector companies in Norway, Sweden, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.