Did You Manage To Avoid Protector Forsikring's (OB:PROTCT) 33% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Protector Forsikring ASA (OB:PROTCT) shareholders, since the share price is down 33% in the last three years, falling well short of the market return of around 41%. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

View our latest analysis for Protector Forsikring

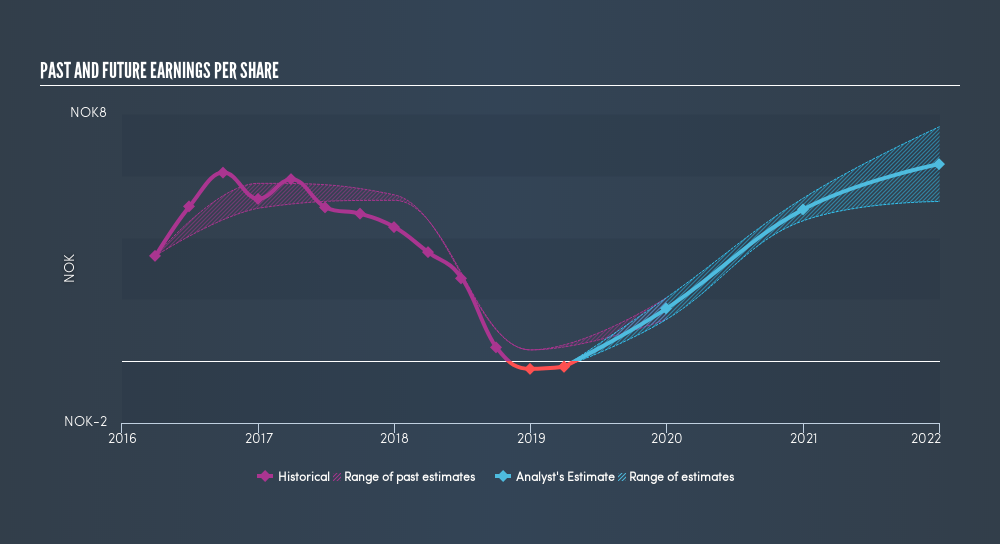

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Protector Forsikring saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Protector Forsikring's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Protector Forsikring's TSR over the last 3 years is -31%; better than its share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

We regret to report that Protector Forsikring shareholders are down 3.2% for the year. Unfortunately, that's worse than the broader market decline of 2.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 3.7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Protector Forsikring is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:PROT

Protector Forsikring

Operates as a non-life insurance company, provides direct general insurance and reinsurance to the commercial lines of business, public sector, and affinity schemes.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives