- Norway

- /

- Energy Services

- /

- OB:TGS

TGS (OB:TGS): Assessing Valuation Following Launch of Amendment West-1 Seismic Survey Expansion

Reviewed by Kshitija Bhandaru

TGS (OB:TGS) has just launched its Amendment West-1 survey, expanding multi-client node coverage in the Paleogene West play by more than 5,400 square kilometers. This initiative leverages cutting-edge seismic technologies and is supported by industry funding.

See our latest analysis for TGS.

TGS’s latest expansion comes on the heels of a busy stretch, including its recent presentation at African Energy Week. Despite innovating in seismic data acquisition, the company’s 1-year total shareholder return is down 0.24%, while the share price has experienced some softening this year. Short-term momentum has faded; however, investors remain focused on the potential for growth in emerging exploration areas.

If you’re curious what else is evolving in the market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a meaningful discount to analyst targets and recent momentum fading, investors are left to wonder whether TGS is currently undervalued or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 38.3% Undervalued

Based on the latest narrative fair value, TGS shares look deeply discounted compared to the most recent close price. This significant gap has analysts and investors debating whether the market is missing a significant turnaround. Here is a key idea shaping that outlook.

TGS is capitalizing on increased digitalization in energy by growing its high-margin Imaging & Technology division, which reported strong revenue and EBITDA margin expansion this quarter. This indicates structural earnings upside from advanced data analytics and AI-driven offerings.

Curious why the narrative sees so much upside? The calculation is built on bold assumptions about how digital growth, margin surges, and new recurring revenues will transform TGS's profit profile. Which surprising future numbers power the estimate? Only the full narrative reveals the exact blueprint.

Result: Fair Value of $120.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oil price swings or delays in major exploration projects could quickly undermine the upbeat outlook that is currently supporting TGS’s fair value narrative.

Find out about the key risks to this TGS narrative.

Another View: Evaluating the Earnings Multiple

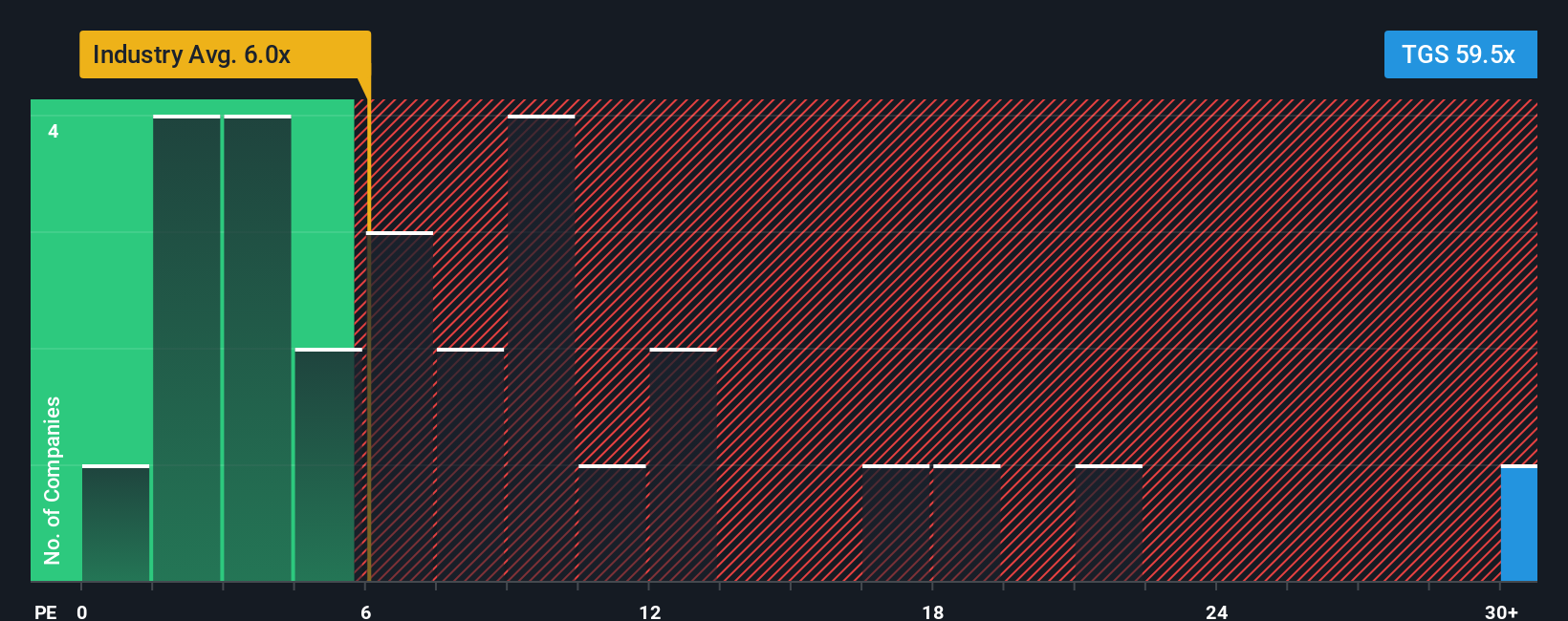

Looking at TGS's share price through the lens of its price-to-earnings ratio tells a strikingly different story. TGS trades at 58.4x earnings, which is much higher than both peers (6.8x) and the Norwegian Energy Services industry average (6.5x). Even compared to its fair ratio of 17.2x, the current valuation looks stretched. This suggests risk if the market decides to pull valuations back down to earth. So, does the discount to analyst targets stand up to scrutiny?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TGS Narrative

If you think there’s more to the story, or prefer your own independent analysis, you can easily shape your perspective in under three minutes. Do it your way

A great starting point for your TGS research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve and seize fresh opportunities with other stocks poised for growth and disruption. Don’t let great investments pass you by and expand your watchlist today.

- Unlock high potential by targeting these 887 undervalued stocks based on cash flows that are trading below their intrinsic worth and could surprise the market.

- Tap into the AI boom by reviewing these 24 AI penny stocks that are redefining automation and business intelligence across industries.

- Maximize your income with these 19 dividend stocks with yields > 3% offering attractive yields, which can be crucial for building a resilient and rewarding portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives