- Switzerland

- /

- Building

- /

- SWX:MTG

Uncovering Europe's Undiscovered Gems This October 2025

Reviewed by Simply Wall St

As European markets continue to rally, reaching record levels on the back of strong technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly optimistic about small-cap opportunities within the region. In this environment, a good stock often combines robust fundamentals with potential for growth in sectors that are benefiting from current economic trends and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Fine Foods & Pharmaceuticals N.T.M (BIT:FF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fine Foods & Pharmaceuticals N.T.M. S.p.A. operates in the nutraceutical, pharmaceutical, and cosmetics sectors with a market cap of €230.82 million.

Operations: Fine Foods & Pharmaceuticals N.T.M. S.p.A. generates revenue primarily from its nutraceutical segment (€141.49 million), followed by pharmaceutical (€80.25 million) and cosmetics (€27.91 million).

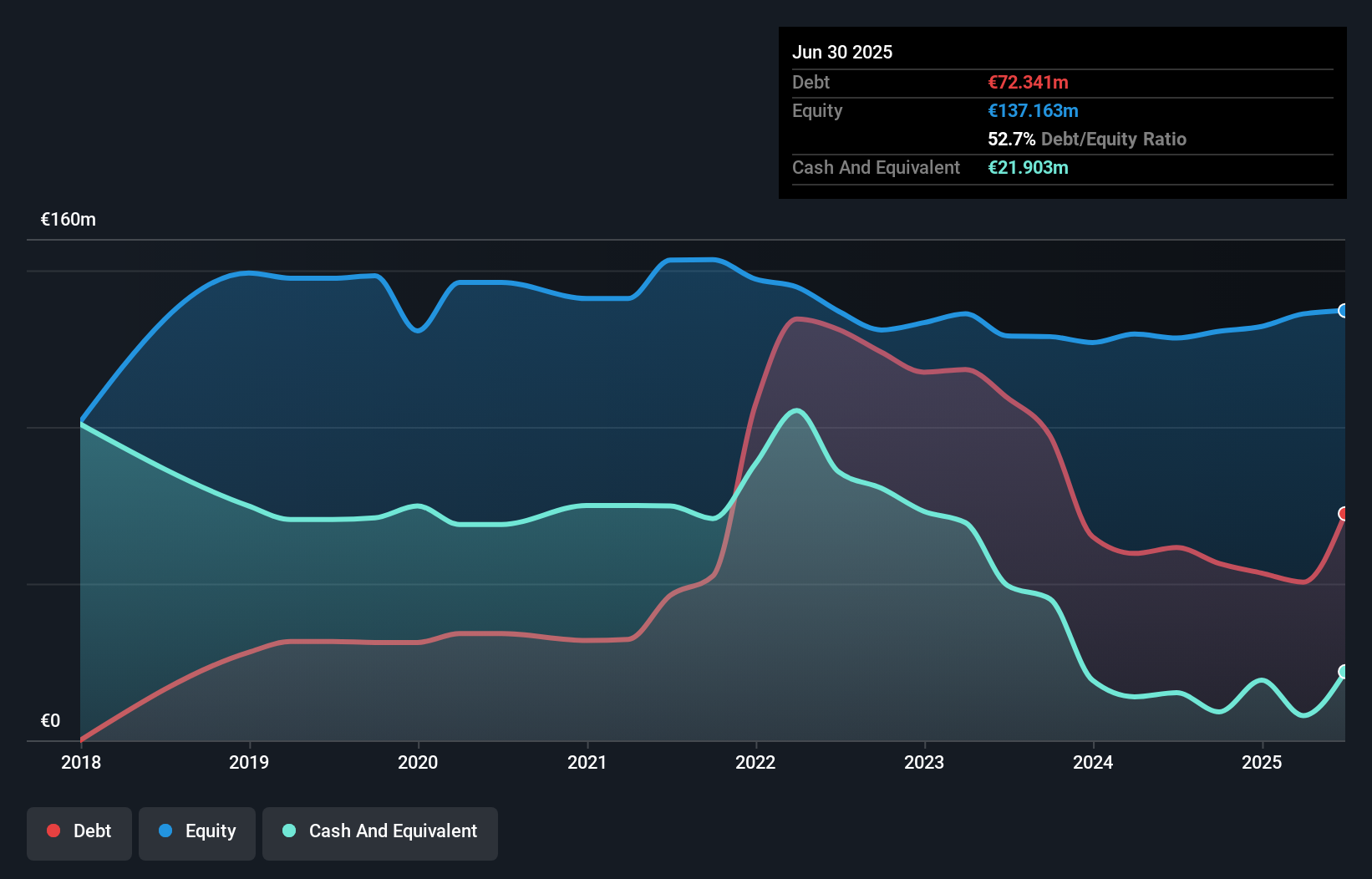

Fine Foods & Pharmaceuticals N.T.M. stands out with a price-to-earnings ratio of 18.6x, noticeably lower than the industry average of 31.7x, suggesting good relative value. The company's earnings surged by an impressive 376.6% over the past year, far outpacing the industry's growth rate of 18.2%. Despite an increase in its debt-to-equity ratio from 23.3% to 52.7% over five years, its net debt to equity remains satisfactory at 36.8%. Recent buybacks saw €0.2 million spent on repurchasing shares, while half-year sales reached €128.73 million with net income doubling to €8.76 million compared to last year.

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Medistim ASA develops, produces, services, leases, and distributes medical devices for cardiac and vascular surgery globally with a market cap of NOK4.39 billion.

Operations: Medistim generates its revenue primarily through Medistim Products, accounting for NOK496.14 million, and Third-Party Products, contributing NOK90.62 million.

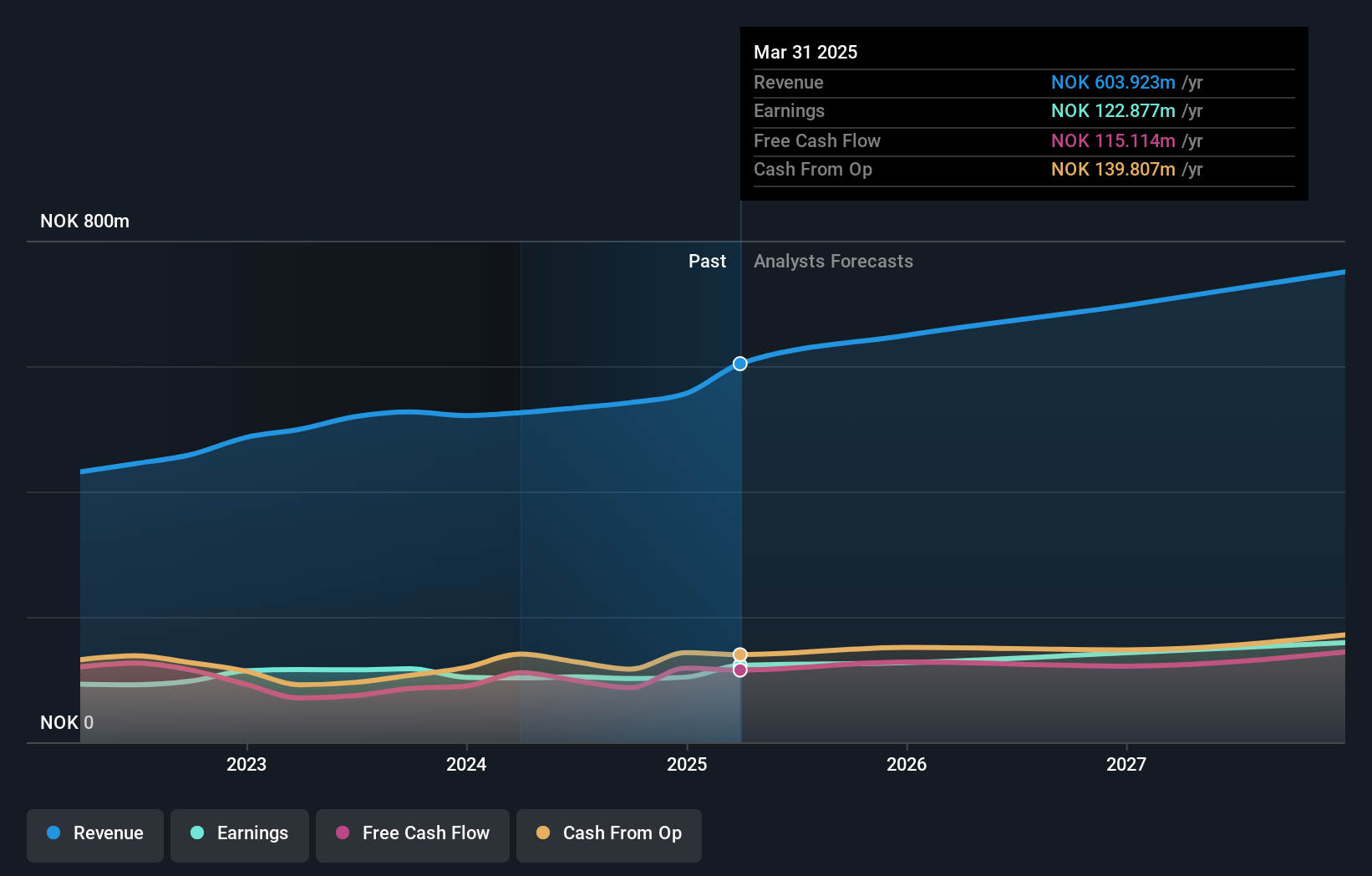

Medistim, a nimble player in the medical device space, has been catching attention with its robust growth. Over the past year, earnings surged by 25.7%, outpacing the broader Medical Equipment industry’s modest 1.7% rise. The firm is debt-free, having reduced its debt to equity ratio from 2.1% five years ago to zero today, which speaks volumes about its financial prudence. Recent results show sales climbing to NOK169 million for Q2 2025 from NOK145 million a year prior, while net income rose to NOK43 million from NOK35 million last year—reflecting strong operational performance amidst market volatility.

Meier Tobler Group (SWX:MTG)

Simply Wall St Value Rating: ★★★★★★

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market capitalization of CHF 427.60 million.

Operations: Meier Tobler Group generates revenue primarily from its Distribution segment, contributing CHF 395.31 million, and its Service segment, which adds CHF 96.89 million.

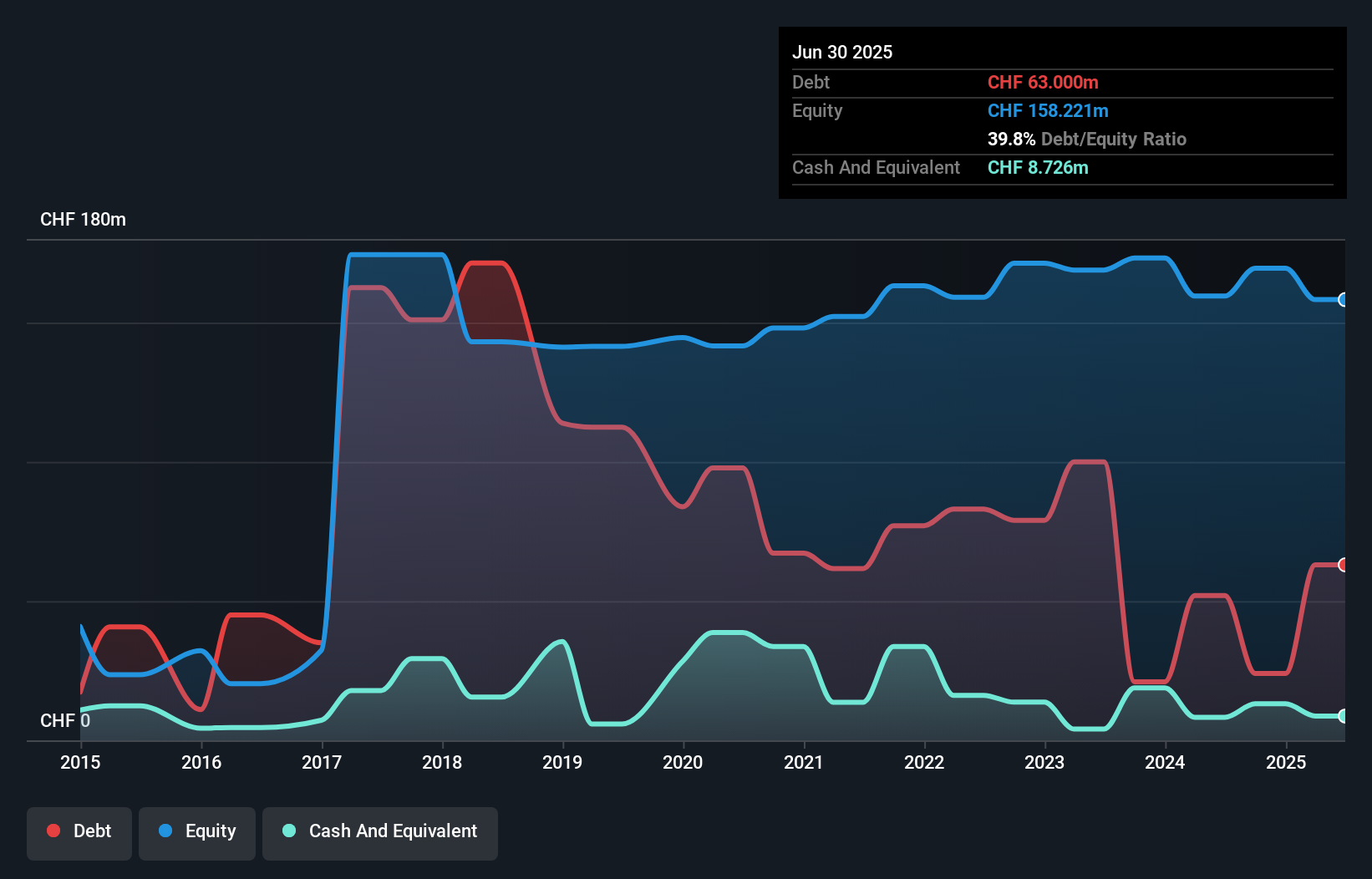

Meier Tobler Group, a smaller player in the building sector, offers an intriguing mix of financial stability and growth potential. Its net debt to equity ratio stands at a satisfactory 34.3%, reflecting prudent financial management as it decreased from 69% over five years. Despite recent volatility in its share price, the company’s earnings have grown by 7.1%, surpassing industry averages. However, a one-off loss of CHF9.9 million impacted recent results to June 2025, yet with EBIT covering interest payments by 40 times and positive free cash flow reported at CHF12 million for Q2 2025, MTG displays resilience amidst challenges.

- Click here to discover the nuances of Meier Tobler Group with our detailed analytical health report.

Assess Meier Tobler Group's past performance with our detailed historical performance reports.

Summing It All Up

- Click here to access our complete index of 331 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MTG

Meier Tobler Group

Operates as a trading and services company in heat generation and air conditioning systems.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives