How Investors May Respond To Mowi (OB:MOWI) After Major Salmon Escape in Scottish Highlands

Reviewed by Sasha Jovanovic

- Nearly 75,000 farmed salmon escaped into Loch Linnhe in the Scottish Highlands after Storm Amy damaged a net at Mowi's Gorsten seawater facility earlier this month.

- This large-scale fish escape has raised concerns among environmental groups and local authorities about potential impacts on wild salmon populations and the company's operations.

- We’ll explore how this significant operational disruption and potential environmental impact could alter the outlook for Mowi going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Mowi Investment Narrative Recap

To be a Mowi shareholder, you need to trust in the company’s ability to sustain growth through expanding salmon volumes, cost improvements, and strong global demand, while managing risks tied to supply swings and environmental events. The recent salmon escape in Scotland is a reminder of these risks, but with limited impact on current volume guidance, the main short-term catalyst, industry supply normalization, remains unchanged. The biggest risk to watch is whether further biological or environmental incidents could disrupt operations or margins.

Of the latest company updates, Mowi’s August guidance to increase 2025 harvest volumes to 545,000 tonnes stands out, given the context of the recent escape. As the company benefits from operational scale, incidents like this can still affect regional output and highlight the need for resilience if further disruptions or regulatory pressures arise.

Conversely, investors should remain alert to operational risks from environmental events that could quickly reshape expectations and...

Read the full narrative on Mowi (it's free!)

Mowi's narrative projects €7.3 billion revenue and €1.1 billion earnings by 2028. This requires 8.6% yearly revenue growth and a €764.7 million increase in earnings from €335.3 million today.

Uncover how Mowi's forecasts yield a NOK225.03 fair value, in line with its current price.

Exploring Other Perspectives

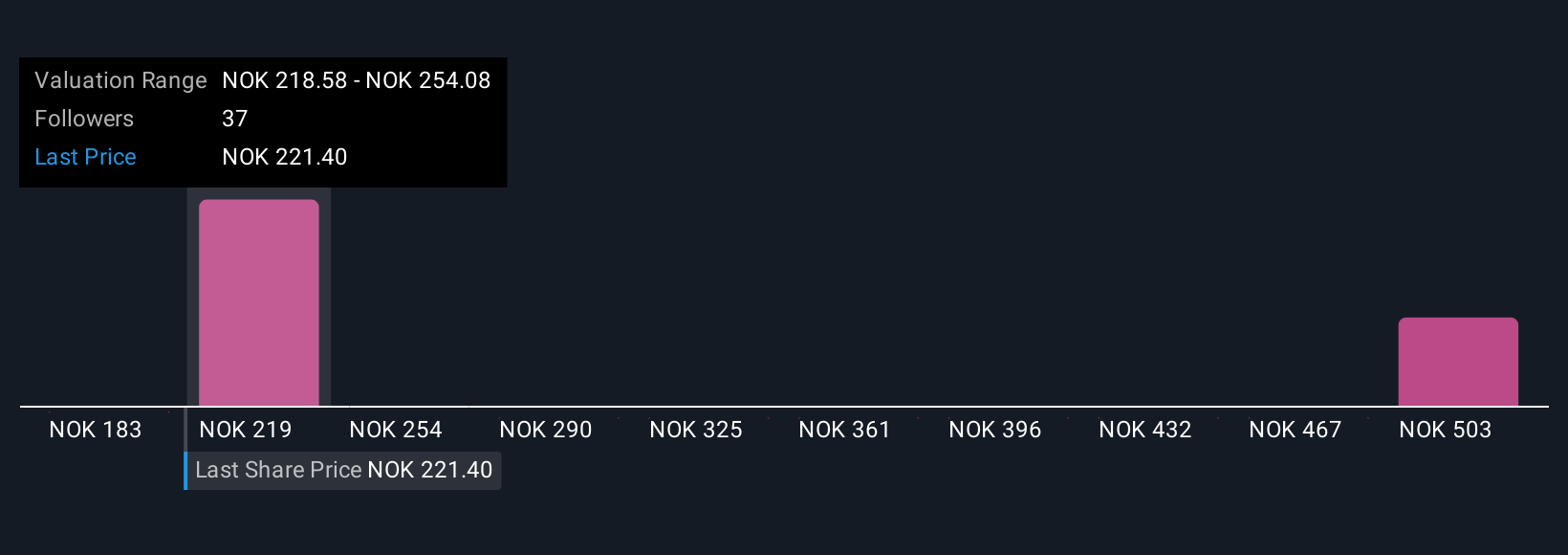

Seven members of the Simply Wall St Community estimate Mowi’s fair value between NOK183 and NOK446 per share. While many expect earnings growth to support better valuations, concerns around supply shocks point to potential for ongoing earnings volatility. Explore the full range of community insights for a more complete picture.

Explore 7 other fair value estimates on Mowi - why the stock might be worth over 2x more than the current price!

Build Your Own Mowi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mowi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mowi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mowi's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives