Investors Continue Waiting On Sidelines For Grieg Seafood ASA (OB:GSF)

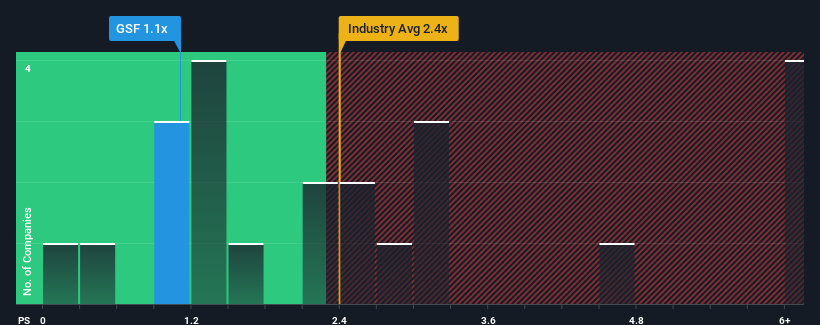

Grieg Seafood ASA's (OB:GSF) price-to-sales (or "P/S") ratio of 1.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in Norway have P/S ratios greater than 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Grieg Seafood

What Does Grieg Seafood's Recent Performance Look Like?

Grieg Seafood could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Grieg Seafood's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Grieg Seafood would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's top line. Still, the latest three year period has seen an excellent 79% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 12% as estimated by the six analysts watching the company. With the industry predicted to deliver 12% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Grieg Seafood's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Grieg Seafood's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Grieg Seafood's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Grieg Seafood (1 is a bit unpleasant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:GSF

Grieg Seafood

Through its subsidiaries, operates as a fish farming company in Norway, the United Kingdom, rest of Europe, the United States, Canada, Asia, and internationally.

Undervalued with reasonable growth potential.