3 Growth Companies Insiders Own With Revenue Growth Up To 24%

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how anticipated policy changes might impact economic growth and inflation. In this environment of optimism tempered by uncertainty, companies exhibiting strong revenue growth coupled with high insider ownership can offer unique insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc., a biotech research company, develops therapeutic drugs for immuno-oncology and neurodegenerative diseases and has a market cap of ₩1.84 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, specifically startups, amounting to ₩32.95 billion.

Insider Ownership: 30.5%

Revenue Growth Forecast: 24.7% p.a.

ABL Bio is set to become profitable within three years, with earnings projected to grow 48.15% annually and revenue expected to increase by 24.7% per year, surpassing the Korean market average of 10.1%. Despite high share price volatility recently, no substantial insider trading activity has been reported over the past three months. The company's Return on Equity is forecasted at a modest 13%, indicating room for improvement in profitability metrics.

- Unlock comprehensive insights into our analysis of ABL Bio stock in this growth report.

- Our comprehensive valuation report raises the possibility that ABL Bio is priced higher than what may be justified by its financials.

P/F Bakkafrost (OB:BAKKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P/F Bakkafrost, along with its subsidiaries, is engaged in the production and sale of salmon products across North America, Western Europe, Eastern Europe, Asia, and other international markets with a market cap of NOK38.72 billion.

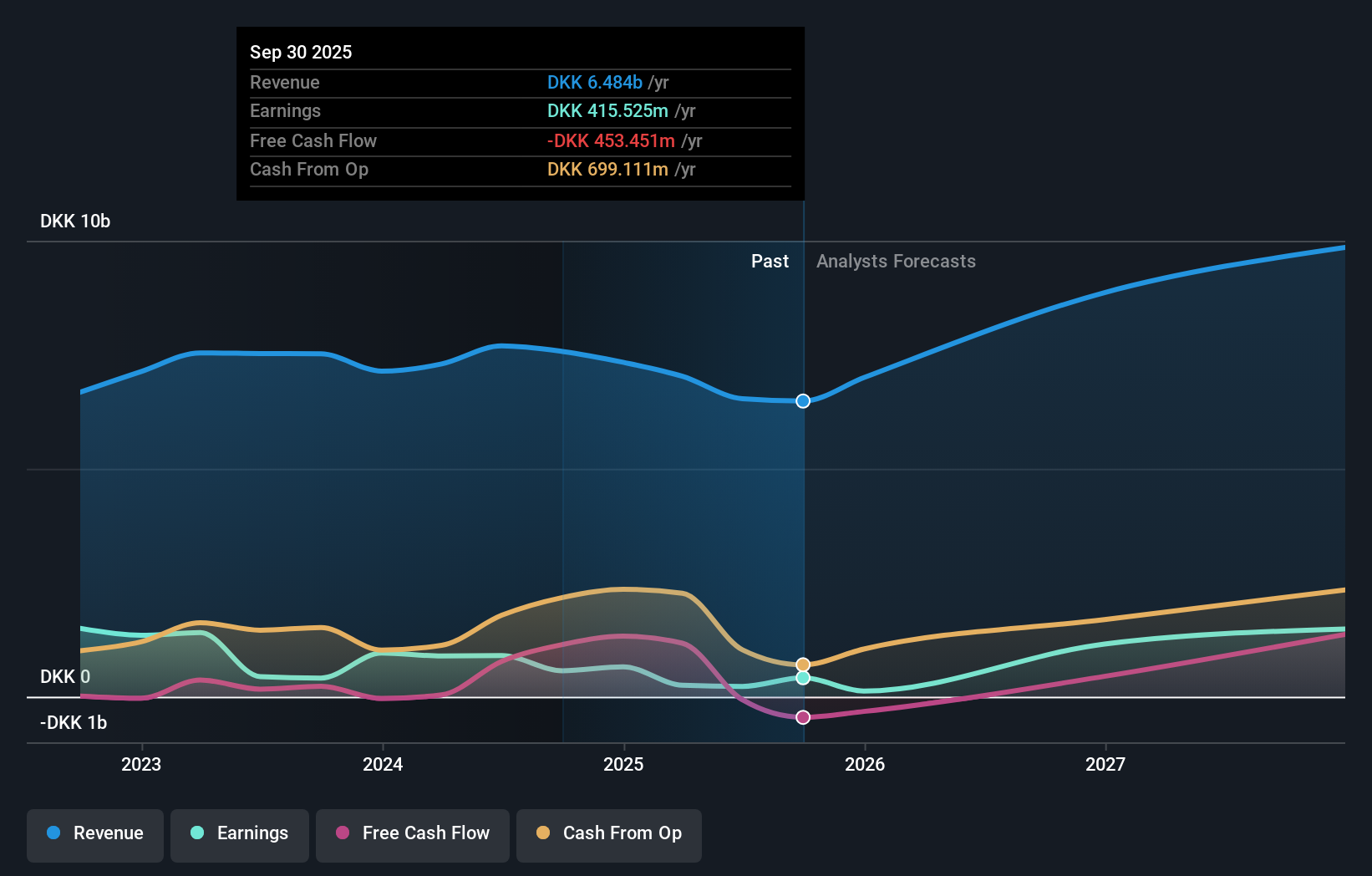

Operations: The company's revenue segments include Sales and Other at DKK10.27 billion, Farming Faroe Islands at DKK3.92 billion, Fishmeal, Oil and Feed at DKK3.13 billion, Farming Scotland at DKK1.68 billion, Services at DKK899.29 million, Freshwater Faroe Islands at DKK686.59 million, and Freshwater Scotland at DKK119.99 million.

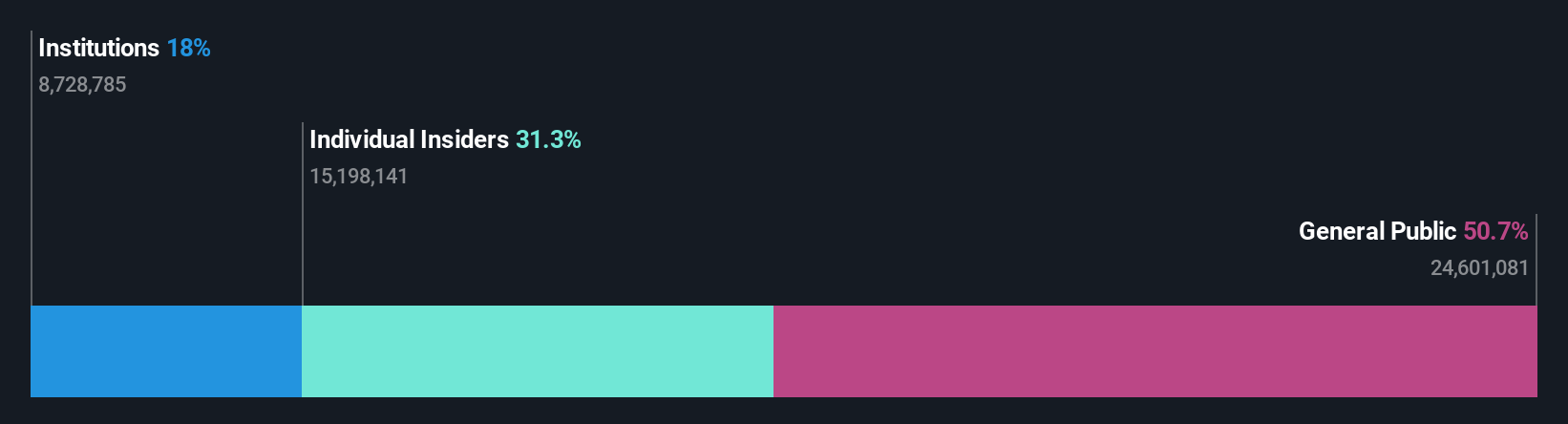

Insider Ownership: 13.3%

Revenue Growth Forecast: 16.7% p.a.

P/F Bakkafrost's earnings are projected to grow significantly at 62.1% annually, outpacing the Norwegian market average. Despite a recent net loss of DKK 113.72 million in Q3 2024, revenue for the first nine months increased to DKK 6 billion from DKK 5.58 billion a year ago. Insider activity shows more shares bought than sold recently, although volumes weren't substantial. The company's Return on Equity is forecasted at a low 14.9% over three years, suggesting potential profitability challenges ahead.

- Delve into the full analysis future growth report here for a deeper understanding of P/F Bakkafrost.

- Our expertly prepared valuation report P/F Bakkafrost implies its share price may be too high.

Nanjing Develop Advanced Manufacturing (SHSE:688377)

Simply Wall St Growth Rating: ★★★★★☆

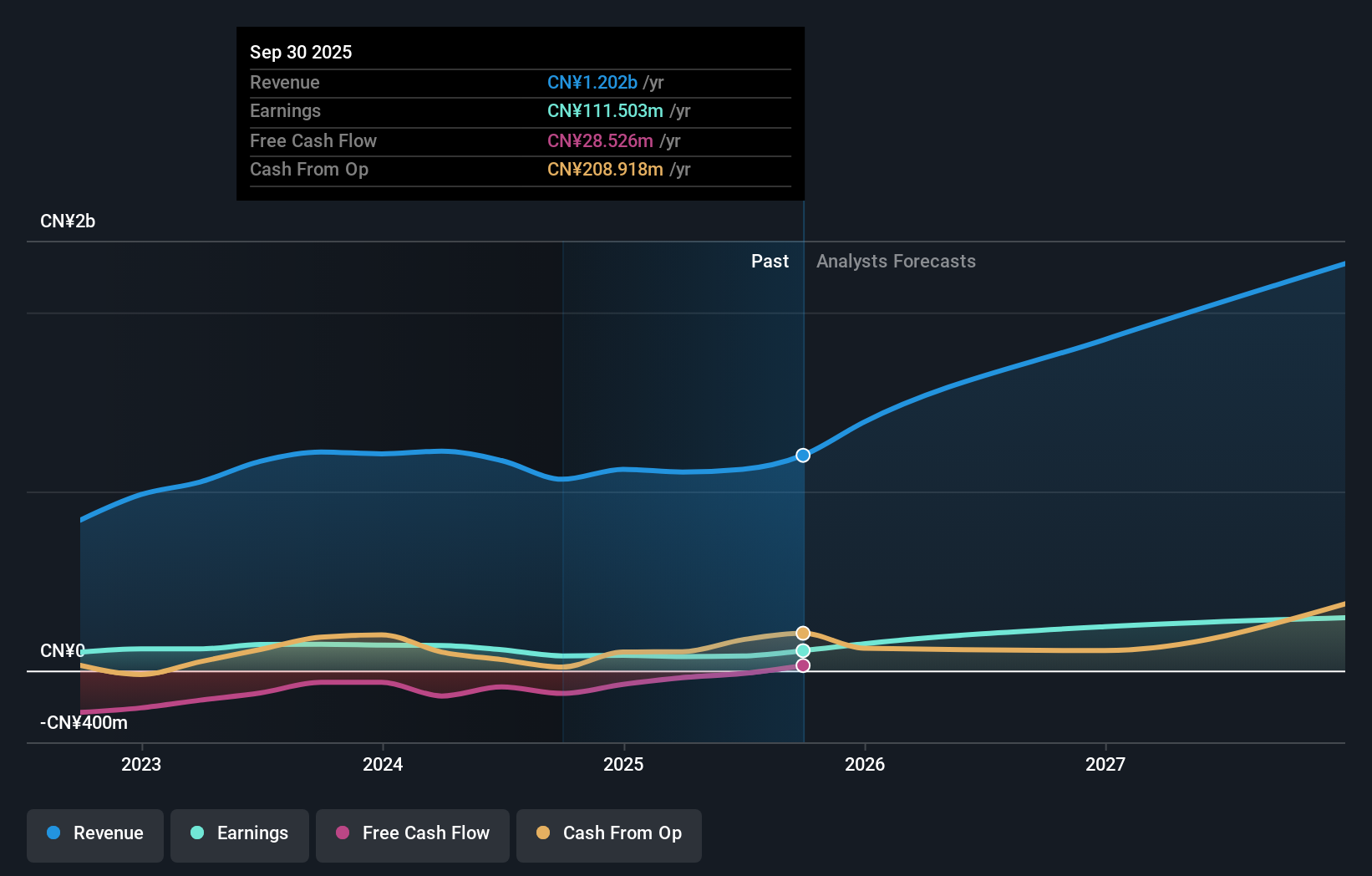

Overview: Nanjing Develop Advanced Manufacturing Co., Ltd. operates in the advanced manufacturing sector and has a market cap of CN¥3.12 billion.

Operations: The company operates in the advanced manufacturing sector with revenue segments not specified in the provided text.

Insider Ownership: 16.6%

Revenue Growth Forecast: 23.9% p.a.

Nanjing Develop Advanced Manufacturing's earnings are expected to grow significantly at 48.24% annually, surpassing the Chinese market average. Despite this, recent financials show a decline, with nine-month revenue dropping to CNY 794.58 million from CNY 936.04 million the previous year and net income falling to CNY 63.81 million from CNY 124.18 million. The company reports no substantial insider trading activity recently, while its Return on Equity is projected to remain low at 11.1%.

- Navigate through the intricacies of Nanjing Develop Advanced Manufacturing with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Nanjing Develop Advanced Manufacturing's shares may be trading at a premium.

Turning Ideas Into Actions

- Explore the 1525 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives