Optimistic Investors Push Aker BioMarine AS (OB:AKBM) Shares Up 25% But Growth Is Lacking

Aker BioMarine AS (OB:AKBM) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 138% in the last year.

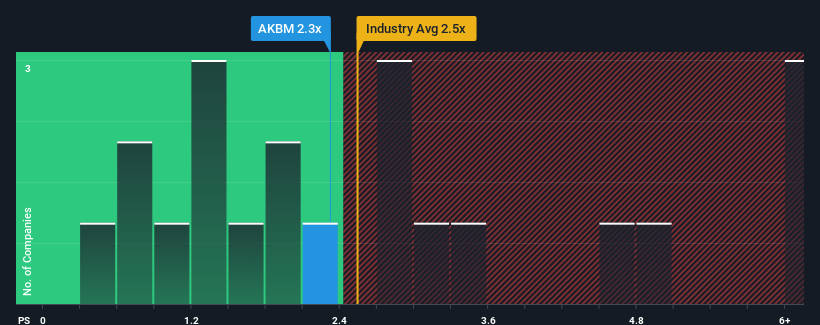

Although its price has surged higher, you could still be forgiven for feeling indifferent about Aker BioMarine's P/S ratio of 2.3x, since the median price-to-sales (or "P/S") ratio for the Food industry in Norway is also close to 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Aker BioMarine

How Aker BioMarine Has Been Performing

With revenue growth that's superior to most other companies of late, Aker BioMarine has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Aker BioMarine's future stacks up against the industry? In that case, our free report is a great place to start.How Is Aker BioMarine's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Aker BioMarine's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. As a result, it also grew revenue by 25% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 2.6% per year over the next three years. With the industry predicted to deliver 14% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Aker BioMarine is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Aker BioMarine's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Aker BioMarine currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Aker BioMarine with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKBM

Aker BioMarine

Engages in harvesting krill and supplies krill-derived products worldwide.

Reasonable growth potential with adequate balance sheet.