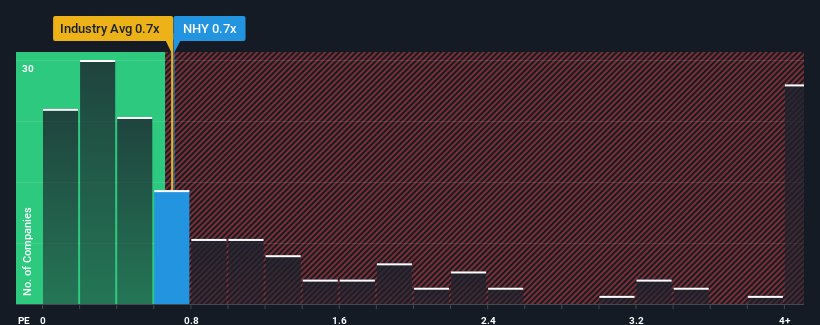

It's not a stretch to say that Norsk Hydro ASA's (OB:NHY) price-to-sales (or "P/S") ratio of 0.7x seems quite "middle-of-the-road" for Metals and Mining companies in Norway, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Norsk Hydro

What Does Norsk Hydro's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Norsk Hydro has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Norsk Hydro will help you uncover what's on the horizon.How Is Norsk Hydro's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Norsk Hydro's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 9.2% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 59% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 4.8% each year during the coming three years according to the twelve analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.04% per annum, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that Norsk Hydro is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Norsk Hydro's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We note that even though Norsk Hydro trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Norsk Hydro that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Norsk Hydro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NHY

Norsk Hydro

Engages in the power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives