Shareholders Will Probably Not Have Any Issues With Europris ASA's (OB:EPR) CEO Compensation

Key Insights

- Europris' Annual General Meeting to take place on 24th of April

- Total pay for CEO Espen Eldal includes kr4.38m salary

- The overall pay is comparable to the industry average

- Europris' total shareholder return over the past three years was 56% while its EPS was down 13% over the past three years

CEO Espen Eldal has done a decent job of delivering relatively good performance at Europris ASA (OB:EPR) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 24th of April. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Europris

How Does Total Compensation For Espen Eldal Compare With Other Companies In The Industry?

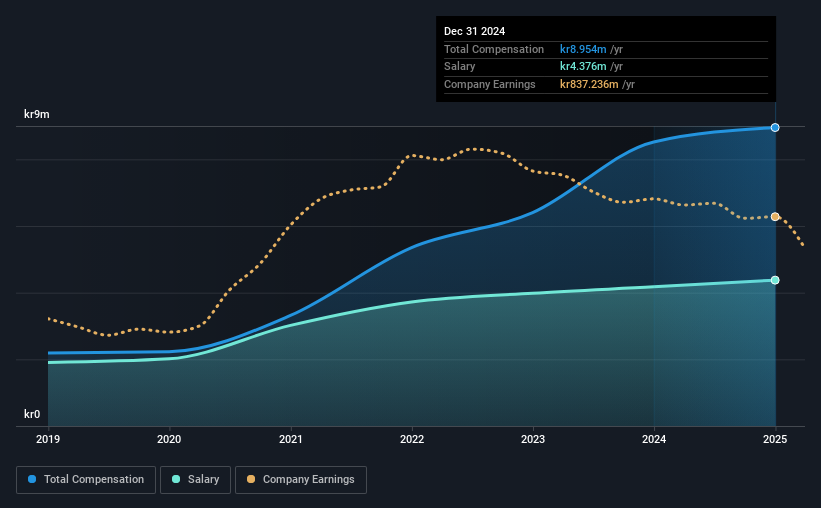

At the time of writing, our data shows that Europris ASA has a market capitalization of kr12b, and reported total annual CEO compensation of kr9.0m for the year to December 2024. That's just a smallish increase of 5.1% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at kr4.4m.

On comparing similar companies from the Norway Multiline Retail industry with market caps ranging from kr4.2b to kr17b, we found that the median CEO total compensation was kr9.0m. This suggests that Europris remunerates its CEO largely in line with the industry average. Moreover, Espen Eldal also holds kr47m worth of Europris stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr4.4m | kr4.2m | 49% |

| Other | kr4.6m | kr4.3m | 51% |

| Total Compensation | kr9.0m | kr8.5m | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Our data reveals that Europris allocates salary more or less in line with the wider market. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Europris ASA's Growth Numbers

Europris ASA has reduced its earnings per share by 13% a year over the last three years. Its revenue is up 43% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Europris ASA Been A Good Investment?

Most shareholders would probably be pleased with Europris ASA for providing a total return of 56% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The overall company performance has been commendable, however there are still areas for improvement. We reckon that there are some shareholders who may be hesitant to increase CEO pay further until EPS growth starts to improve, despite the robust revenue growth.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Europris that investors should be aware of in a dynamic business environment.

Important note: Europris is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Europris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:EPR

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives