- Norway

- /

- Metals and Mining

- /

- OB:NHY

Is Norsk Hydro (OB:NHY) Fairly Valued After Striking a Low-Carbon Aluminium Deal With Mercedes-Benz?

Reviewed by Kshitija Bhandaru

Mercedes-Benz’s adoption of low-carbon aluminium sourced from Norsk Hydro (OB:NHY) marks a new chapter in sustainable manufacturing for the automotive sector. This move promises noticeable emissions reductions in upcoming electric vehicles and positions Norsk Hydro as a key partner in the push for greener materials.

See our latest analysis for Norsk Hydro.

Norsk Hydro’s industry partnerships are coming at a time when investors are still weighing up its longer-term potential. The stock shows a respectable 1-year total shareholder return of 5.8% and considerable gains over three and five years. Recent collaborator news has given the momentum a fresh context, hinting at renewed confidence around Hydro’s sustainable materials strategy and its future earnings prospects.

If the move toward greener auto manufacturing has you thinking bigger, now’s a great time to expand your search and discover See the full list for free.

With solid long-term returns and current prices near analyst targets, is Norsk Hydro undervalued in light of its sustainability push, or has the market already accounted for its future growth story?

Most Popular Narrative: 3.7% Overvalued

With Norsk Hydro’s current share price so close to the widely followed fair value estimate, the market appears to have priced in much of the sustainability optimism. But what is really behind this consensus view? Let’s hear directly from the dominant narrative shaping Hydro’s outlook.

“Automation, cost savings, and a downstream focus drive margin improvements and position the company for sustainable long-term earnings growth. Geopolitical risks, weak demand, market oversupply, structural challenges, and volatile costs all threaten Norsk Hydro's profitability and make earnings improvement uncertain.”

Wondering what is powering this valuation? The secret ingredient is a precise combination of rising profit margins and bold future earnings assumptions. The connection between automation strategies, targeted cost cuts, and premium pricing sets the narrative apart. Eager to see what is lurking in the detail of those projections?

Result: Fair Value of $65.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak demand in key markets or persistent global aluminum oversupply could quickly undermine Hydro’s profit growth and threaten future price upside.

Find out about the key risks to this Norsk Hydro narrative.

Another View: Discounted Cash Flow Paints a Different Picture

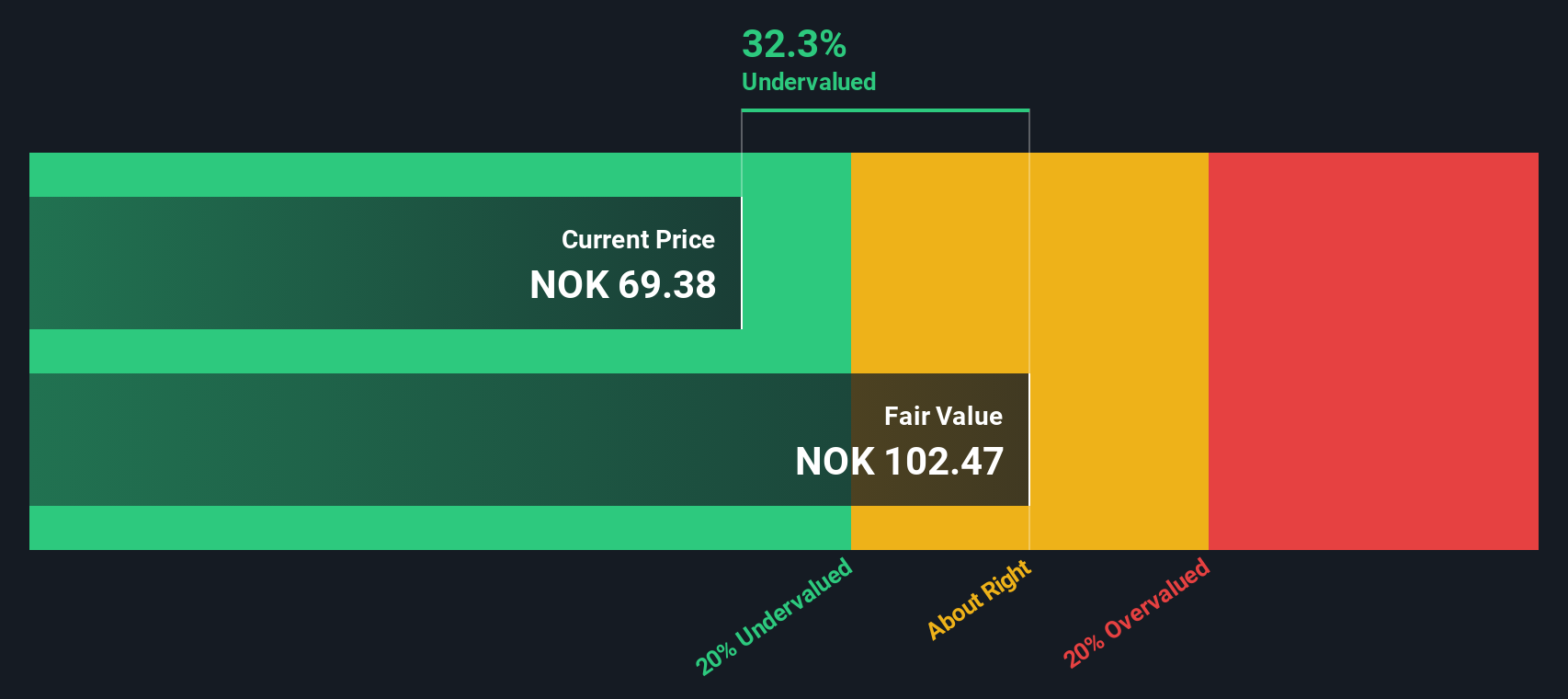

While the consensus view sees Norsk Hydro as fairly valued based on its current share price and analyst targets, the SWS DCF model offers a very different perspective. This method estimates the intrinsic value at NOK102.57, suggesting the shares are trading at a notable discount. Could the market be overlooking long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Norsk Hydro Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, you can build your own perspective in just a few minutes: Do it your way

A great starting point for your Norsk Hydro research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are already spot-checking sectors that hold real potential. You could miss the next big opportunity by ignoring these powerful, data-backed screens:

- Tap into rapid rewards by scanning these 910 undervalued stocks based on cash flows, filled with stocks trading below their calculated cash flow value, and be the first to spot overlooked bargains.

- Position yourself ahead of industry disruption by evaluating these 24 AI penny stocks, where artificial intelligence drives futuristic growth and game-changing innovation.

- Grab consistent income streams with these 19 dividend stocks with yields > 3%, highlighting stocks offering attractive yields above 3 percent and strong dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norsk Hydro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NHY

Norsk Hydro

Engages in the power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives