Did The Underlying Business Drive Atlantic Sapphire's (OB:ASA) Lovely 386% Share Price Gain?

For us, stock picking is in large part the hunt for the truly magnificent stocks. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Atlantic Sapphire ASA (OB:ASA) share price, which skyrocketed 386% over three years. Also pleasing for shareholders was the 41% gain in the last three months.

View our latest analysis for Atlantic Sapphire

We don't think Atlantic Sapphire's revenue of US$6,021,000 is enough to establish significant demand. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Atlantic Sapphire can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. There was already a significant chance that they would need more money for business development, and indeed they recently put themselves at the mercy of capital markets and raised equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Atlantic Sapphire investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

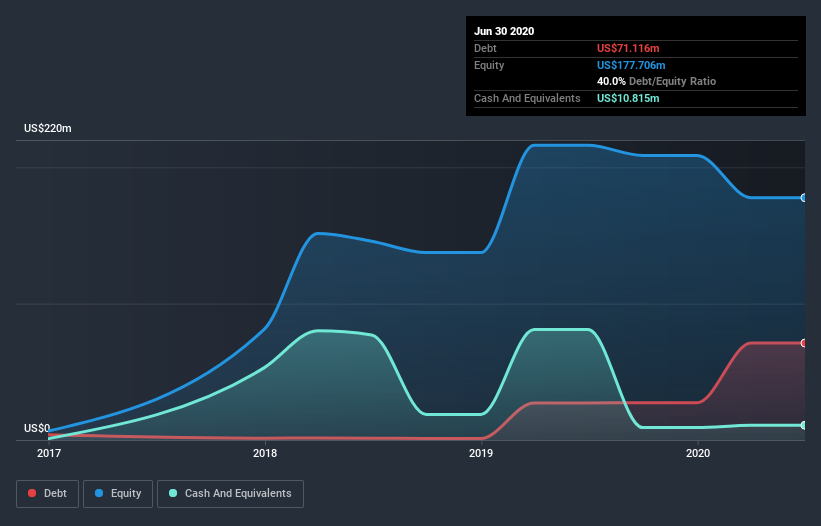

Our data indicates that Atlantic Sapphire had more in total liabilities than it had cash, when it last reported. That made it extremely high risk, in our view. So the fact that the stock is up 51% per year, over 3 years shows that the cash injection was a welcome one. Investors must really like its potential. The image below shows how Atlantic Sapphire's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

While the market return was 31% in the last year, Atlantic Sapphire returned 28% to shareholders. It has to be noted that the recent return falls short of the 69% shareholders have gained each year, over the last three years. Share price gains are anything but steady, so it's a positive to see that the longer term returns are reasonable. It's always interesting to track share price performance over the longer term. But to understand Atlantic Sapphire better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Atlantic Sapphire , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you’re looking to trade Atlantic Sapphire, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:ASA

Atlantic Sapphire

Engages in the production and sale of land-based salmon in Denmark and the United States.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives