With global markets experiencing volatility amid cautious Federal Reserve commentary and political uncertainty, investors are closely monitoring opportunities that can offer potential value. In this context, penny stocks—often seen as relics of past market eras—continue to capture interest due to their affordability and growth potential. These smaller or newer companies can provide a unique combination of value and stability when backed by strong financials, making them intriguing options for those seeking under-the-radar investment opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,840 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

DISA (Catalist:532)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DISA Limited is an investment holding company involved in the technology sector across Singapore, China, Hong Kong, and the United States with a market cap of SGD 21.01 million.

Operations: The company's revenue is derived from its technology segment, totaling SGD 7.54 million.

Market Cap: SGD21.01M

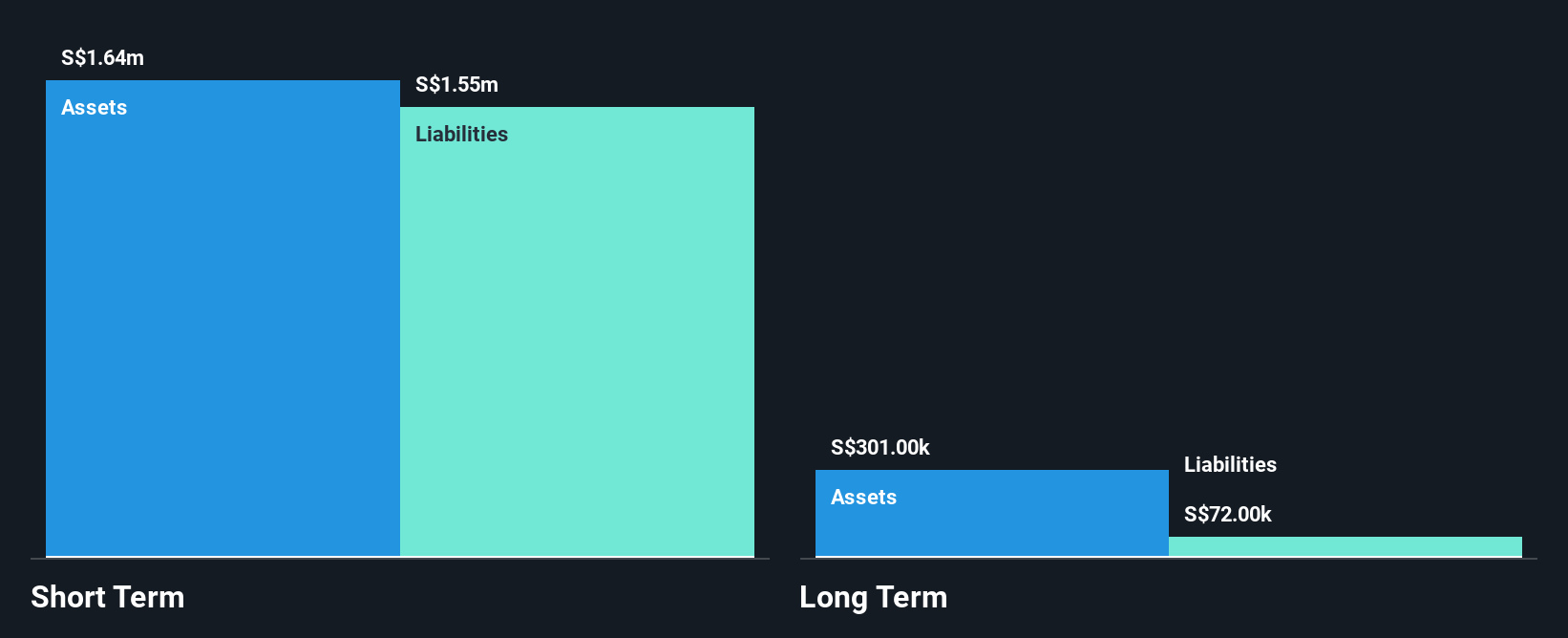

DISA Limited, with a market cap of SGD 21.01 million, operates in the technology sector across several regions. Despite being unprofitable, it has managed to reduce losses by a significant rate over the past five years and maintains no debt. The company's short-term assets of SGD 2 million exceed both its short-term and long-term liabilities, indicating sound financial management. Recent board changes include appointing Mr. Lim Soon Hock as Lead Independent Director and Mr. George Kho Wee Hong as Non-Executive Director, suggesting an emphasis on strengthening governance structures amidst ongoing volatility in share price and shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of DISA stock in this financial health report.

- Evaluate DISA's historical performance by accessing our past performance report.

Skellerup Holdings (NZSE:SKL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skellerup Holdings Limited designs, manufactures, and distributes engineered products for specialist industrial and agricultural applications, with a market cap of NZ$980.36 million.

Operations: The company generates its revenue from two main segments: Agri, contributing NZ$105.29 million, and Industrial, accounting for NZ$226.22 million.

Market Cap: NZ$980.36M

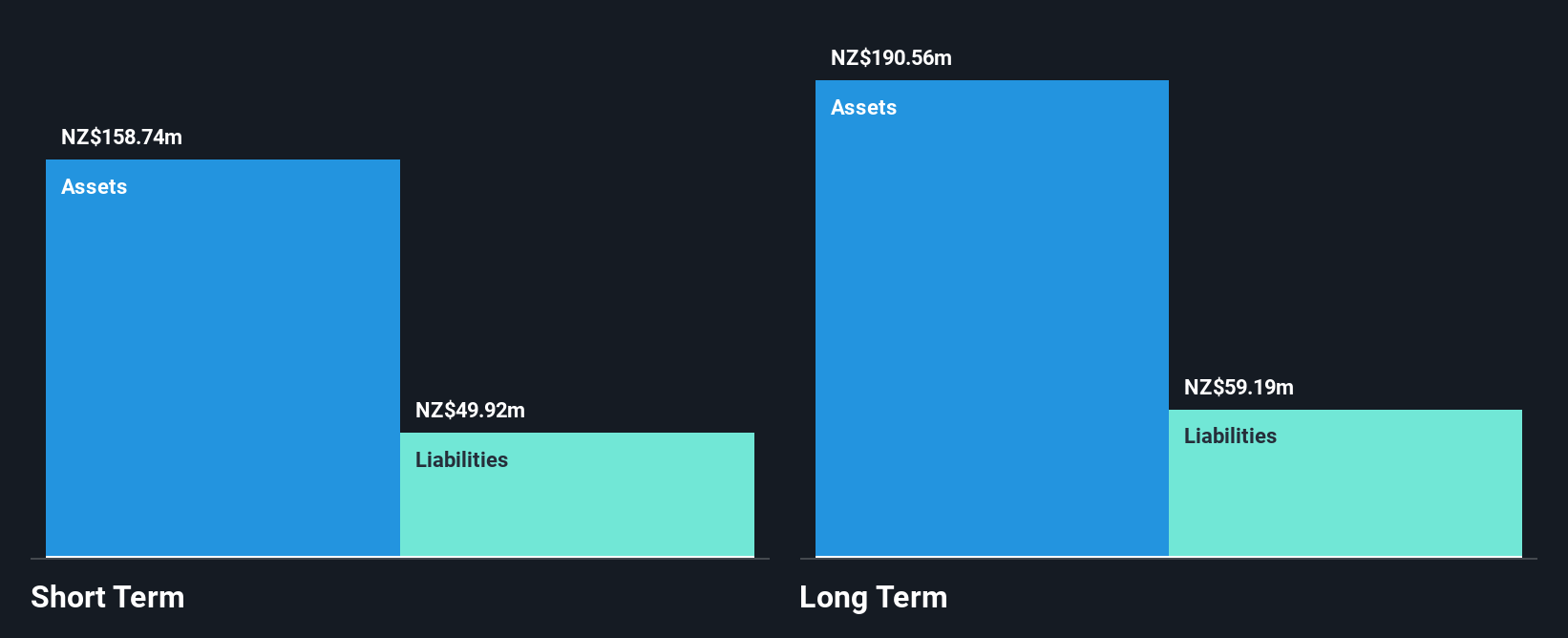

Skellerup Holdings, with a market cap of NZ$980.36 million, shows strong financial health and stability. Its operating cash flow comfortably covers its debt, and both short-term and long-term liabilities are exceeded by its assets. The company has experienced a reduction in its debt-to-equity ratio over the past five years, now at 13.9%, and maintains a satisfactory net debt to equity ratio of 6.7%. Despite recent negative earnings growth, Skellerup's Return on Equity is high at 20.4%, indicating efficient use of equity capital. However, dividends remain unsustainably covered by earnings amidst stable weekly volatility.

- Take a closer look at Skellerup Holdings' potential here in our financial health report.

- Gain insights into Skellerup Holdings' outlook and expected performance with our report on the company's earnings estimates.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies, with a market cap of NOK986.17 million.

Operations: The company generates its revenue from the Pharmaceuticals segment, amounting to $4.37 million.

Market Cap: NOK986.17M

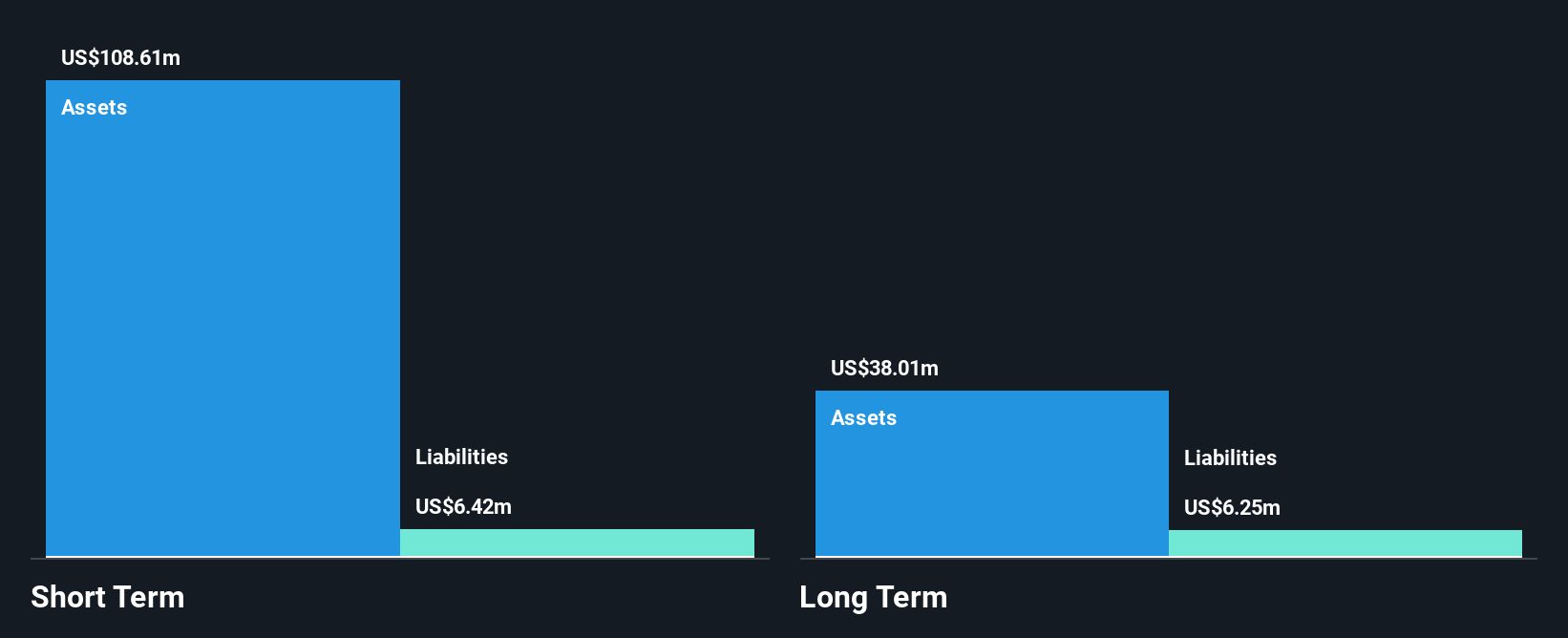

Nykode Therapeutics, with a market cap of NOK986.17 million, is navigating the challenges typical of clinical-stage biopharmaceutical firms. Despite being unprofitable and experiencing declining revenue—US$2.27 million for the first nine months of 2024—the company maintains a strong balance sheet with short-term assets of US$128.7 million far exceeding its liabilities. Recent data on its mRNA-based neoantigen vaccine highlights potential in cancer immunotherapy, though Genentech's termination of their collaboration may impact future prospects. The management team shows moderate experience, while recent product developments underscore Nykode's innovative capabilities amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Nykode Therapeutics.

- Explore Nykode Therapeutics' analyst forecasts in our growth report.

Where To Now?

- Unlock more gems! Our Penny Stocks screener has unearthed 5,837 more companies for you to explore.Click here to unveil our expertly curated list of 5,840 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nykode Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NYKD

Nykode Therapeutics

A clinical-stage biopharmaceutical company, discovers and develops novel immunotherapies.

Flawless balance sheet slight.

Market Insights

Community Narratives