Assessing Storebrand (OB:STB) Valuation After Sustained Share Price Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 174.6% Overvalued

The prevailing narrative values Storebrand as significantly overvalued, contending that its market price far exceeds assumptions for future profit and revenue.

Storebrand's strategic growth, sustainability leadership, and financial maneuvers strengthen its revenue potential, brand value, and shareholder returns. These efforts also boost future asset management growth. Catalysts About Storebrand: Provides insurance products and services in Norway, the United States, Japan, and Sweden.

Curious how such aggressive growth ambitions stack up against bold financial forecasts? The case hinges on rapidly shifting profit margins and ambitious assumptions for operating performance. Wondering how this turns into one of the market’s most stretched valuation calls? Take a closer look and discover which underlying projections fuel this contrarian price target calculation.

Result: Fair Value of $55.86 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong cost controls and successful acquisitions could boost revenue and earnings and challenge current assumptions of overvaluation in Storebrand's outlook.

Find out about the key risks to this Storebrand narrative.Another View: Our DCF Model Says Undervalued

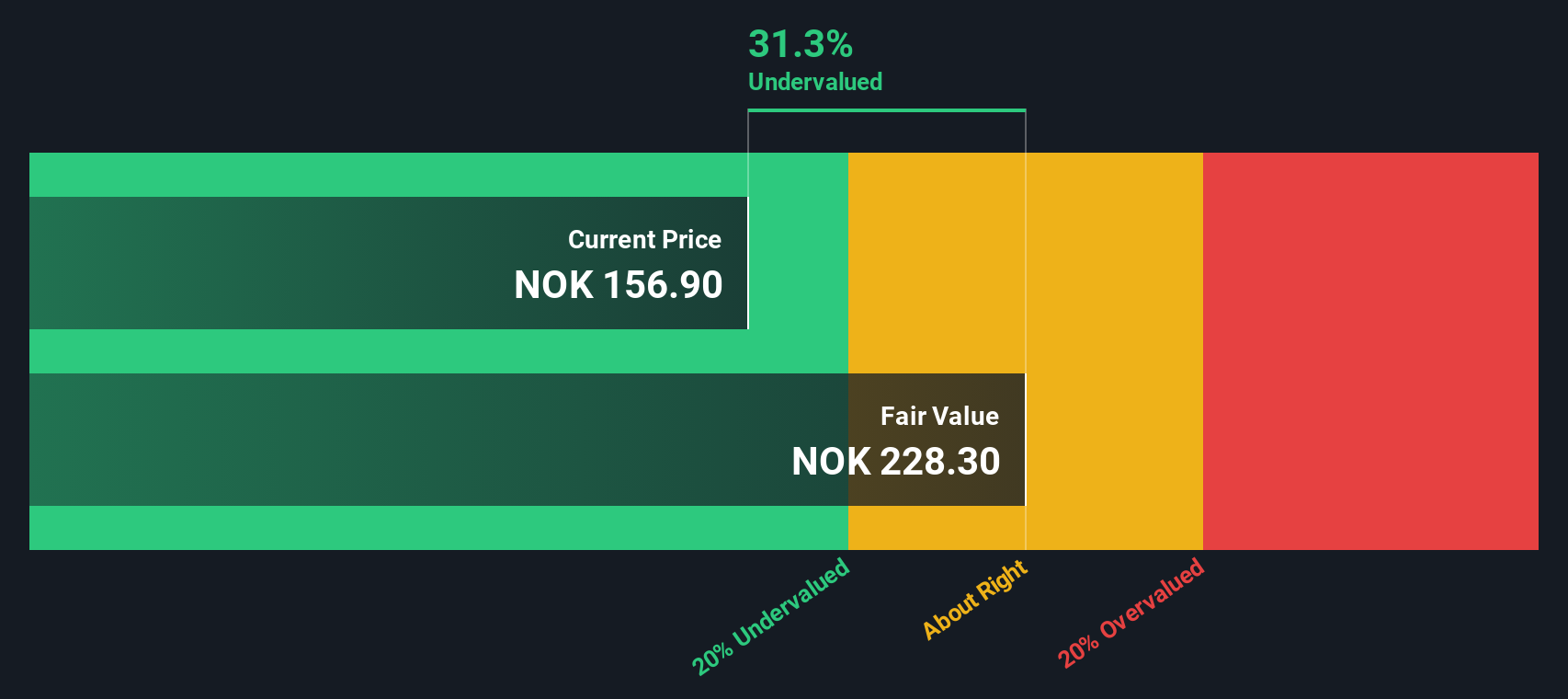

Looking at Storebrand through the lens of our DCF model, the stock appears undervalued. This challenges the earlier view that it is overpriced. Could longer-term cash flows change the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Storebrand Narrative

If you see things differently or would rather shape the story for yourself, you can build your own narrative quickly and easily. Do it your way with Do it your way.

A great starting point for your Storebrand research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let great opportunities pass you by. Go beyond Storebrand and get ahead of the curve with tailored investment ideas from market specialists and trendsetters using the Simply Wall Street Screener.

- Capitalize on tomorrow’s breakthroughs by scanning for innovations in high-potential AI-driven firms with AI penny stocks.

- Boost your passive income strategy by zeroing in on companies delivering stable payouts through dividend stocks with yields > 3%.

- Uncover hidden gems that the market has overlooked and hunt for value-packed opportunities via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:STB

Storebrand

Provides insurance products and services in Norway, Sweden, the United Kingdom, Finland, Denmark, Germany, Luxemburg, and Ireland.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives