Despite shrinking by kr605m in the past week, Aker BioMarine (OB:AKBM) shareholders are still up 52% over 1 year

It's easy to feel disappointed if you buy a stock that goes down. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. So while the Aker BioMarine AS (OB:AKBM) share price is down 16% in the last year, the total return to shareholders (which includes dividends) was 52%. And that total return actually beats the market return of 12%. On the other hand, the stock is actually up 8.7% over three years. Unfortunately the last month hasn't been any better, with the share price down 19%.

Since Aker BioMarine has shed kr605m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

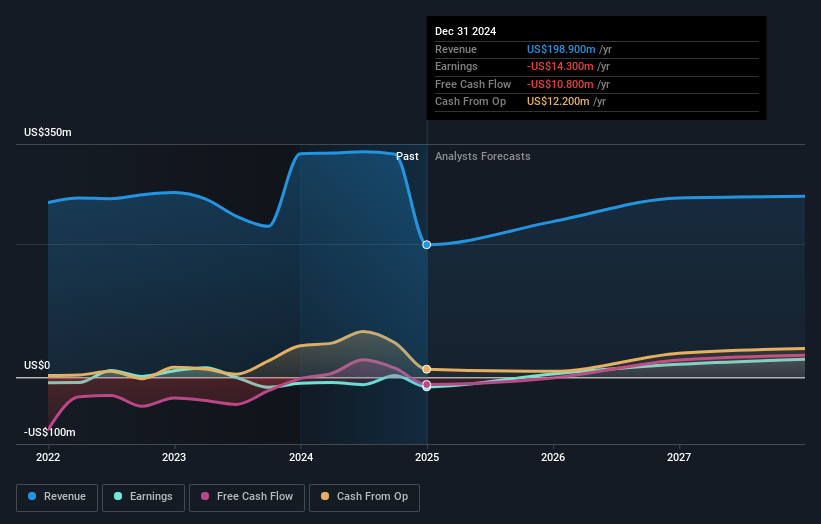

Given that Aker BioMarine didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In just one year Aker BioMarine saw its revenue fall by 41%. That looks pretty grim, at a glance. The stock price has languished lately, falling 16% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Aker BioMarine's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Aker BioMarine, it has a TSR of 52% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Aker BioMarine rewarded shareholders with a total shareholder return of 52% over the last year. That's including the dividend. That's better than the annualized TSR of 25% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Aker BioMarine on your watchlist. Before spending more time on Aker BioMarine it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AKBM

Aker BioMarine

A biotech innovator, develops and supplies krill-derived products for consumer health and wellness worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives