Borregaard (OB:BRG) Margin Gain Reinforces Bullish Narrative as Earnings, Valuation Outpace Market

Reviewed by Simply Wall St

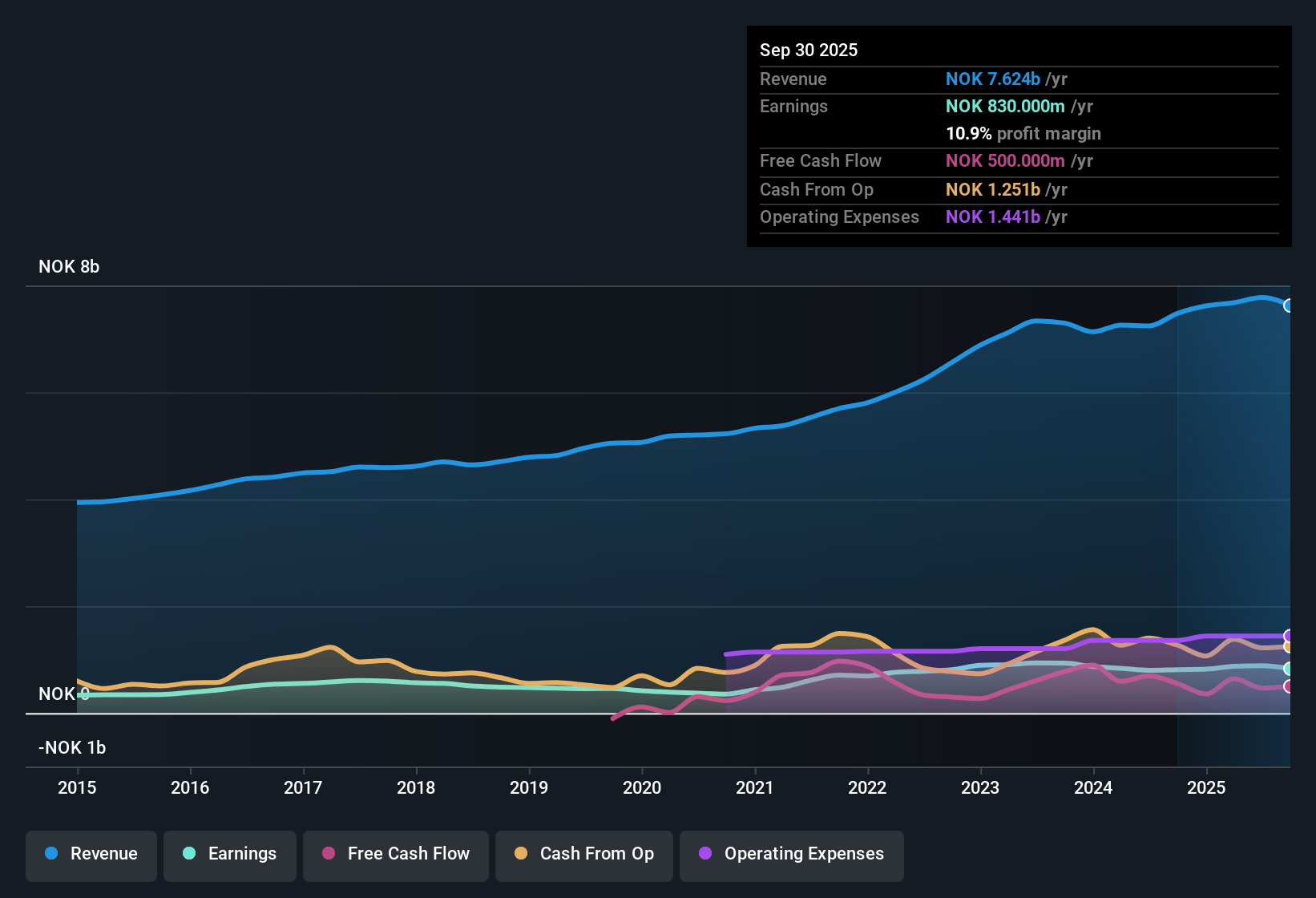

Borregaard (OB:BRG) delivered a solid earnings report, with EPS growth averaging 11.7% per year over the past five years and a 10.6% increase in the most recent period. The company maintains a strong net profit margin of 11.4%, up from 11% last year. With no flagged risks and high quality earnings, forward-looking estimates show anticipated annual earnings growth of 14.41%, which is set to outpace broader Norwegian market trends. These results, along with a price-to-earnings ratio below peer levels and a share price still trading at a discount to fair value, position Borregaard as a compelling story this earnings season.

See our full analysis for Borregaard.The next section digs into how these numbers compare with some of the bigger market narratives around Borregaard, and where investor expectations might diverge from the latest results.

See what the community is saying about Borregaard

Margins Lift as Profit Mix Shifts

- Borregaard's net profit margin has risen to 11.4%, with analysts projecting a further increase to 14.8% in three years, driven by growth in high-value specialties.

- Consensus narrative points out that the favorable BioSolutions product mix, focused on green and biocontrol products, is expected to boost overall earnings and help sustain higher margins over time.

- Strong demand from agriculture is driving segment revenue and EBITDA margins beyond sector averages.

- Ongoing investments such as electrifying spray dryers to cut energy expenses could enhance profitability as operations scale up.

Tariffs and Costs Test Resilience

- Introducing a 10% U.S. tariff on Norwegian imports could pressure revenues, given that 10% of Borregaard’s sales last year were shipped to the U.S., while higher wood and logistics costs are already raising expenses.

- Consensus view flags that exposure to trade tensions and rising transport costs could limit margin expansion and highlights how dependency on agriculture also intensifies top-line risk if sector demand fluctuates.

- Additional competition from cheaper bioethanol in Europe could challenge pricing power in the Fine Chemicals segment.

- A downturn in agriculture spending would leave Borregaard’s revenue base more vulnerable than peers with a broader customer mix.

Share Price Still Trails DCF Fair Value

- Borregaard’s share price of NOK189.4 trades noticeably below its discounted cash flow (DCF) fair value of NOK296.16, while the company’s price-to-earnings ratio of 21.3x sits under the peer average of 25.1x but above the European chemicals sector average of 17x.

- Consensus narrative argues that the modest gap between today’s share price and analyst price target (NOK216.5) suggests Borregaard is fairly valued, but the much wider discount to DCF keeps the valuation story alive for those seeking long-term upside.

- The company’s forecast 14.41% earnings growth per year outpaces the Norwegian market, providing further support to valuation optimists.

- Analysts assume constant share count, so future multiple compression is needed for the share price to fully close the gap with anticipated intrinsic value.

Consensus sees Borregaard’s margin expansion and discounted valuation as a strong springboard for debate. Read the full narrative to see how market bulls and skeptics are reacting to the latest numbers. 📊 Read the full Borregaard Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Borregaard on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on Borregaard’s results? Share your outlook and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Borregaard.

See What Else Is Out There

Borregaard’s profitability remains solid. However, its exposure to trade tensions and dependence on volatile agriculture markets leaves its revenue base vulnerable compared to more diversified peers.

If you value steadier performance through market shifts, use our stable growth stocks screener (2094 results) to discover companies delivering consistent growth and less exposed to sector swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borregaard might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BRG

Borregaard

Engages in the development, production, and marketing of specialized biochemicals and biomaterials in Norway, rest of Europe, Asia, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives