Atea ASA (OB:ATEA) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline. Investor sentiment seems to be improving too, with the share price up 9.6% to kr146 over the past 7 days. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

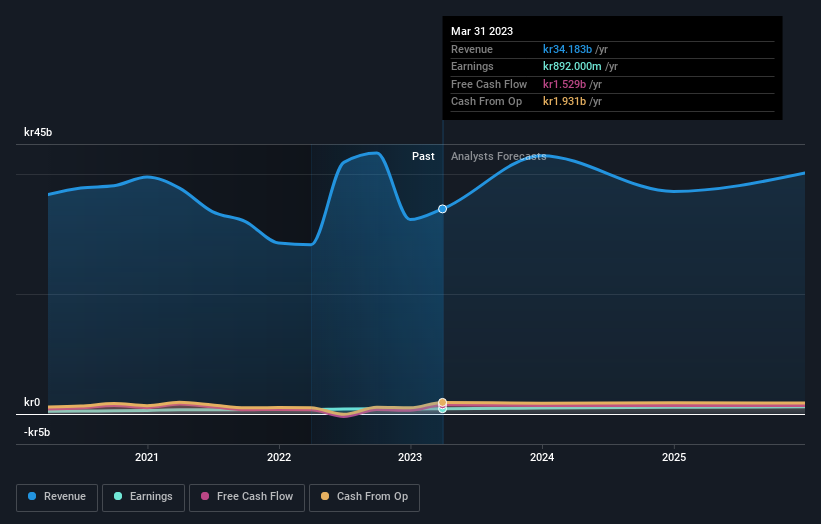

After this upgrade, Atea's three analysts are now forecasting revenues of kr43b in 2023. This would be a substantial 26% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to increase 9.8% to kr8.83. Prior to this update, the analysts had been forecasting revenues of kr34b and earnings per share (EPS) of kr8.46 in 2023. The forecasts seem more optimistic now, with a very substantial lift in revenue and a slight bump in earnings per share estimates.

Check out our latest analysis for Atea

It will come as no surprise to learn that the analysts have increased their price target for Atea 7.1% to kr150 on the back of these upgrades. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Atea analyst has a price target of kr170 per share, while the most pessimistic values it at kr140. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Atea's rate of growth is expected to accelerate meaningfully, with the forecast 36% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 0.2% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.1% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Atea is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Atea.

Better yet, our automated discounted cash flow calculation (DCF) suggests Atea could be moderately undervalued. You can learn more about our valuation methodology on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion