- Norway

- /

- Specialty Stores

- /

- OB:ELIMP

Elektroimportøren AS (OB:ELIMP) Looks Just Right With A 27% Price Jump

The Elektroimportøren AS (OB:ELIMP) share price has done very well over the last month, posting an excellent gain of 27%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

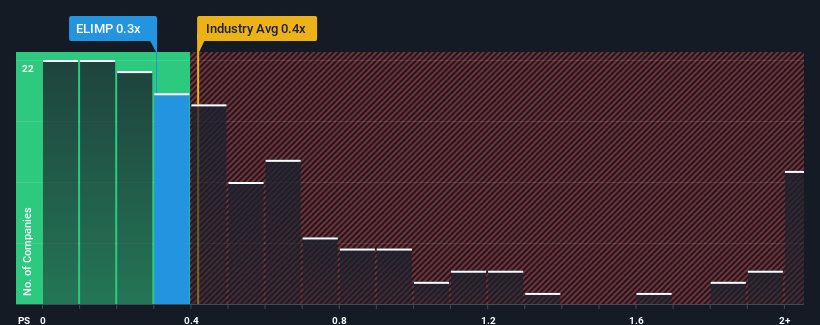

Although its price has surged higher, you could still be forgiven for feeling indifferent about Elektroimportøren's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in Norway is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Elektroimportøren

What Does Elektroimportøren's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Elektroimportøren's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Elektroimportøren's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Elektroimportøren?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Elektroimportøren's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 5.9% each year during the coming three years according to the one analyst following the company. With the industry predicted to deliver 6.7% growth per year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Elektroimportøren's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Elektroimportøren's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Elektroimportøren's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Plus, you should also learn about these 4 warning signs we've spotted with Elektroimportøren (including 2 which can't be ignored).

If you're unsure about the strength of Elektroimportøren's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Elektroimportøren might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ELIMP

Elektroimportøren

Engages in the sale of electrical installation products to private and professional customers in Norway.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives