As European markets navigate a period of mixed performance, with the STOXX Europe 600 Index rising for the fourth consecutive week amid easing trade tensions, investors are increasingly focused on companies that demonstrate robust growth potential and strong insider ownership. In this context, stocks with high levels of insider influence can offer unique insights into company strategies and align management's interests closely with those of shareholders, making them appealing options in today's uncertain economic landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Yubico (OM:YUBICO) | 36.5% | 27% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 52.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

We'll examine a selection from our screener results.

Ferrari (BIT:RACE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ferrari N.V. designs, engineers, produces, and sells luxury performance sports cars globally and has a market cap of €78.52 billion.

Operations: Ferrari's revenue primarily comes from its luxury performance sports car segment, generating €6.88 billion.

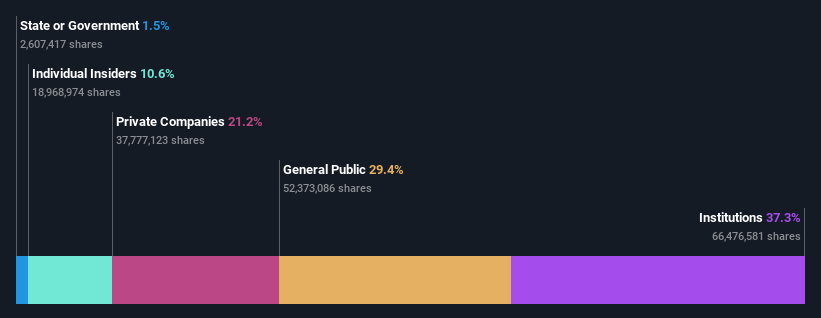

Insider Ownership: 10.6%

Ferrari's earnings are projected to grow at 7.95% annually, outpacing the Italian market, and its Return on Equity is expected to remain strong. Despite recent insider selling, Ferrari has engaged in significant share buybacks, enhancing shareholder value. The company reported robust first-quarter results with sales of €1.79 billion and net income of €411.64 million. Additionally, Ferrari confirmed full-year revenue guidance exceeding €7 billion while managing potential profitability impacts due to new U.S.-EU import tariffs.

- Navigate through the intricacies of Ferrari with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Ferrari shares in the market.

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

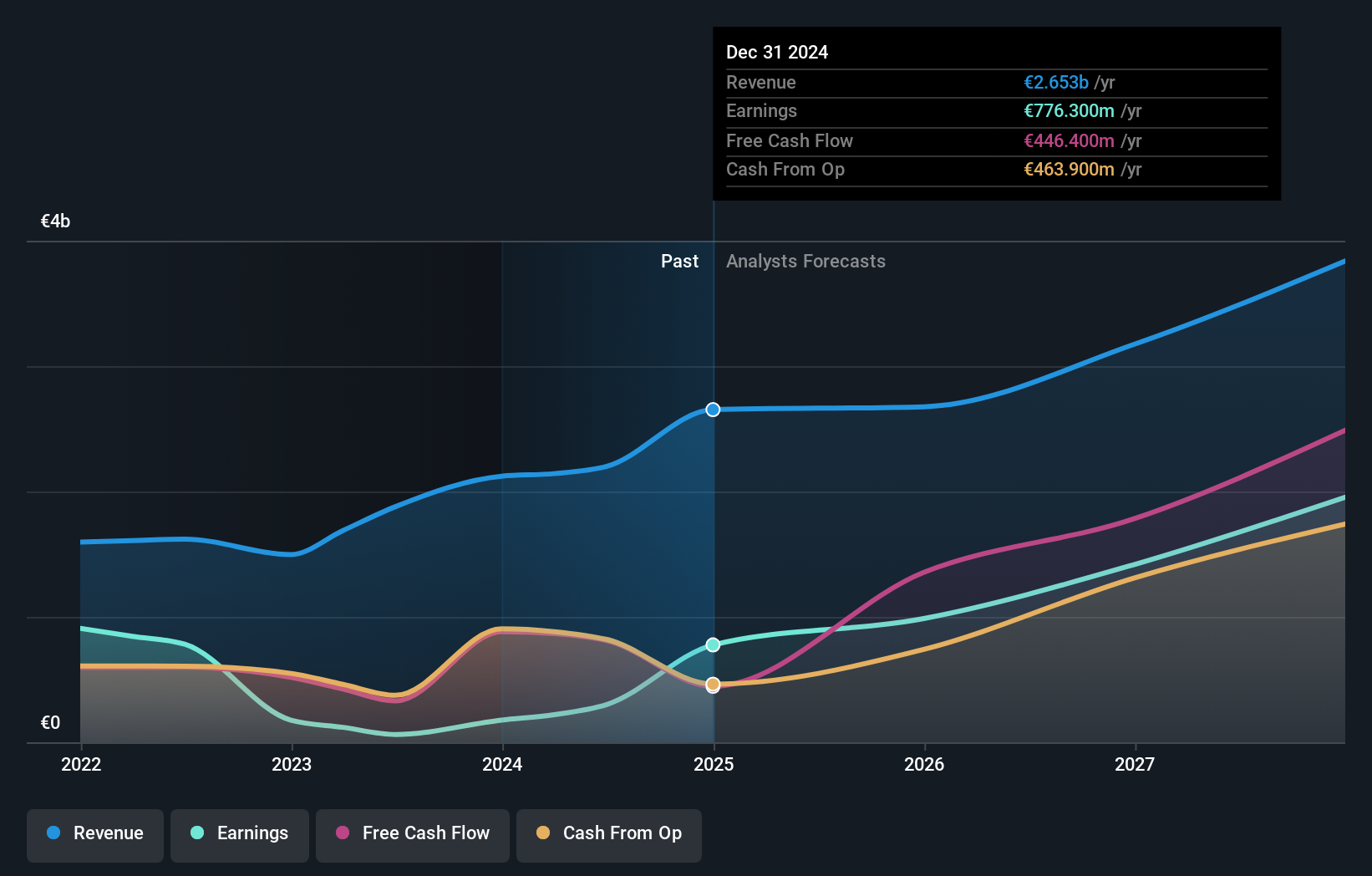

Overview: Mowi ASA is a seafood company that produces and sells Atlantic salmon products globally, with a market cap of NOK97.84 billion.

Operations: Mowi ASA generates revenue through several segments, including Feed (€1.12 billion), Farming (€3.51 billion), Sales & Marketing - Markets (€4.00 billion), and Sales & Marketing - Consumer Products (€3.70 billion).

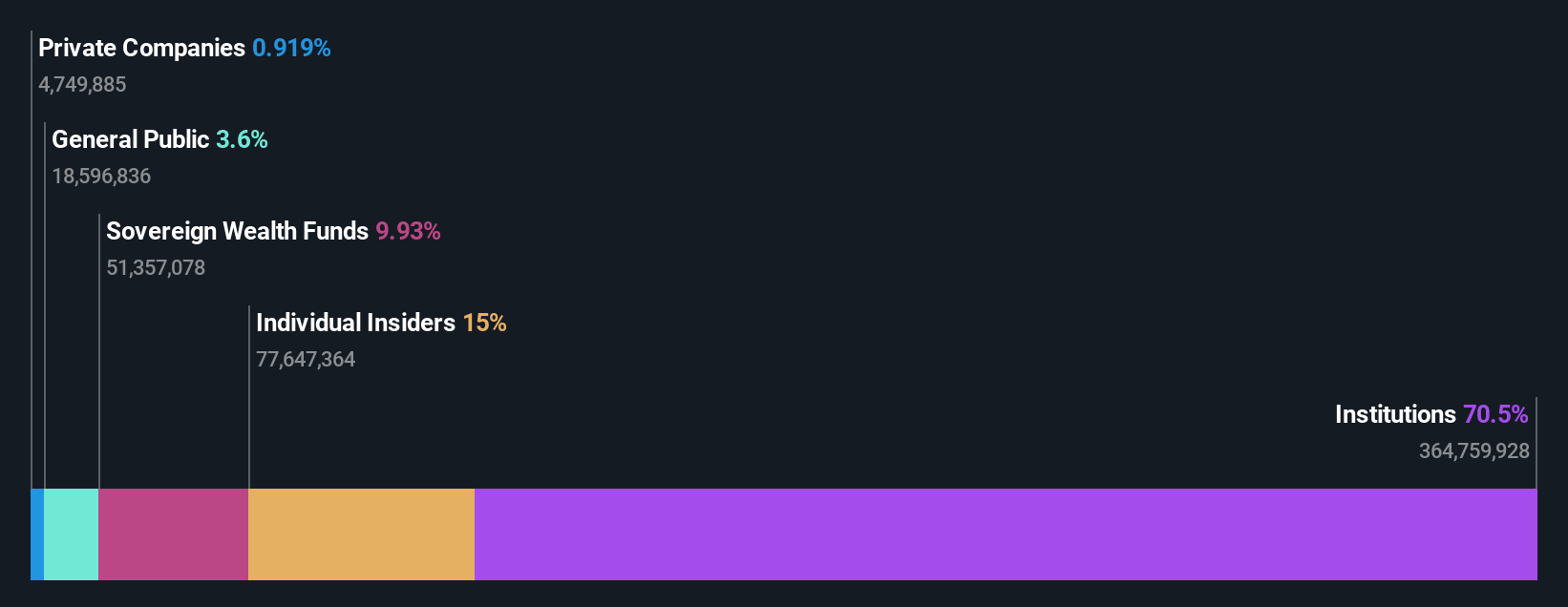

Insider Ownership: 14.7%

Mowi's earnings are forecast to grow significantly at 20.1% annually, surpassing the Norwegian market average. Despite high debt levels and a low Return on Equity projection of 18.6%, Mowi trades at a substantial discount to its estimated fair value. Recent strategic reviews of their Feed division could streamline operations further, while new product launches like the Norwegian Salmon Fjord Burgers in the US may enhance revenue growth beyond the current 6.5% annual forecast.

- Click to explore a detailed breakdown of our findings in Mowi's earnings growth report.

- Our comprehensive valuation report raises the possibility that Mowi is priced lower than what may be justified by its financials.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity and venture capital firm focusing on private capital and real asset segments, with a market cap of approximately SEK351.48 billion.

Operations: The company's revenue is derived from its Private Capital segment at €1.36 billion and Real Assets segment at €951.90 million, with an additional contribution of €41.50 million from the Central segment.

Insider Ownership: 12.6%

EQT's earnings are projected to grow significantly at 24.9% annually, outpacing the Swedish market. The company, trading slightly below its estimated fair value, has seen substantial insider buying recently. With a high forecasted Return on Equity of 21.4%, EQT is exploring strategic partnerships, such as a potential tie-up with Arctos Partners LP. Additionally, the recent $500 million debt offering supports ongoing initiatives and expansion plans under new CEO Per Franzén's leadership.

- Take a closer look at EQT's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that EQT is trading beyond its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 209 companies by clicking here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives