As inflation eases and the European Central Bank signals a near conclusion to its monetary policy cycle, European markets have shown resilience with major indices like the STOXX Europe 600 Index posting gains. In this environment of economic stability and cautious optimism, dividend stocks can offer investors a reliable income stream, making them an appealing option for those looking to balance growth with steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.44% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.96% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.84% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.67% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.51% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.32% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.19% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.45% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

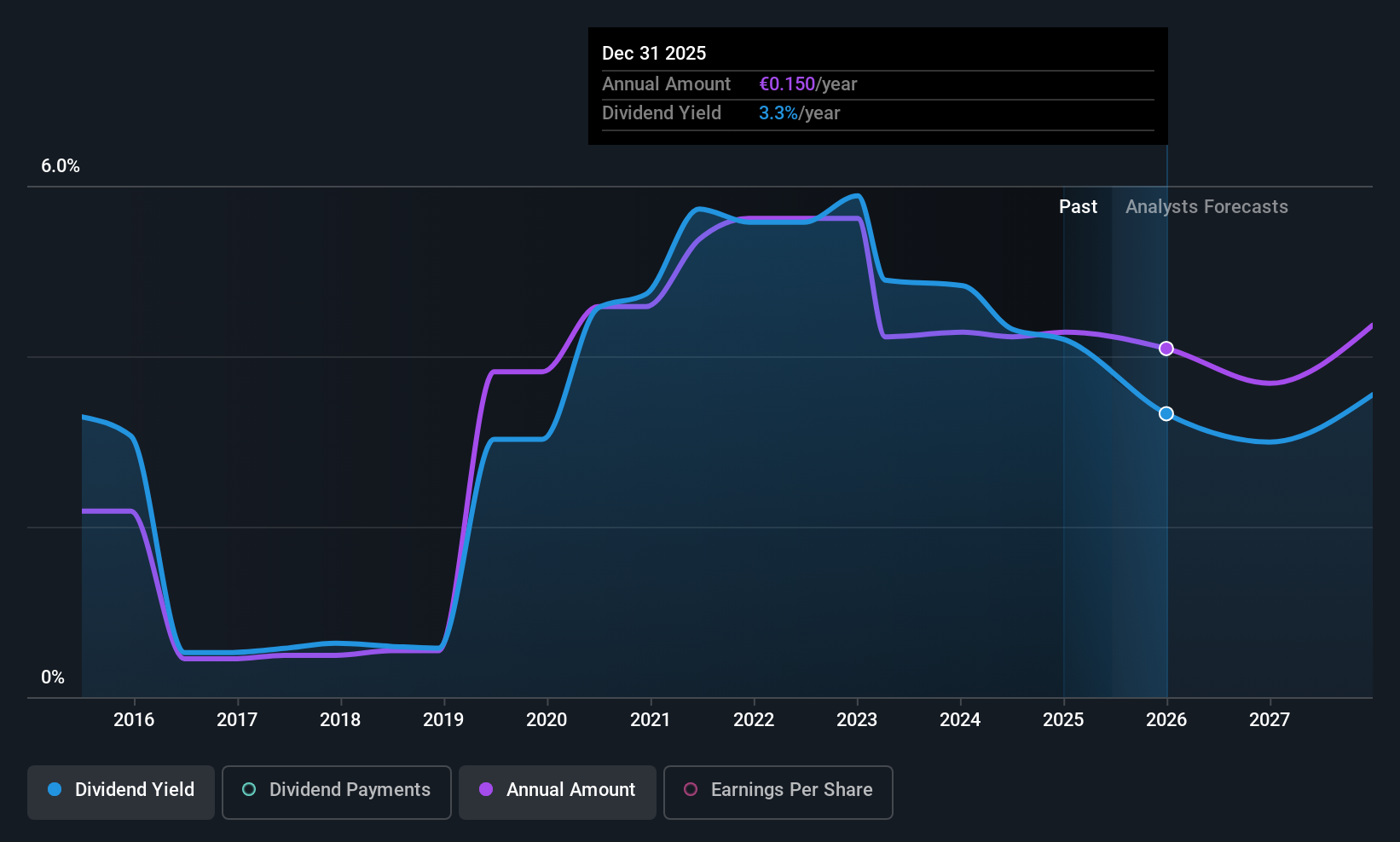

Faes Farma (BME:FAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Faes Farma, S.A. is involved in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials globally, with a market cap of €1.42 billion.

Operations: Faes Farma generates revenue through its global operations in pharmaceuticals, healthcare products, and raw materials.

Dividend Yield: 3.4%

Faes Farma's dividend yield of 3.45% is below the top quartile in Spain, yet its dividends are sustainably covered by both earnings and cash flows with payout ratios of 50.3% and 64.3%, respectively. While dividend payments have grown over the past decade, they remain volatile and unreliable due to historical instability. Recent earnings showed revenue growth but a slight decline in net income to €28.38 million, highlighting challenges despite trading at a good relative value post-acquisition discussions of SIFI SpA.

- Dive into the specifics of Faes Farma here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Faes Farma shares in the market.

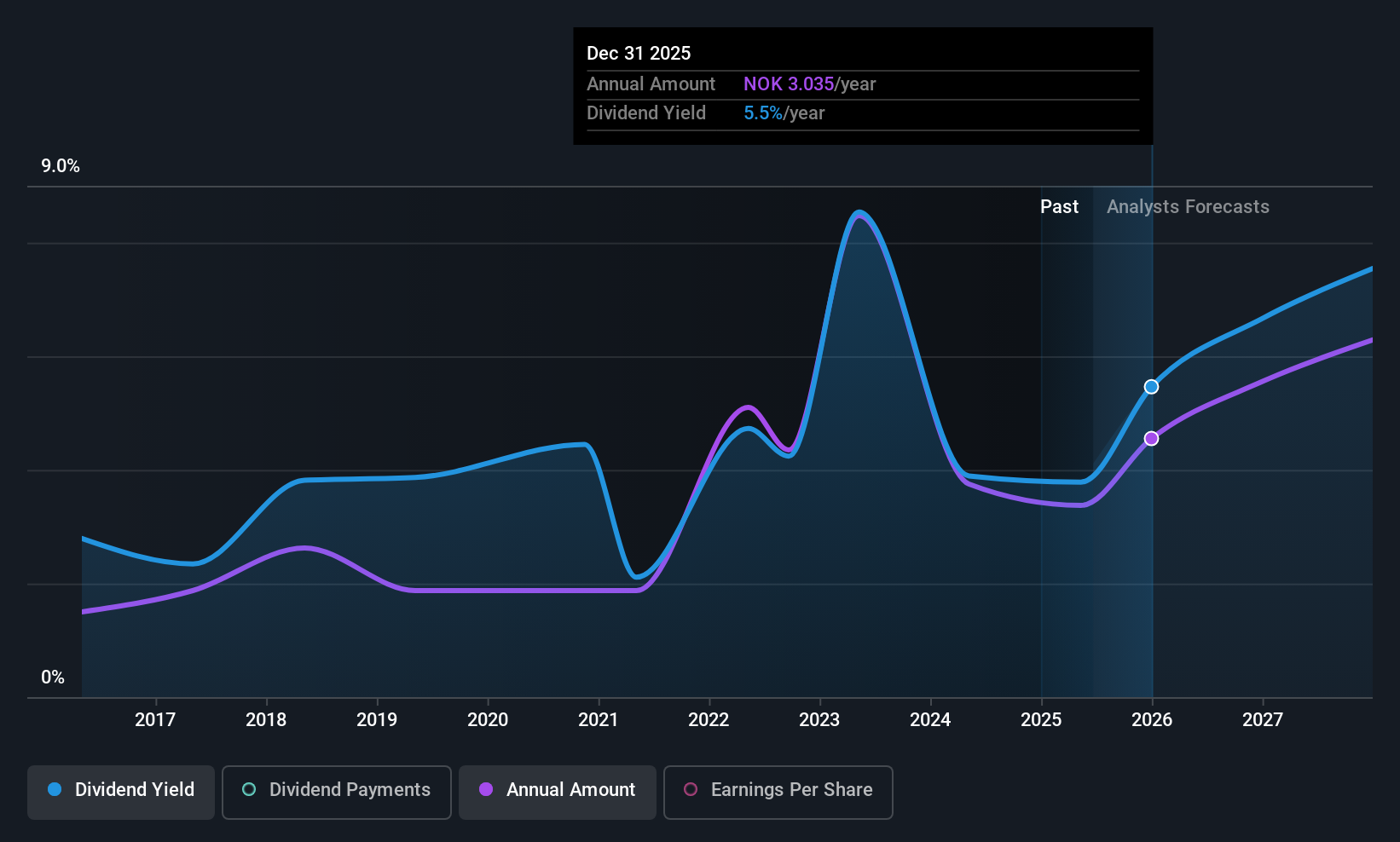

Norsk Hydro (OB:NHY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norsk Hydro ASA is involved in power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities globally, with a market cap of NOK112.37 billion.

Operations: Norsk Hydro ASA's revenue segments include Hydro Energy (NOK10.80 billion), Hydro Extrusions (NOK76.38 billion), Hydro Metal Markets (NOK85.31 billion), Hydro Aluminium Metal (NOK59.01 billion), and Hydro Bauxite & Alumina (NOK60.65 billion).

Dividend Yield: 4%

Norsk Hydro's dividend yield of 3.95% is lower than Norway's top quartile, with dividends covered by earnings and cash flows at payout ratios of 46.2% and 71.3%, respectively. Despite past volatility in dividend payments, recent earnings growth suggests potential stability improvements. The company announced a NOK 2.25 per share dividend amid strategic investments like the new wire rod casthouse in Norway, reflecting its commitment to enhancing long-term shareholder value while navigating market challenges effectively.

- Get an in-depth perspective on Norsk Hydro's performance by reading our dividend report here.

- Our valuation report unveils the possibility Norsk Hydro's shares may be trading at a discount.

Adecco Group (SWX:ADEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Adecco Group AG, along with its subsidiaries, offers human resource services across Europe, North America, the Asia Pacific, South America, and North Africa and has a market cap of CHF4.01 billion.

Operations: Adecco Group AG generates revenue from several segments, including AKKODIS (€3.50 billion), Adecco APAC (€2.46 billion), Adecco France (€4.44 billion), Adecco Americas (€2.53 billion), and LHH (Talent Solutions) (€1.74 billion).

Dividend Yield: 4.1%

Adecco Group's dividend yield of 4.09% ranks in the top quartile of Swiss payers, with dividends well-covered by earnings and cash flows at payout ratios of 59% and 35.4%, respectively. Despite a volatile dividend history over the past decade, recent financials show stable coverage. The company reported Q1 2025 sales of €5.57 billion, slightly down from last year, with net income also decreasing to €60 million from €73 million, reflecting ongoing operational challenges.

- Click to explore a detailed breakdown of our findings in Adecco Group's dividend report.

- Our valuation report here indicates Adecco Group may be undervalued.

Turning Ideas Into Actions

- Dive into all 229 of the Top European Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives