Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Olav Thon Eiendomsselskap ASA (OB:OLT) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Olav Thon Eiendomsselskap

What Is Olav Thon Eiendomsselskap's Net Debt?

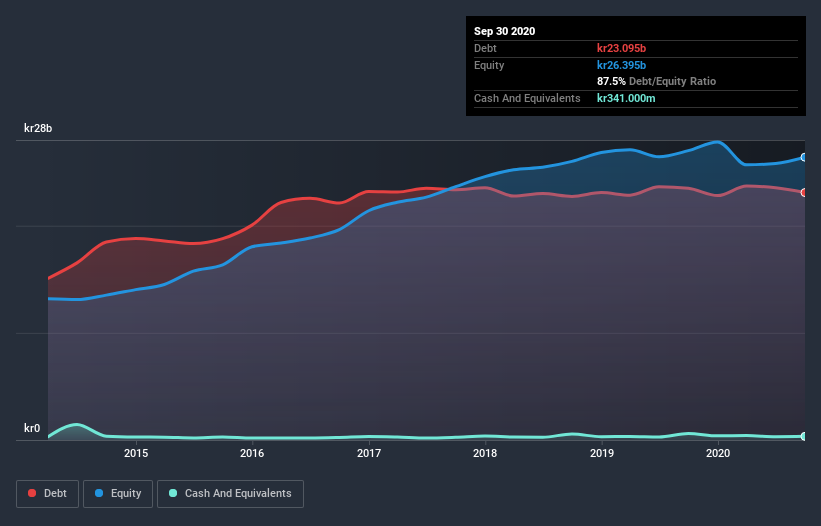

As you can see below, Olav Thon Eiendomsselskap had kr23.1b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Olav Thon Eiendomsselskap's Balance Sheet?

We can see from the most recent balance sheet that Olav Thon Eiendomsselskap had liabilities of kr8.72b falling due within a year, and liabilities of kr22.8b due beyond that. Offsetting these obligations, it had cash of kr341.0m as well as receivables valued at kr774.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr30.4b.

This deficit casts a shadow over the kr17.8b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Olav Thon Eiendomsselskap would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 2.1 times and a disturbingly high net debt to EBITDA ratio of 9.2 hit our confidence in Olav Thon Eiendomsselskap like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even more troubling is the fact that Olav Thon Eiendomsselskap actually let its EBIT decrease by 8.1% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Olav Thon Eiendomsselskap's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Olav Thon Eiendomsselskap produced sturdy free cash flow equating to 67% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Olav Thon Eiendomsselskap's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Overall, it seems to us that Olav Thon Eiendomsselskap's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Olav Thon Eiendomsselskap has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Olav Thon Eiendomsselskap, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:OLT

Olav Thon Eiendomsselskap

Engages in the property rental business in Norway and Sweden.

Good value second-rate dividend payer.

Market Insights

Community Narratives