Protector Forsikring (OB:PROT) Margin Decline Challenges Bullish Narratives Despite Strong Revenue Outlook

Reviewed by Simply Wall St

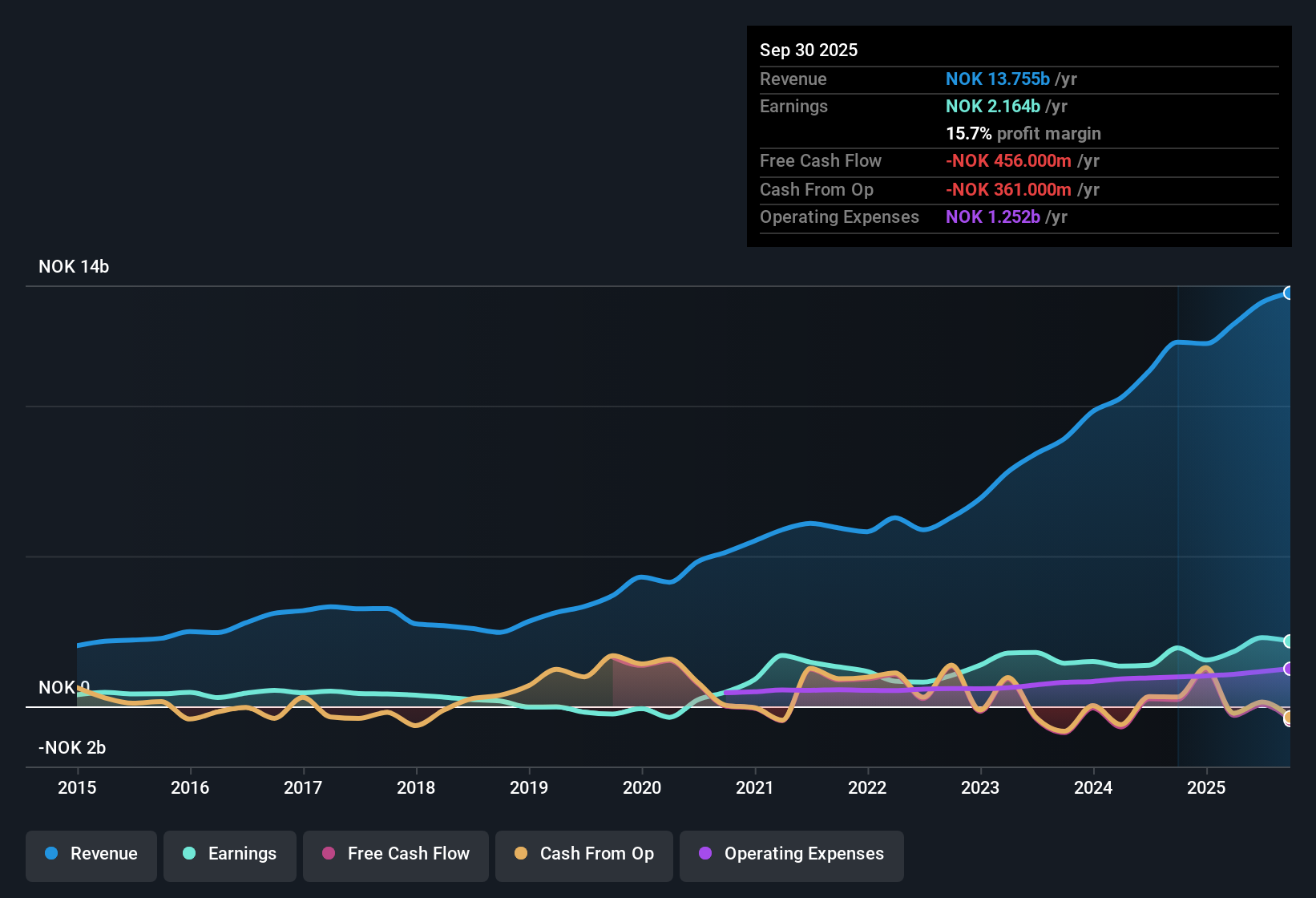

Protector Forsikring (OB:PROT) reported revenue growth forecasts of 9.1% per year, outpacing the Norwegian market average of 3.9%. While EPS is projected to grow at 2% annually, this lags behind the broader market’s 14% rate, and the net profit margin narrowed to 15.7% from last year’s 16.1%. Over the past five years, annual earnings have grown by an average of 14.9%, but slowed to 11% last year. Investors are now weighing these slowing earnings and margin trends against strong revenue forecasts and the company's current valuation discount in the market.

See our full analysis for Protector Forsikring.The real test is how these numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged.

See what the community is saying about Protector Forsikring

AI-Driven Productivity Aims at Margins

- Protector Forsikring has launched an AI tool to boost employee productivity and operational efficiency, aiming to counter the shrinking profit margin that fell from 16.1% to 15.7% this year.

- According to analysts' consensus view, the focus on technology and efficiency is expected to help stabilize margins over the longer term, even as immediate forecasts show margins dropping to 11.8% in three years.

- Consensus narrative highlights investment in data and technology as key to offsetting rising operational costs.

- Analysts flag that without significant efficiency gains, ongoing competitive pressure in core markets may outweigh the technology benefits.

Competition Stresses Profitability, Despite Revenue Growth

- Successful expansion in Norway and Denmark contributes to the 9.1% revenue growth forecast, but analysts foresee earnings declining from NOK 2.3 billion to NOK 2.1 billion by 2028 alongside shrinking profit margins.

- Consensus narrative notes that increased competition and irrational pricing, especially in Sweden’s motor sector, could squeeze revenue and destabilize profit margins.

- Analysts point to rational pricing in core markets helping maintain stability, but warn that higher churn rates and lower hit ratios risk undermining growth momentum.

- The narrative also cautions that price hikes in the UK aimed at improving segment profitability could further increase churn and pressure top-line results.

Valuation Attracts on Discount to DCF Fair Value

- Shares trade at NOK 462.50, which is well below the DCF fair value estimate of NOK 905.02 and lower than the analyst consensus price target of NOK 554.00. The stock’s P/E of 17.6x is also below the peer average of 22.3x.

- Consensus narrative suggests the relatively modest 9% gap between current price and analyst target signals that most expect Protector Forsikring is fairly valued on current risk and growth expectations.

- Analysts explicitly state that further upside depends on beating expectations for revenue and margin retention, rather than just near-term price movement.

- The price gap to DCF fair value is larger than to the analyst target, highlighting deeper valuation upside if revenue and cost assumptions play out more favorably than forecast.

Curious to see how community investors interpret these numbers? Read the full spectrum of opinions in the consensus narrative for OB:PROT — see the prevailing arguments and their supporting evidence. 📊 Read the full Protector Forsikring Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Protector Forsikring on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective and shape the story in just a few minutes: Do it your way.

A great starting point for your Protector Forsikring research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Protector Forsikring’s margins are under pressure as competitive pricing and rising costs threaten stable earnings and consistent profit growth in the coming years.

If you want to focus on companies delivering dependable earnings and steady performance, now is the time to check out stable growth stocks screener (2092 results) for alternatives that prioritize reliability through various cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PROT

Protector Forsikring

Operates as a non-life insurance company, provides direct general insurance and reinsurance to the commercial lines of business, public sector, and affinity schemes.

Proven track record and fair value.

Market Insights

Community Narratives